Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Canada’s Freeland Unveils “Feminist” Budget: Slaps New Tax On Non-Residents & Big-Tech

Canada’s Finance Minister Chrystia Freeland unveiled C$101.4 billion ($80.9 billion) in new policy actions over three years to aid the economic recovery.

Freeland’s historic budget as the first female finance chief follows the blueprint of previous Liberal fiscal plans in seeking to expand the state and make social programs more generous.

“This is social infrastructure that will drive jobs and growth. This is feminist economic policy. This is smart economic policy,” Freeland said.

Overall, as Bloomberg reports, the nearly C$500 billion ($399 billion) budget is a bet that voters will support Trudeau and Freeland’s vision for the government to play a bigger role in the country’s economy over the long run.

“This budget is about finishing the fight against Covid. It’s about healing the economic wounds left by the Covid recession,” Freeland said in prepared remarks Monday.

“And it’s about creating more jobs and prosperity for Canadians in the days — and decades — to come.”

The headline item is new childcare and early learning funding of about C$30 billion over five years, with the intention of creating a subsidized program offering C$10-a-day care

Freeland announced various “green” initiatives, including various tax incentives, including a 50% cut to the general corporate and small business income tax rate for companies that manufacture zero-emissions technologies, and an investment tax credit to speed up adoption of carbon capture technology with the goal of reducing emissions by at least 15 megatonnes of CO2 annually.

“The resource and manufacturing sectors that are Canada’s traditional economic pillars — energy, mining, agriculture, forestry, steel, aluminum, autos, aerospace — will be the foundation of our new, resilient and sustainable economy,” Finance Minister Chrystia Freeland said in her planned remarks to Parliament.

“Canada will become more productive and competitive by supplying the green exports the world wants and needs.”

But the populist budget could not just incentivize, it needed to punish too… (in the name of feminist fair share seeking we presume). The measures won’t bring in a lot of revenue but will generate some headlines.

-

The budget includes a tax measure that will sting a few private equity shops, limiting interest-expense deductions to 40% of a company’s earnings starting in 2023 and 30% after that.

-

Non-resident homeowners will face a 1% tax if their property remains vacant, and a luxury tax will be levied on airplanes and cars worth over C$100,000, as well as yachts.

-

And finally, as of 2022, some digital companies will face a 3% tax on revenue from “digital services that rely on data and content contributions from Canadian users” — a measure designed to squeeze some cash from foreign technology giants including Facebook. The government thinks it can raise C$3.4 billion over five years from the levy.

As Bloomberg notes, the budget will now face a vote in the House of Commons, where the Liberals will need the support of at least one opposition party. Failure to pass it would trigger an election.

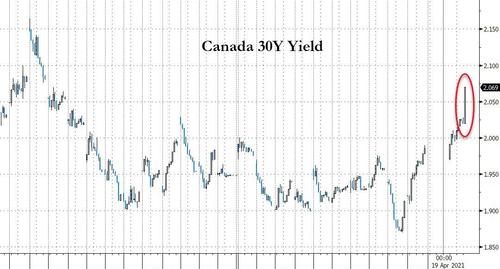

The Loonie is largely unaffected but the long-end of the Canadian yield curve is surging higher as the government plans to issue a record C$121 billion ($96 billion) of bonds maturing in 10 years or later, up from C$107 billion in previous fiscal year that ended March 31 (and includes a reopening of 50-year issue)…

The virtue-signaling government also disclosed that, subject to market conditions, it targets C$5 billion in its first green-bond debut, the first of “many”.

Tyler Durden

Mon, 04/19/2021 – 16:31

Continue reading at ZeroHedge.com, Click Here.