Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Have Chinese State Banks Quietly Bought $180 Billion In Gold?

By Ye Xie, Bloomberg Live commentator and author

Three things we learned last week:

1. U.S. Treasury scrutinizes Chinese state banks for possible hidden currency intervention

While Janet Yellen’s Treasury Department refrained from labeling China as a currency manipulator in its semi-annual currency report, it again zeroed in on the role of Chinese state banks in the foreign-exchange market. It noted that China’s net foreign exchange settlement, which it considers a more comprehensive proxy for intervention because it includes the activities of China’s state-owned banks, surged to about $180 billion last year. But the PBOC’s foreign exchange assets, which historically track the settlement data, stayed flat.

The Treasury cautioned that it’s not clear what’s driving the unusual divergence between the two data sets, which used to provide roughly similar estimates of the direction and size of China’s currency intervention. While acknowledging that the difference could be due to commercial reasons, it’s also possible that these banks intervened on behalf of the PBOC to cover the central bank’s tracks, the Treasury said (ZH: or, it is the case that China has been stealthily accumulating some $180 billion in gold, as discussed last Friday in “Beijing Greenlights Purchases Of Billions In Bullion“).

“Overall, this development highlights the need for China to improve transparency regarding its foreign exchange intervention activities,” the Treasury Department wrote in a report released Friday. “Compared to other major economies, especially in Asia, China is increasingly an outlier with respect to its non-disclosure of foreign exchange market intervention.”

The Treasury raised similar concerns in its previous report. This won’t be the last time we hear about the issue.

2. Besieged Huarong got some reprieve

Dollar bonds of China Huarong Asset Management Co. rallied after financial regulators sought to ease investors’ concerns that the nation’s largest bad-debt manager may be heading for default. Huarong’s operations are normal and the company has ample liquidity, the China Banking and Insurance Regulatory Commission said Friday. Chinese regulators asked banks not to withhold loans to help stabilize to Huarong’s cash flow, Reuters reported, citing people familiar with the matter.

It’s clear that Beijing wants to keep Huarong from becoming China’s “Lehman moment”, even as it works to remove the perception of a blanket guarantee supporting state-owned companies.

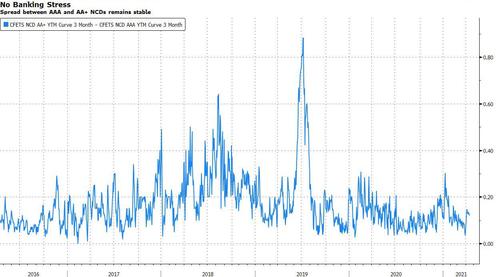

The uncertainties remain, with Huarong’s perpetual bonds trading at about 73 cents on the dollar. But so far, the contagion has been limited as the domestic funding market remains calm.

3. Global growth is accelerating

China’s economy strengthened in the first quarter as consumer spending rose more than expected. In the U.S., economic data from retail sales to manufacturing surveys also surged. In Europe, vaccine rollouts are starting to speed up. Meanwhile, bond yields remain contained as traders have pared back their expectations for central bank hikes.

No wonder global stocks keep smashing records.

Tyler Durden

Sun, 04/18/2021 – 19:30

Continue reading at ZeroHedge.com, Click Here.