Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Hash Ribbon Indicator With Nearly 100% Accuracy Flashes Buy Signal

Coinbase’s quarterly earnings exceeded expectations as the leading crypto exchange registered a 44% influx in monthly user growth since the last quarter.

At the same time, after the recent miner exodus out of China, the bitcoin hash rate has recovered spectacularly — so much so that the Bitcoin Hash Ribbon suggests that a long-term bottom is probably in for BTC/USD.

Let’s dig in.

Coinbase Surpasses Expectations, Records $2.23 Bn in Q2 Revenue

In their quarterly 2021 earnings call, Coinbase announced that the company exceeded expectations by bringing in over $2.23 billion in revenue — a figure notably higher than the expected $1.78 billion, per a CNBC report.

Check out the full article here!

Technically speaking

BTC/USD Hash Ribbons flash Buy signal

One of the best-known and most effective signals to buy bitcoin, the Hash Ribbon, just flashed a ‘buy signal’. The indicator has nearly 100% historical efficacy, an average return of 4157%, and an average downside risk of -11% (measured since bitcoin’s inception).

What is the bitcoin hash rate?

Before we look into the hash ribbons indicator, let’s briefly get through the basics of the bitcoin hash rate.

Put simply, the hash rate is the amount of processing power that miners contribute to the bitcoin network at a given moment.

The hash rate goes up when more miners compete to mine bitcoin. Normally, this happens when bitcoin’s Dollar price is relatively high as there is good incentive to mine bitcoin (or when there is a favourable difficulty adjustment). The hash rate can also go up when electricity costs are low relative to the price of bitcoin.

On the other hand, the hash rate usually trends lower when the bitcoin price drops, or when the price stagnates for a (relatively) long time (until the game theory kicks in). When this happens, miners often take their resources elsewhere, as was the case with the recent Chinese crackdown on the mining sector (though this was politically motivated).

In other words, bitcoin mining activity goes down because it is less profitable for miners.

What is the hash ribbon?

The hash ribbon indicator is a long-term signal that is used to indicate macro bottoms for bitcoin’s USD denominated price. It was created by Charles Edwards, who describes its inner workings in this article.

The basic interpretation is that the blue dot signals that the higher low ($29,300) printed before it on the daily chart were a macro low in the market.

In other words, the daily low before the ‘buy’ signal sets a floor price to which BTC is unlikely to ever return to in the future (according to this indicator).

Historically, out of 12 signals, all but one marked macro lows in bitcoin’s price. That said, it goes without saying that the past is no guarantee of the future but rather another consideration for informed decision-making under risk.

Is another Alt season around the corner?

This is where things get tricky. After ringing the alarm bells in May regarding crypto bubbles, I have been largely silent about altcoins, in large part due to the fact that trading ALT/BTC pairs are not for everyone. In fact, it’s probably not a good idea altogether, but when has that ever stopped an honest betting man of good standing from doing the lord’s work?

Jokes aside, take this analysis with a fist of salt.

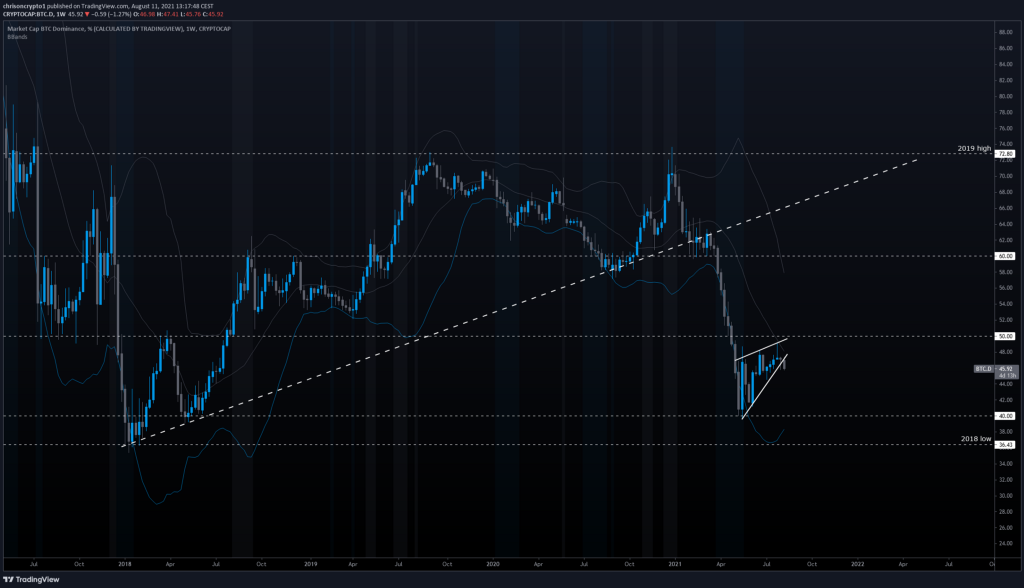

With that out of the way, the Bitcoin dominance chart, which compares bitcoin’s market capitalisation to other cryptocurrencies, has broken down from an ascending wedge, which coincides with weekly Bollinger Band resistance. Conservatively, assuming BTC.D will not print new lows, this presents an opportunity for altcoins to rally against bitcoin until BTC.D bottoms out. More aggressive targets would aim for fresh lows below the 2018 level marked on the chart. This possibility would not be out of the ordinary, given that Ethereum’s EIP-1559 upgrade is now live.

Needless to say, if BTC/USD fails to trend higher, it’s likely that altcoins will suffer a fate worse than death. And even if BTC/USD heads for higher highs, there is no guarantee that altcoins will fare better until new all-time highs are printed.

N.b. These write-ups take a lot of time and effort to make. I do not have a pay wall. All I ask is that you share and like this content on Twitter (and elsewhere) if you find it useful. It helps to grow my audience and it’s motivating to see that these newsletters are well received.

Bulls lead the way.

Catch you later.

Join the Telegram channel for live updates & setups!

Follow me on Twitter & Gab and my social portals below.

Read More: Coinbase Surpasses Expectations, Records $2.23 Bn in Q2 Revenue

You can also support me in Bitcoin!

BTC address: 3EydsEYpjHn68axKnCUqBB7EbqcxrEjamr

Best regards,

Christopher Attard

Founder of Chris on Crypto

Contributor to www.cityam.com

Connect directly on: Telegram

Originally published at https://mailchi.mp.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

Hash Ribbon Indicator With Nearly 100% Accuracy Flashes Buy Signal was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.