Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Big-Tech Breaks Weekly Win Streak, Bonds Shrug Off Inflation-Fest

It was a week of transitory-trampling inflation prints with CPI, PPI, Import/Export Prices, UMich inflation expectations, and the concomitant ‘hangover’ as buyers’ sentiment (for homes/cars/durables) crashed due to the soaring prices… and stocks did not like it (especially Small Caps). As we noted earlier, there was a big drop in gamma after the open’s OPEX which enabled today’s pain (the last 3 Fridays have been big up days)… Nasdaq has been up 8 weeks in a row before this week…

S&P 500 e-mini futures have printed all-time highs in 13 of the last 16 sessions. This was the first weekly drop in Nasdaq since mid-May, and the worst week for Russell 2000 since Jan 2021… and worst week for Small Caps since Oct 2020.

The market’s message to Powell…

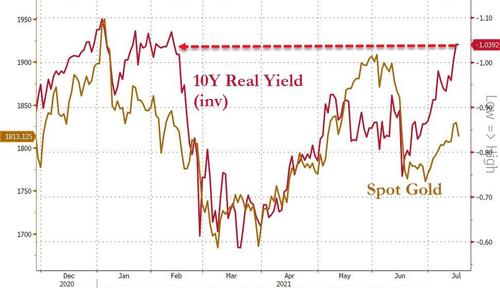

Small Caps vs Big-Tech continue to track real yields…

Source: Bloomberg

Small Caps rebound back over its 50- and 100-DMA did not hold this week…

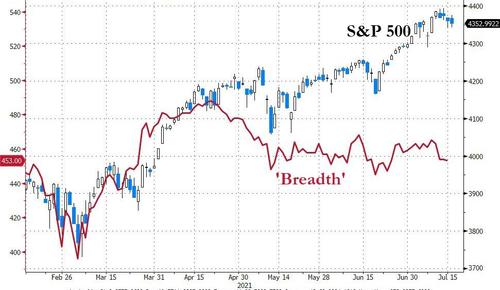

Breadth refuses to confirm the overall exuberance of this recent run…

Source: Bloomberg

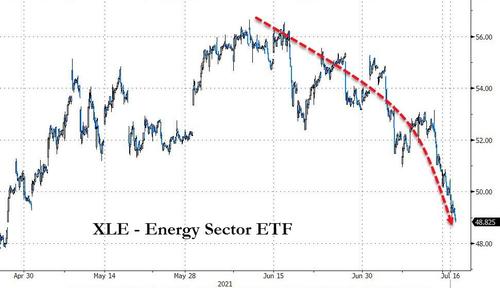

Under the surface, traditional defensive sectors such as Utilities, Staples, and Real Estate are all outperforming with Energy getting monkeyhammered. Financials ended lower despite earnings being encouraging…

Source: Bloomberg

Energy stocks are in correction, down almost 14% from their early June highs…

Source: Bloomberg

That is even more clearly shown here with ‘Defensives’ massively outperforming ‘Cyclicals’…

Source: Bloomberg

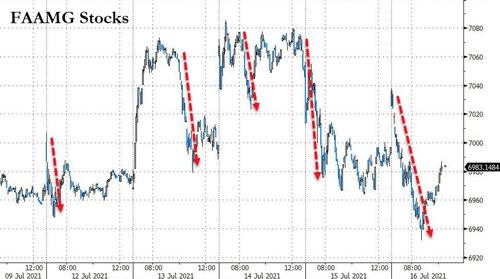

Notably, the market’s largest stocks (the FAAMG complex which now makes up ~23% of the S&P 500’s market cap), has not performed well this week, seeing heavy selling pressure hit each bounce…

Cathie Wood’s ARKK was clubbed like a baby seal this week (worst week in two months)…

Banks were mixed after earnings this week with BofA worst and MS best…

Source: Bloomberg

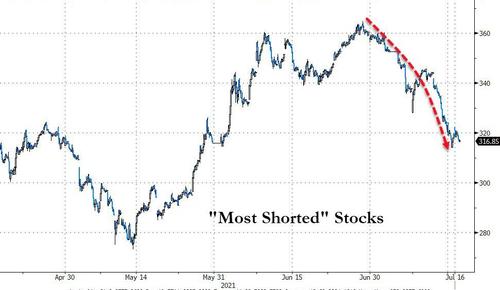

“Most Shorted” stocks tumbled almost 8% this week, the worst week (or best if you’re short) since Oct 2020…

Source: Bloomberg

Long-end yields are down for the 3rd straight week (8th week of the last 9)

Source: Bloomberg

30Y yields ended with the lowest weekly close since Jan 29th…

Source: Bloomberg

Real yields tumbled to their lowest (most negative) since mid-Feb (suggesting more upside for gold)…

Source: Bloomberg

The dollar ended higher on the week…

Source: Bloomberg

Cryptos were notably lower on the week but Bitcoin held around $32,000 and Ethereum above $1900…

Source: Bloomberg

Oil’s worst week since March (first 3-week losing streak in over a year) as WTI hit a $70 handle after UAE headlines…

Gold is up for the 4th straight week (albeit with an ugly end to the week)…

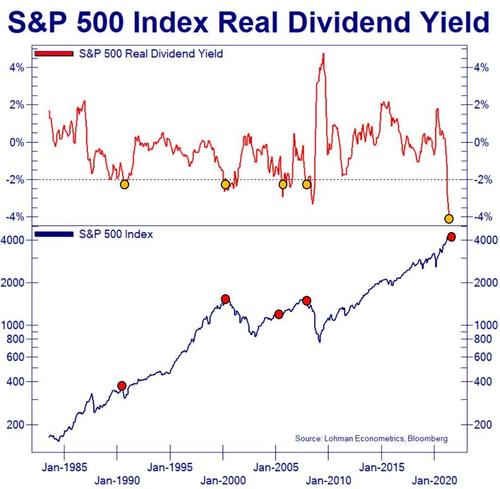

Finally, as @Not_Jim_Cramer notes, the plunge in the S&P’s real dividend yield has not ended well in the past for stocks…

And don’t forget Peter Lynch’s “Rule of 20″…

Stretched valuations plus today’s CPI send Peter Lynch’s “Rule of 20” valuation method into orbit pic.twitter.com/f8pxQ28cEq

— Not Jim Cramer (@Not_Jim_Cramer) July 13, 2021

Tyler Durden

Fri, 07/16/2021 – 16:00

Continue reading at ZeroHedge.com, Click Here.