Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

“Bulls For The Win, Bears Have Nothing, Everything Is Great, Right?”

Tyler Durden

Mon, 11/09/2020 – 15:40

Authored by Sven Henrich via NorthmanTrader.com,

Bull Targets

First off: Great news. As I’m sitting here in the UK with lockdown number 2 I’m very pleased to hear the news of the Pfizer vaccine. I hope it’s a winner. Yay for science, an amazing achievement. Besides I can’t wait to hit the beach. Unfortunately we all still have to wait until it’s approved and distributed so we need to remain patient until next year it looks.

Markets however are not patient. Far from it and bulls have done what bears haven’t been able to do since March: Crash markets, in this case crash markets upwards.

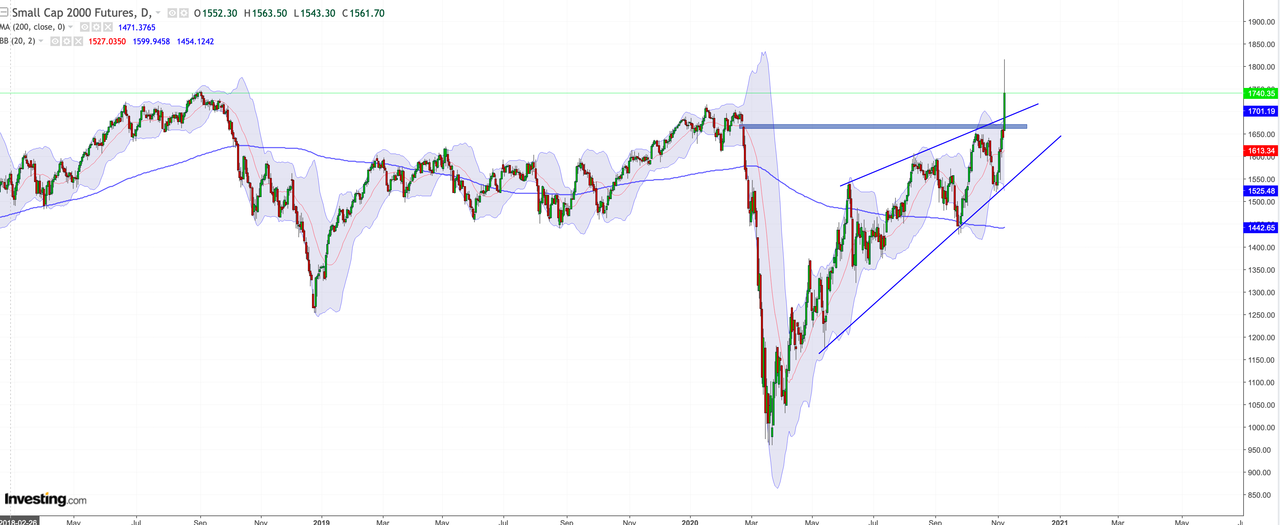

Look no further to small caps which went lock limit up in overnight trading and then poked even higher during market open:

New all time highs for small caps. Must’ve been a great year and I, naturally being me, couldn’t quite resist the sarcasm this morning:

In 2020 I learned you can have negative earnings growth, a shrinking economy, several hundred thousand dead, high unemployment and markets will still make record highs because the Fed says so.

— Sven Henrich (@NorthmanTrader) November 9, 2020

But these are the markets we have and bulls have accomplished the trifecta here: Monetary stimulus, election certainty, and now a vaccine.

Bears are dead, long live bears for now the real test begins as all good news has been priced into markets.

Lest not forget that this market is now trading at the highest valuations in history, by far. As of this morning near 176% market cap to GDP.

No worries, let’s project to 200% market cap to GDP so the Wall Street hype machine disseminates:

JPMORGAN: “We view a confirmed Biden victory with a likely legislative gridlock as a goldilocks outcome .. we see the S&P 500 reaching 4,000 by early next year, with a good potential for the market to move even higher (~4,500) by the end of next year ..” [Dubravko]

— Carl Quintanilla (@carlquintanilla) November 9, 2020

For that’s what a 4,500 S&P 500 target implies by next year.

But valuations haven’t mattered all year so why bother about it now or so sentiment goes.

