Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

SEC Finally Considers Requiring US-Listed Chinese-Companies To Use Auditors With US Oversight

Tyler Durden

Wed, 11/18/2020 – 15:05

What would the U.S. capital markets look like to China based companies if they were forced to use U.S. auditors? We’re guessing U.S. markets would lose a lot of their appeal overnight.

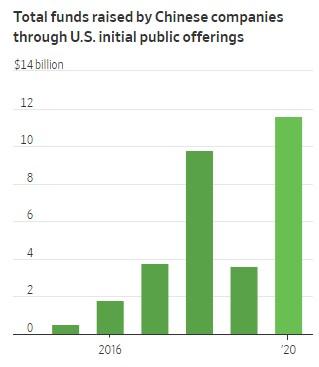

Regardless, that’s the extremely serious question that many Chinese firms may want to start asking themselves, as regulators are now proposing a plan that could require exactly that, according to the Wall Street Journal.

The proposal will be issued for public comment in December, and will address a problem that has plagued Chinese companies on U.S. capital markets for more than a decade: China hasn’t let the work of Chinese auditors be inspected.

This has been the key factor in a number of Chinese firms being halted and delisted from U.S. exchanges over the last decade, as short sellers like Citron Research and Muddy Waters Research have collectively worked, among others, to help expose innumerable frauds and misstatements from companies based in China. A movie, “The China Hustle“, was even made about the widespread fraud.

The PCAOB has been unable to get cooperation from China on a broad scale. The PCAOB has often had to sue Chinese audit firms and negotiate with Chinese regulators for more information. Now, new regulations could put the responsibility on the listing exchanges, like NASDAQ and NYSE, who choose to give credibility to China-based entities by accepting their listing fees and putting them on their well known exchanges.

In other words, it appears to us that U.S. exchanges seem to have no problem making people like Jack Ma into billionaires with U.S. capital, without even understanding the intricacies of the opaque businesses they choose to list.

So far, the NASDAQ and NYSE have refused to change their listing rules, despite massive frauds like Luckin Coffee being uncovered. The regulations could wind up hurting the top lines of exchanges, as many U.S. listed China-based companies could wind up moving off of major exchanges and onto the Over the Counter market to skirt the new regulations.

The SEC is trying to get the plan in order before Chairman Jay Clayton leaves at the end of the year, as we noted yesterday. The regulation could then be “tweaked” by an incoming Biden administration.

China has come up with the laughable excuse that it “is worried about auditors revealing strategic secrets held by domestic firms, some of which are majority-owned by the Chinese government”. In fact, the country signed into law this year a rule stating that its citizens can’t comply with overseas regulators without the government’s permission.

Those “secrets”, if we had to guess, may include fraud being perpetrated on a massive scale.

The regulation seeks to address this issue by including a separate proposal to allow Chinese firms to get a second review of their books by any firm globally that complies with PCAOB oversight.

Paul Leder, an attorney at Miller & Chevalier and former head of the SEC’s Office of International Affairs, said: “How do you meet the U.S. goal which is an audit subject to a meaningful inspection, and what appears to be the Chinese goal of limiting the access to information held in China?”

Continue reading at ZeroHedge.com, Click Here.