Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

30x Levered Hedge Fund That Got Steamrolled On Treasury Basis Trade Launching Its Own Repo Dealer

By now most are aware that when the Fed first launched “NOT QE” in September 2019 to inject liquidity into the market, what it was really doing was bailing out dozens of hedge funds engaging in highly levered trades involving a relative value compression trade in the Treasury cash/swap basis… almost identical to what LTCM was doing ahead of its 1998 bailout (see “The Fed Was Suddenly Facing Multiple LTCMs”).

A similar hedge fund bailout occurred in March 2020 when amid the covid lockdown crash, treasury trades went haywire, and crushed many of the same hedge funds that had clearly not learned their lesson just 6 months earlier. The resulting bloodbath was among the reasons the Fed was forced to inject trillions in liquidity via overnight repo facilities.

One of the funds that got hammered especially hard by the dislocation in treasury basis trades was Capula Investment Management’s Global Relative Value Fund which dropped 5.2%, only to rebound sharply once the Fed flooded the system with funds restoring normality to the popular hedge fund trade.

The unspoken message among all the market turmoil was that hedge funds had joined the ranks of Bank Holding Companies as entities that are, in the eyes of the Fed, too big to fail, and any existential threat to their P&L would be met with further aggressive liquidity injections.

Fast forward to today, when we read in Bloomberg that the same Capula which is so intricately part of the repo market which it uses to fund its own Treasury basis trades is also preparing to “function as a broker-dealer in the same multitrillion-dollar lending market that it taps to finance highly leveraged bets on government bonds.”

As Bloomberg reports, an American subsidiary of the Capula Global Relative Value Master Fund – the same fund that has been directly participating and profiting from the tiny dislocations in the Treasury basis trade – registered in April as a government securities broker-dealer, filings show. The new broker, Montec Securities, is seeking to join the likes of JPMorgan and Bank of New York Mellon in a central clearinghouse for repurchase agreements, or repos, that hedge funds and other investors use to finance their trading in U.S. Treasuries.

This is notable because as Bloomberg observes, “it’s rare for a hedge fund to form its own broker-dealer, given the costs and additional regulatory burdens.” But the costs pale in comparison to the potential benefits: having its own captive broker-dealer could help London-based Capula weather the type of disruption that gripped the Treasuries market in the early stages of the pandemic, when the big banks that serve as conduits to the repo market retrenched, forcing many of their hedge fund clients to close out trades at a loss.

As we explained in March, the key ingredient of the basis trade is access to constant and copious liquidity, because in many ways, the Treasury basis trade is similar to the logic behind the LTCM trade that worked for so long and then one day, blew up spectacularly. This is how Kathryn Kaminski, chief research strategist and portfolio manager at AlphaSimplex Group explained the dynamics in March 2020:

“We’ve had 10 years of a perfect paradise and so people have been picking up pennies thinking there’s no risk in holding strategies like the basis trade. A lot of the strategies, like the basis, that hedge funds tend to use don’t work when markets aren’t stable. You’ll see more of these types of blowouts.”

As such, one can see why not just Capula, but all other hedge funds that participate in the trade will now seek to become their own broker dealers with direct access to the only source of liquidity that truly matters: the Fed itself.

“For a lot of the bigger institutional hedge funds, if they have enough capital to support being a broker-dealer, they all should do that,” said Stephen Siu, who retired earlier this year after spending decades in repo trading, most recently as the head of CCSZF Management, a hedge fund backed in part by the Industrial & Commercial Bank of China. “You have better control of your risk, especially in times of a liquidity squeeze.”

Capula, which manages $23 billion and which was co-founded in 2005 by Yan Huo, first broached the idea of starting a broker-dealer as early as 2015 Bloomberg reports. Since then, the repo market has grappled with multiple bouts of turmoil, most notably in September 2019, when some banks, seeking to dress up their balance sheets for quarter-end, temporarily stopped providing overnight repo.

Seeking to avoid any future overnight funding crises like those observed in Sept 2019 and March 2020, last month the Federal Reserve announced a standing repo facility, which is meant to serve as a backstop to prevent repo rates from spiking. It pledges to provide overnight financing at the annual equivalent of 25 basis points, or a quarter of a percentage point. It will initially only open the program to its primary dealers, which are mainly large banks, though it may later be expanded to include additional depository institutions.