Let me make a few observations here.

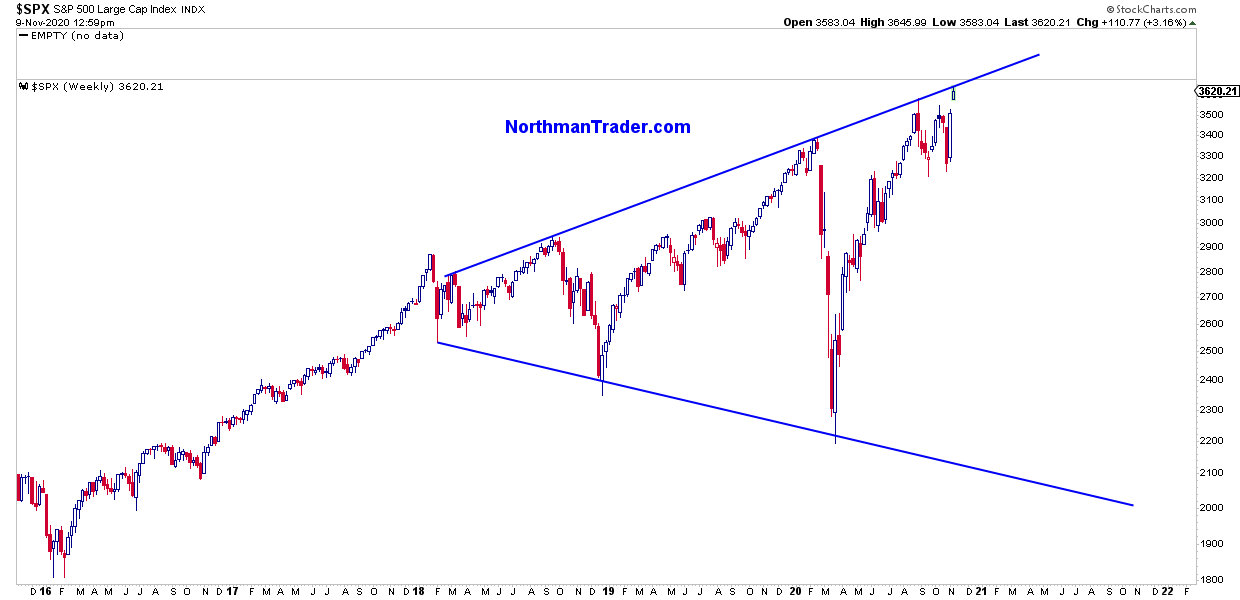

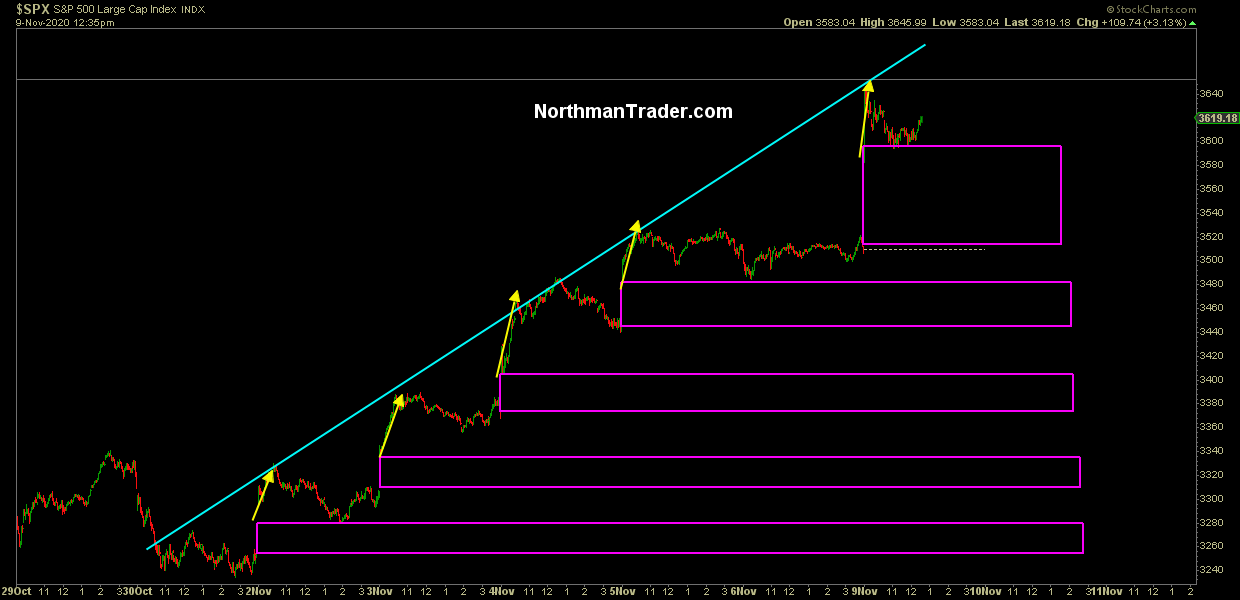

First off, today $SPX hit the 3650 area. That price zone is actually not a surprise. Indeed I highlighted it in the recent Bull Case, part of it was seasonality based part was technical, although, admittedly, the specific technical patterns fell apart in the lead up to the election. Yet the price zone with the upper trend line was clearly in the sight of markets:

“Upside risk per the inverse pattern outlined is into 3650 and the upper trend line.”

As I kept outlining in my mini videos on Twitter bulls kept holding support and a positive divergence was forming on the 2 hour chart into the election and I highlighted it again on Friday:

Quick market update: pic.twitter.com/P26ArQCDtR

— Sven Henrich (@NorthmanTrader) November 6, 2020

And here we are today and we see the upper trend line tagged:

Interesting times.$ES pic.twitter.com/HLTgyqnuA7

— Sven Henrich (@NorthmanTrader) November 9, 2020

And one has to appreciate how clean all this is from a technical perspective:

So what’s the problem with all this? Bulls for the win, bears have nothing, everything is great right?

Not so fast.

