Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Surprise: Student Debt Relief Will Mostly Help Middle- And Upper-Income Households

Tyler Durden

Tue, 12/08/2020 – 15:40

Now that the air is heavy with talk of debt forgiveness, initially starting with the government’s $1.6 trillion student loan portfolio before Democrats move to a broad debt jubilee much to the chagrin of all those Americans who responsibly have paid their obligations every month, investment banks have started analyzing the impact of the various student loan forgiveness proposals.

One such analysis comes from Goldman’s economics team which, in what will likely come as a disappointment for progressives, has calculated that even substantial debt reilef “would only have a small effect on GDP”, specifically, forgiving federal student loans up to $10k would add less than 0.1% to the level of GDP starting in 2021, and cumulatively add only $0.43 in real GDP for each $1 of forgiven debt over the next 10 years. A more generous debt relief program that forgives federal loan balances up to $50k would provide a slightly bigger boost to GDP, but would have a smaller per-dollar impact.

Meanwhile, forgiving federal student loans up to $10k would likely cost around $300bn (1.6% of GDP), while forgiving loans up to $50k would cost around $800bn (4.1% ofGDP). However, since these loans have already been funded through prior Treasury issuance, the impact on Treasury financing would be spread out over many years due to the lack of interest and principal payments. If loans were forgiven immediately, Treasury’s financing needs might actually decline, as tax payments on the forgiven amounts would likely more than offset the lack of scheduled loan payments.

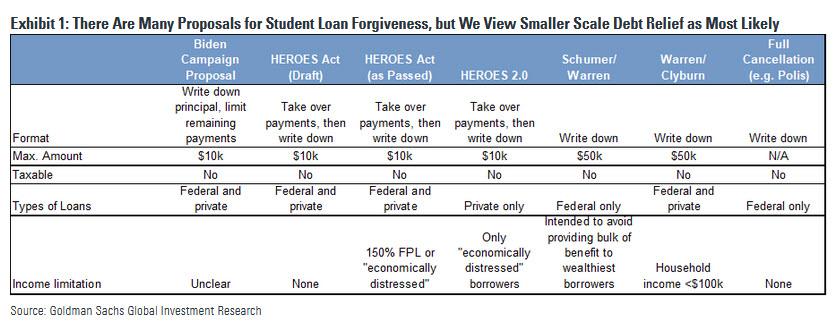

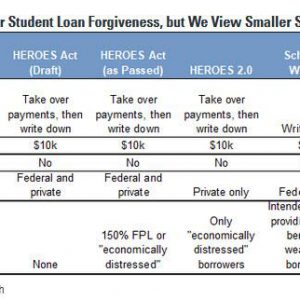

Taking a step back, loan forgiveness provisions have made it into the initial version of the HEROES Act—the House Democrats’ $3.4 trillion COVID-relief proposal that the Senate never passed—though none of the leading stimulus proposals in front of Congress at the moment deal with the issue. In light of the seemingly dim prospects for near-term legislative approval,several Democrats, including Senate Majority Leader Chuck Schumer (D-N.Y.) and Senator Elizabeth Warren (D-Mass.), have instead shifted their sights to executive action. The chart below summarizes several of the recent proposals.

While noble in theory – if only to those who have never paid down their debt while a slap in the face to all those who have – in practice this rush to appeal to populism carries numerous traps, besides just the modest boost to the economy.

- One is that while loan forgiveness is fairly popular in concept — 55% to 60% of voters in several recentsurveys support forgiving up to $50k in student loans — it is likely to become more controversial once the cost and distribution of benefits of such a policy becomes clear, especially if it amounts to $800BN (as noted above).

- Second, there are potentially significant tax implications that could do more harm than good to some borrowers in the near term. Debt forgiveness is usually treated as taxable income to the borrower. Some student debt is excepted from this, either because of specific exemptions in the HEA or the tax code, or through Treasury’s interpretation of the tax laws in specific circumstances. However, as it currently stands, debt forgiven through a broad federal forgiveness program would be taxable to the borrower. (Some tax lawyers argue that the Treasury would have the authority to exempt this debt without Congress, but whether this could or would happen is hard to predict.) For example, forgiving $50k in student debt for a borrower with $100k in income (and a marginal tax rate of around 25%) would leave them with a tax bill of around $12.5k in a single year, probably more than the entire tax bill on their other income. Beyond a legislative or administrative change to tax rules, one potential way to mitigate this might be to spread forgiveness over several years by relieving borrowers of their responsibility for scheduled payments or simply forgiving loan principal in several installments.

