Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Defi Token Design

Follow me on Twitter @ordcryptoguy

Besides being the medium of fundraising for the company in a less regulated matter, a token’s purpose is the underlying driver for determining its true value. Tokens require functionality to maintain and accrue value. There need to be incentives for investors to hold onto their tokens besides the promise that when the invested project is successful in the future, they will be rewarded, otherwise a great portion of the token price being left to pure speculation.

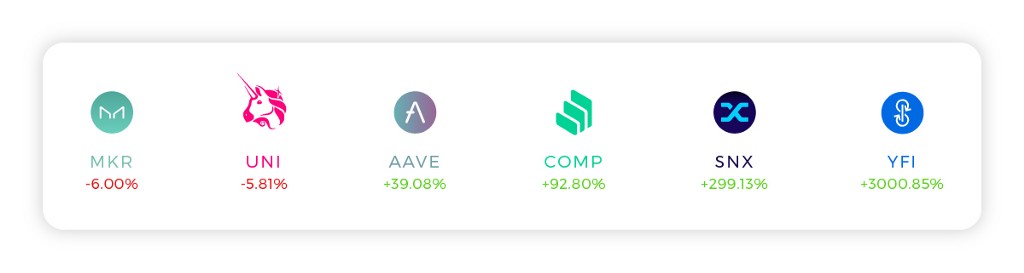

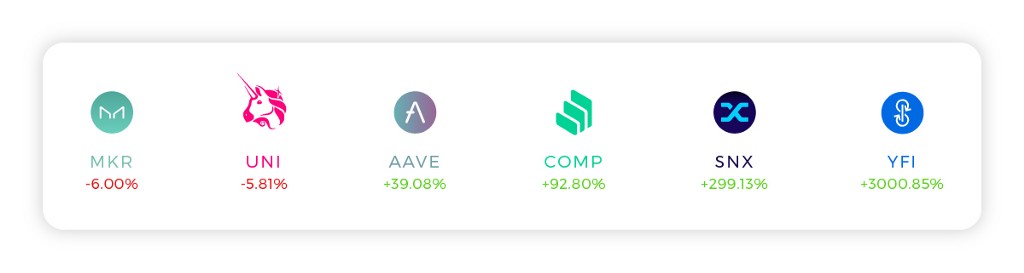

The rise of Defi has pushed forward the importance of token design, and its different nature to many previous crypto projects has also made it easier for Defi tokens to justify their value. Most Defi tokens are designed with the focus that holders benefit proportionally to network usage and growth of the protocol. It’s no surprise that some of the functionality of Defi tokens is modeled after equity, where investors value their stake based on the revenue provided by the underlying asset and have the right to influence the direction of the organisation. I aim to cover some important features of Defi tokens and explain how they contribute to retaining a token’s value.

Staking

Staking is when investors deposit their tokens into a protocol, locking it for a period of time and reducing the circulating supply of the token. Staking is a real functionality feature for the token since staking in a network protocol’s PoS consensus helps guarantee the underlying security of the network (like MATIC tokens on the Polygon Network). Staking can also occur in a protocol without a PoS reason like many exchange protocols (QuickSwap, SushiSwap, PancakeSwap) where depositing funds simply means the investor believes in the long term interests of the protocol since with all things equal, staking raising the price of the token. In both cases, the staking is in effect making the network more valuable and thus rewarded with more of the staked token i.e. via inflation.

Inflation

Inflation provides liquidity into the market in a healthier way than releasing all the available tokens at once. The gradual injection of liquidity lowers volatility on top of rewarding holders of the token. When a token utilises inflation as the primary incentive to attract current investors and provide a new supply of tokens for new users in its early growth stages, this is known as bootstrapping via liquidity mining. The economic dynamic between staking and inflation is also very important. Although both work together to justify fundamental value for a token, their balance is important. High staking yields draw out large amounts of tokens from the supply causing prices for the token to rise significantly. Lower liquidity also means interactions between buyers and sellers have a greater impact on the token price. With high yields, when stakers un-stake and sell their yields, the sudden influx of supply tank the token price (exchange tokens are also a great example). Depending on the potential of the protocol, the price recovery can also be a slow process with the high inflation. This further adds volatility to the token price.

Fee Distribution

Staking provides investors with inflationary rewards, but investors can also be rewarded with noninflationary rewards in the form of the fees generated by the underlying protocol. Fees are typically integral in transacting on the protocol, where they are distributed proportionally to the Ethereum address that holds the underlying fee token. The fees can be in stablecoins, ETH, or the underlying fee token. Fees function like dividends with equities and provide investors value accrual for holding a token. In some cases, the fees can also be burned directly, creating a deflationary token supply and increasing its value, equivalent to stock buybacks with equities. The network value can be valued through basic finance frameworks like a Discounted Cash Flow Analysis, where the fees can be forecasted out based on future network growth. This further translates to the ability to perform a comparative analysis of tokens relative to similar tokens to determine if a token is mispriced or not.

Governance Incentives

Governance in a protocol works in mind that token holders collectively own the set of contracts holding the protocol together and decide how they change over time through a voting process. Governance incentives within a Defi protocol hold more significance than their equity counterparts. In cryptocurrency ethos, no minority party should be deciding on the outcome of the token. Governance tokens aren’t just a driver of the fundamental value of a token but also actively impact the future valuation of the token. For example, deciding on how protocol fees should be handled whether they should be burned or distributed directly impacts a token price. For lending protocols like Compound, the decisions made on the over collateralisation levels for borrowed assets impact the protocols risk profile and thus attractiveness to investors. In the future, the impact of governance tokens won’t just be limited to every major protocol change but potentially down to every smart contract upgrade i.e. like a vote on approving a pull request for the smart contract code.

The future

Over time, with the continual experiments in the Defi space, improvements to token design will continue to be made, with changes being ever more granular and better in capturing the value of the underlying protocol network.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

Defi Token Design was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.