Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

BofA Lists “Five Volatility Inducing Surprises” For 2021

Tyler Durden

Mon, 12/14/2020 – 15:20

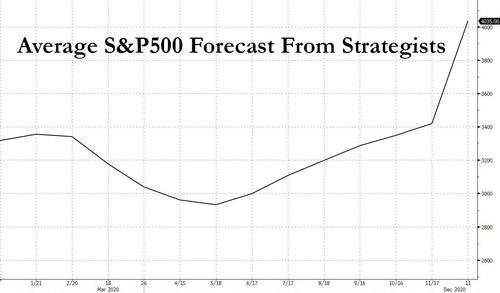

While consensus is uniformly, concerningly bullish about 2021, with the average sellside forecast expecting a more than 10% rise in the S&P500 which is now seen as hitting 4,035 in 2021, up from below 3,000 just in May…

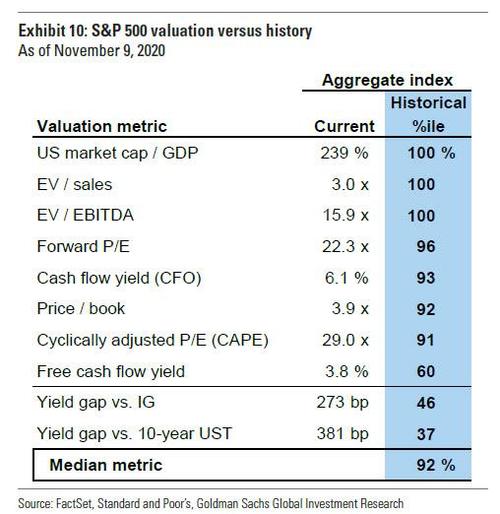

… the odds of disappointment in a market priced beyond perfection, and at valuations that have never been higher…

… are rising by the day. And while there is no shortage of “black swan” scenarios proposed by strategists after a year where everyone was wrong – a good list can be found on Macro Hive – here are five “volatility-inducing events” from Bank of America which have a high probability of happening including 1. rising China debt defaults tighten credit and spark recession; 2. US zombie firm bailouts cap productivity; 3. persistent WFH caps inflation; 4. big bipartisan industrial policy boom; 5. climate reformers accept nuclear, and which could have a significant impact on risk prices in the coming year.

1. China debt defaults force tighter credit, strangling the global recovery

China is on pace for another record year of corporate bond defaults (Chart 10), including by some state-owned enterprises that investors had assumed were implicitly guaranteed by the central government. Winnie Wu notes that the overall default rate is low, but given the 27ppt spike in debt/GDP this year (greatest increase since 2009; Chart 11), also flags the likelihood of policy tightening in 2020 to levels that previously triggered an A-share market crash, trade tensions, and big pain for the private sector.

2. Bailouts of zombie firms cap productivity & GDP

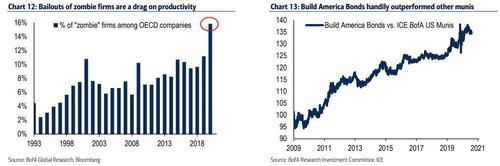

$21tn in 2020 global stimulus was necessary, but one policy cost is that “bad” firms are bailed out along with the good. The big risk is not a dramatic debt crisis but a long-term drag on productivity. 16% of OECD companies are now “zombies” (income doesn’t cover debt payments; Chart 10), which means that even in a rebound, revenues go to balance sheet repair instead of capex. The only cure for zombies is more aggregate demand.

3. Persistent Work-from-Home (WFH) caps wage inflation

As more firms move workers out of expensive cities and adjust wages accordingly, we wonder if global labor arbitrage is coming for the upper middle class. High overall savings figures are not a reason to expect inflation once you consider the composition: wealthy & WFH earners have more savings but don’t spend (just $0.52 of every new $1). Low-income service workers spend ($1.30 of every new $1) but have little savings.

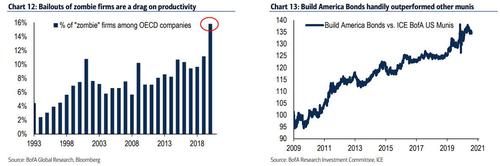

4. Big bipartisan industrial policy boom

BofA expects gridlock & austerity, but hope for a bipartisan détente, perhaps united around the threat of Chinese competition. As we have argued this year, the history of every successful modern country is a history of industrial policy (link), and after decades of neglect, the US desperately needs to rebuild its physical infrastructure, improve its digital infrastructure, and support growth industries. Complaints about funding are either confused or dishonest: R&D bonds priced above Treasuries and made available only to US citizens would be attractive, per the history of Build America Bonds (Chart 13).

5. Climate reformers let nuclear energy join the party

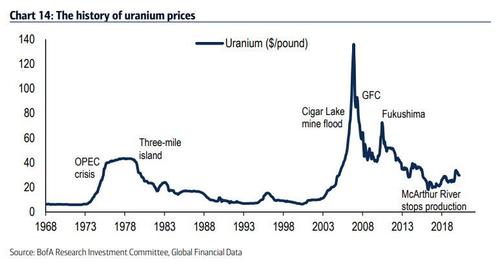

Clean energy is one of the most popular investment themes this year, but some policymakers are raising questions about the attainability of climate goals using renewables alone. Advocates argue that nuclear plants are necessary to meet backup needs when wind & solar are unavailable and are nearly emission-free when running. Uranium trades around $30/pound; it was $70 in 2011 and $136 in 2007.

Continue reading at ZeroHedge.com, Click Here.