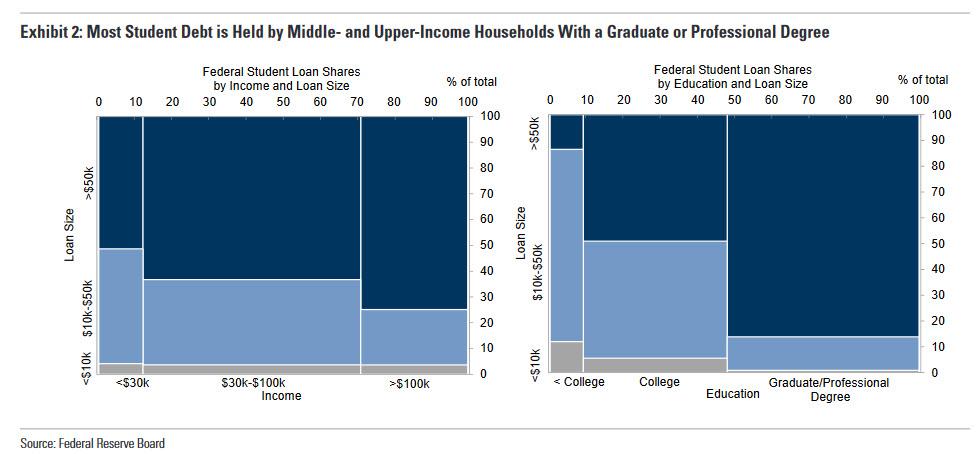

- The third and biggest reason we Goldman expects the Biden Administration to take a much more incremental approach is not only that the boost to consumption from widespread student debt relief would likely be modest in comparison to the budgetary cost (as noted above), but that it would mostly benefit the middle and – drumroll – upper classes. As Goldman’s Jan Hatzius writes, “although over 43 million individuals have federal student loans totaling almost $1.6tn, most federal student debt is held by middle- and upper-income households, and over half—including the vast majority of large debt balances—is held by highly-educated households with a graduate or professional degree (Exhibit 2).” According to Goldman – and frankly anyone with half a brain – these households likely have significant earning potential (we do not adjust for pervasive laziness or a predisposition to sit on your ass and ruminate rather than actually doing something useful with your life) and are less likely to be resource constrained, so eliminating their loan payments i) might not generate a large spending response and ii) once the peasants realize that their progressive heroes are once again bailing out the rich, the outcry would be a sight to behold.

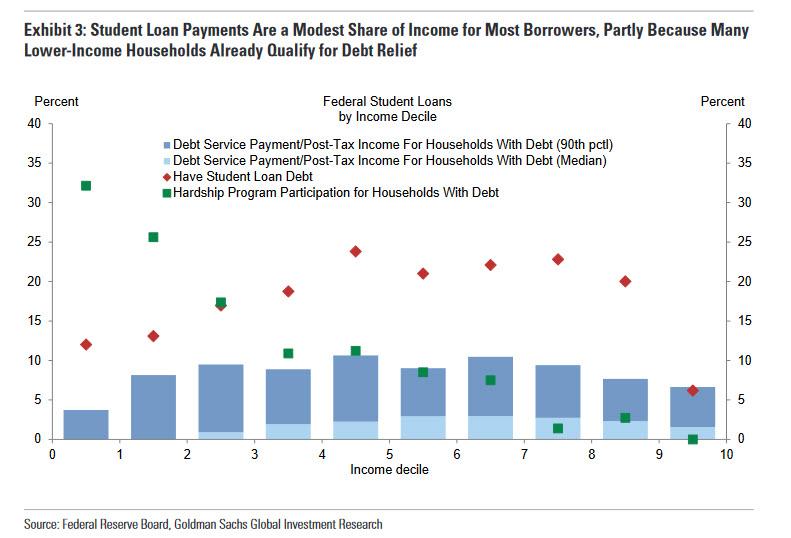

As an aside, despite what you may have read, federal student loan payments account for only a modest share of after-tax income for most borrowers. The next chart shows that the median payment-to-income ratio for households with outstanding federal student debt is below 3% for all income deciles, and the 90th percentile is less than 11%. These low payment-to-income ratios reflect low interest rates on federal student loans, and that many households that would otherwise struggle to meet payments already qualify for debt relief (that’s right: all those feminism and classical harpsichord majors who make about $15,000 a year already have debt forgiveness). Indeed, as Goldman confirms, over 32% of households with federal student debt in the bottom income decile are already enrolled in an income-based repayment or hardship deferral program.

