Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Vol, Correlation Massacre Means Capitulation Is Just Starting

Following a series of warnings that risk parity funds may be on the verge of capitulation and deleveraging into the maelstrom of tumbling stocks and bonds…

Not a good day for risk parity

— zerohedge (@zerohedge) February 22, 2021

Is Bridgewater ok

— zerohedge (@zerohedge) February 25, 2021

… yesterday it was JPMorgan’s turn to join the chorus of warnings that the continued selloff in rates, coupled with the accelerating drop in tech/growth stocks would result in very unpleasant consequences for both risk parity and conventional 60/40 balanced funds.

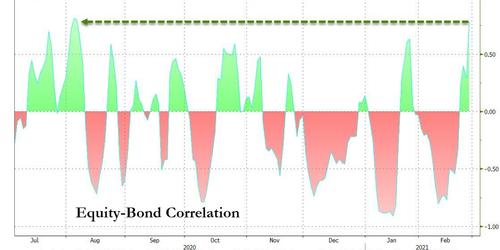

In his report, JPM quant Nick Panigritzoglou looked that the recent surge in the bond-equity correlation (which is usually negative and “helps to contain the volatility of risk parity funds and balanced mutual funds”)…

… which he wrote was “raising concerns about de-risking by multi-asset investors, such as risk parity funds and balanced mutual funds.”

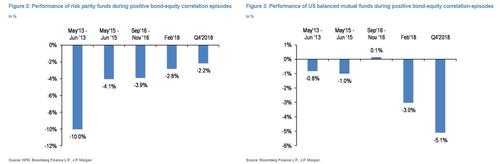

Addressing the $150bn risk parity fund universe, the JPM quant wrote that the most problematic episode was the taper tantrum of May-June 2013 as they had entered that episode with very high leverage. As a result they were forced to de-risk abruptly and suffered a heavy 10% loss. The other episodes, i.e. May-June 2015, Oct-Nov 2016, Feb 2018 and Q4 2018 were relatively less severe, as risk parity funds lost around 4% and their de-risking was likely more orderly

In other words, only a VaR shock episode similar to the Taper Tantrum could have dire consequences for risk parity funds. Well, unfortunately it now appears that the current tantrum is beginning to look awfully similar to the 2013 taper tantrum when viewed from the perspective of risk parity funds, which have been absolutely hammered in the past two weeks.

What about the far bigger universe of balanced (or 60/40)mutual funds, which have $1.5tr in AUM in the US and $7tr globally?

Panigirtzoglou explained that these funds have typically higher allocation to equities, around 60%, and are less mechanical and thus have more flexibility in responding to changes in volatilities and correlations. As a result of this flexibility and their higher equity allocation, they posted modest losses during the episodes of May-June 2013, May-June 2015 and Oct-Nov 2016. However, they suffered heavy losses during the Feb 2018 and Q4 2018 episodes as they were caught up with higher equity positioning and thus forced to de-risk by more than the former episodes. This shows how important is the starting point of risk positioning in determining the eventual loss in each episode.

As the Greek strategist concluded, it was “balanced mutual funds which looked more vulnerable than risk parity funds currently” because after de-risking in January these balanced mutual funds appear to have raised their risk positioning, i.e. increased their equity overweights and bond underweights, to high levels in February. Instead, after de-risking in January, risk parity funds’ leverage stayed below average during February. In other words, the JPM quant warned “if the bond-equity correlation continues to creep up, e.g. via a worsening of the equity market drawdown even as yields continue to grind higher, balanced mutual funds pose a greater vulnerability for the equity market.”

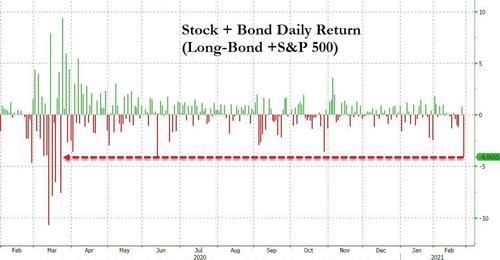

He was right because just one day later – today – balanced funds suffered the worst drawdown (a combination of long bond + SPX returns) since the March covid panic.

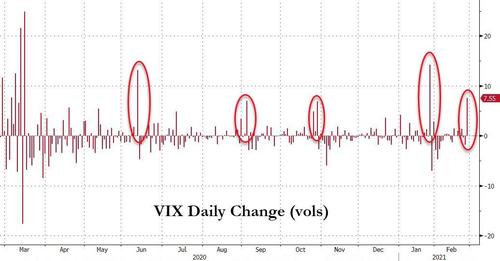

Meanwhile, as the VIX continues to surge, we next expect vol-control funds to join the liquidation panic, because after the VIX exploded by 8 vols from 22 to 30 (so much for Kolanovic’ “the VIX is a bubble”)…

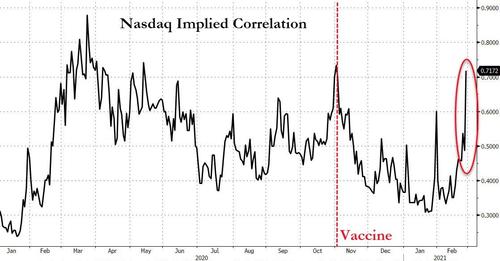

The surge into VIX, or macro overlays, is even more evident in the extreme move in Nasdaq’s implied correlation (which as a reminder measures the relative demand for index protection over the demand for protection for the underlying index components). The higher implied correlation goes, the higher market participants are preparing for ‘crash risk’ and as of tonight’s close, Nasdaq is back at pre-election levels (which was only calmed by the vaccine news removing that tail)…

…and one look at the parallel shift higher in the MOVE and to a lesser extent, shows that the VIX which may be headed to 70 if the VIX-MOVE correlation we discussed earlier this week (in “Is The Move In MOVE About To Rock The VIX“) holds…

… and unless bond yields stabilize and very soon at that (which may require a Fed statement), much more pain is coming not only for the VIX but all those funds which use it as a signal to de- and re-leverage.

Tyler Durden

Thu, 02/25/2021 – 18:00

Continue reading at ZeroHedge.com, Click Here.