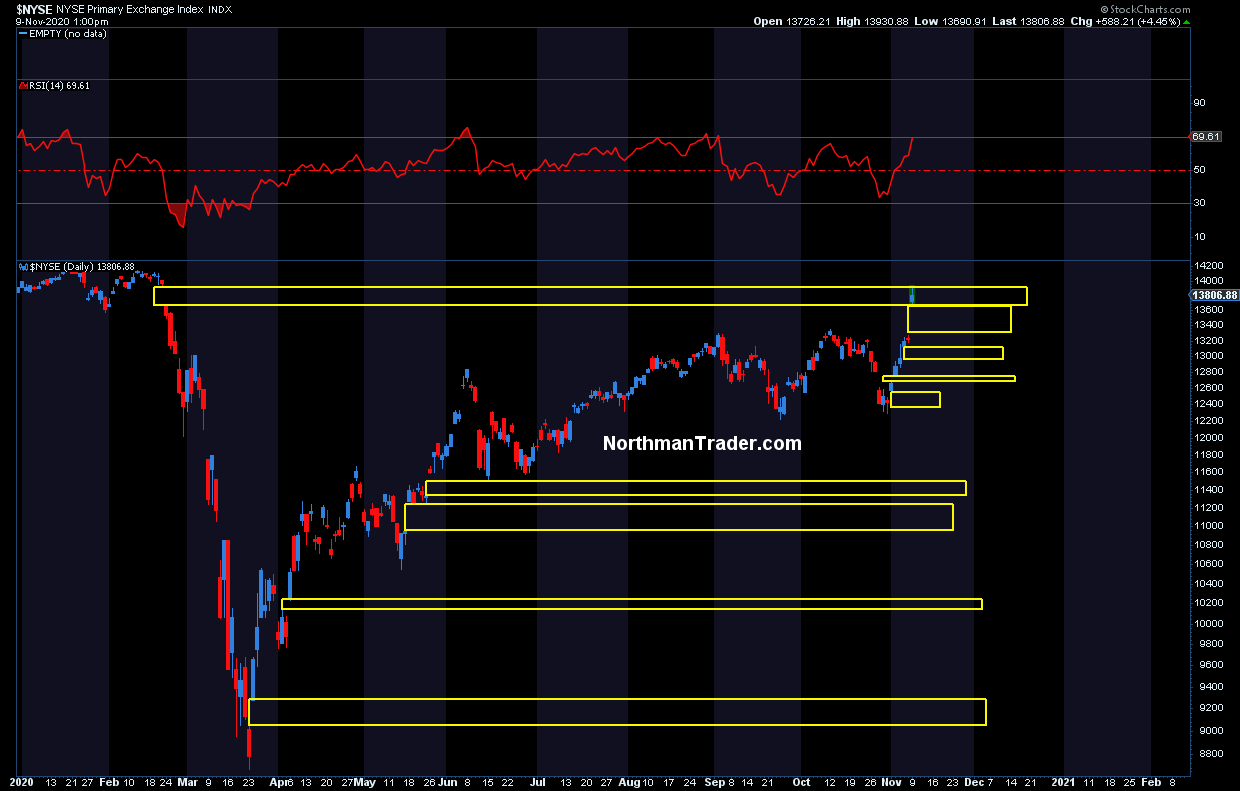

Firstly, note that something important happened today, $NYSE, after many months failing to fill its February gap, finally managed to do so today:

There are now no more gaps to fill to the upside, nothing but a large array of gaps to the downside to fill for this rally off of the March lows is defying all technical history. It is entirely built on gaps that are unfilled. Some gaps may never fill or may take years to fill is generally