“You can liken it to competing with the people who set the rules,” said Jeff Kidwell, a repo consultant who formerly ran Morgan Stanley’s North American financing desk for fixed-income trading and repo sales. “That is probably not a win-win situation.”

But having a direct funding line to the Fed is certainly win, and Capula will surely enjoy the extra liquidity from the central bank which will allow the fund to pocket even more money from minute dislocations in Treasury basis trades, which as we explained previously, seek to profit from minuscule differences between prices in the futures and cash markets for Treasuries by using massive amounts of borrowed money. It is literally a trade that collects pennies in front of a liquidity steamroller. So what better way to maximize returns than to create a direct access line to the Fed.

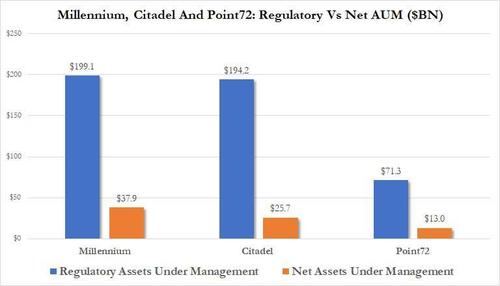

As a reminder, basis trades are a relative-value pair trade strategy with one leg in the cash bond market and the other in swaps, which have become a staple for giant, heavily levered money managers such as Citadel and Management.

But those are amateur hour compared to the massive leverage Capula’s relative-value fund uses: according to Bloomberg, gross assets, a regulatory calculation that reflects the use of leverage, totaled about $355 billion at the end of last March, compared with roughly $11 billion in net assets, meaning the fund uses more than 30x leverage!

As noted above, the Capula Global Relative Value Fund sank 5.2% during the first two weeks of March 2020, when the basis trade went haywire, but it ended the month with a remarkable 1% gain as the Fed swooped in and pumped trillions of dollars into fixed-income markets. The fund also has a micro strategy that involves providing liquidity to the market when there are dislocations, a Bloomberg source said.

With the Fed aggressively pushing counterparties to establish direct repo lines, hedge funds are increasingly financing their trades through repo, which is usually far less costly and far more liquid than longer-term loans. The transactions accounted for almost 42% of the $3.2 trillion in total borrowings at the end of September by hedge funds with net assets of at least $500 million, up from 35% five years earlier, according to SEC data. Meanwhile, borrowing from prime brokers – many of whom got ensnared in a similar trade when they funded Archegos’ Total Return Swaps – slipped to 44% from 52% during the period.

It is therefore not surprising that hedge funds such as Capula and Millennium have signed up with multiple banks to have their repo contracts cleared through a central facility run by the Fixed Income Clearing Corp. That , Bloomberg explains, allows banks to net both sides of the transaction against each another and therefore extend greater amounts of funding (a collapse of central clearing is considered an unthinkable event).

It is also not surprising, that for now, one of the only money managers that’s directly part of the FICC’s central clearinghouse is Citadel, the hedge fund that directly retains more former central bankers than any other company. Griffin’s Palafox Trading became a member years ago to provide Citadel’s Kensington and Wellington hedge funds with access to the broad repo market and to diversify their funding sources.

Having its own broker-dealer could give Capula similar access to this inter-dealer market for cleared repo without going through a bank. It’s seeking membership in the FICC’s central clearing system, according to a person familiar with its plans. Montec Securities lists its activities as proprietary trading, repo transactions, and securities clearance and settlement.

“These hedge funds that run very large businesses in fixed-income markets are constantly looking for new sources of liquidity to allow them to execute their strategies,” said Glenn Havlicek, chief executive officer of GLMX, an electronic securities financing trading platform. “The more outlets available to you, the less likely that there will be bottlenecks.”

And in a world where the Fed’s liquidity tidal wave is the only thing pushing risk assets higher, it is easy to see why hedge funds are increasingly seeking backstops for that one day when liquidity once again becomes scarce.

Tyler Durden

Wed, 08/18/2021 – 15:40

Continue reading at ZeroHedge.com, Click Here.