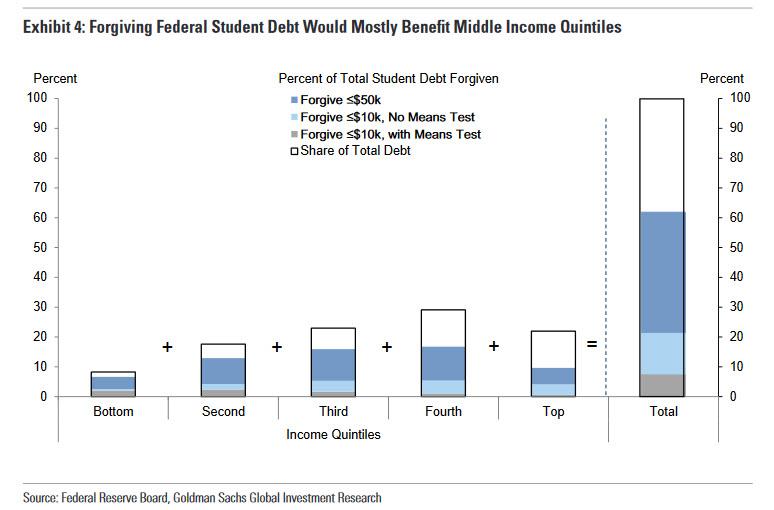

Finally, the chart below, looks at the share of total student debt that would be forgiven under a 10K and 50K forgiveness policy. Forgiving up to $10k in student loans per borrower would reduce total federal student debt balances by 22%, with the benefits most concentrated among middle-income households (Applying a means test by only forgiving debt for households that either have income less than 150% of the federal poverty line or are economically distressed would make the policy significantly more progressive). The more expansive policy that forgives all federal debt up to $50k per borrower reduces total debt balances by 62%, but middle- and upper-income households receive an even greater share of the benefits.

Yet despite this analysis showing the student debt forgiveness would i) do little to boosting consumer spending or the economy, ii) would mostly benefit middle and upper-income households, we are confident that Biden will sign an executive order forgiving at least $10,000 in student loans.

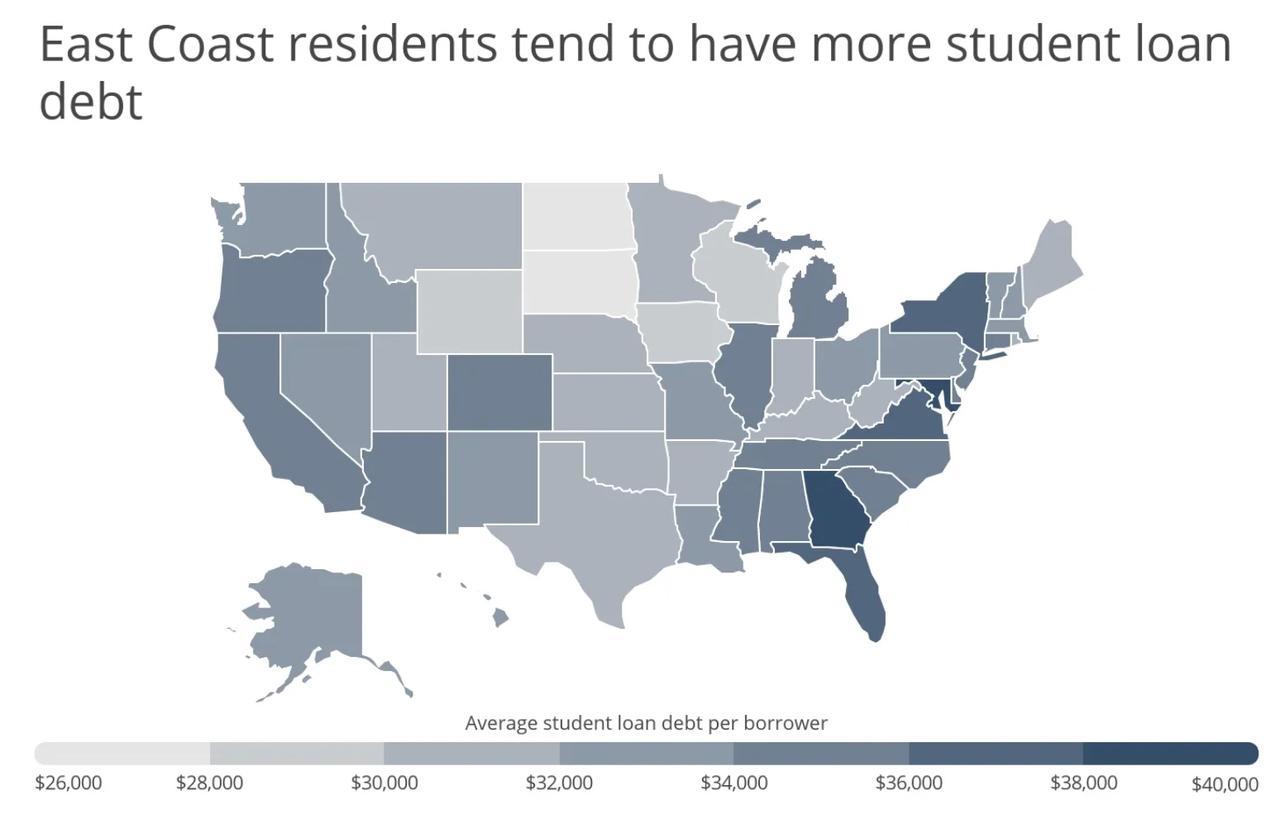

Why? Because as we showed recently, blue states have the highest average student debt.

And since this proposal has little to do with actually stimulating the economy (and certainly encouraging responsible financial behavior) and everything to do with further widening the red-blue divide, it is virtually assured that it will pass if only for that reason.

Continue reading at ZeroHedge.com, Click Here.