the technical experience, but this here, a market so reliant on some many open gaps is entirely without precedence.

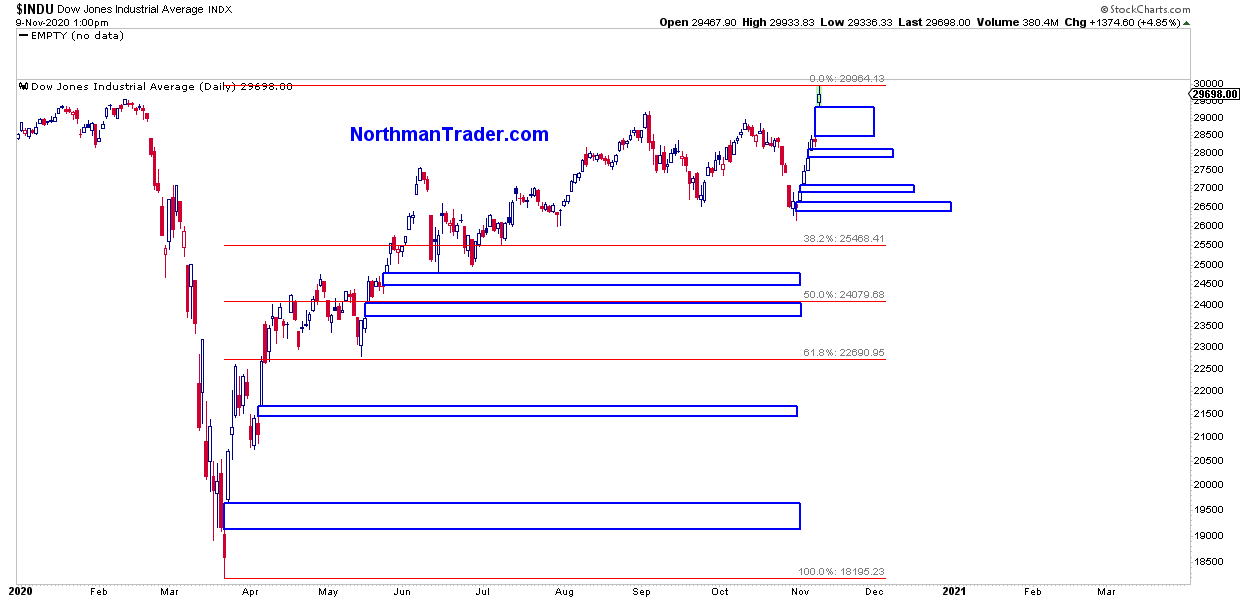

We can observe a similar structure on the $DJIA:

Massive amount of gaps. Indeed the market structure we can now observe since the beginning of November is entirely unprecedented:

Price discovery. Ha ha. It’s gap, ramp and camp in mechanical fashion. All price gains are achieved via overnight gap, then an open ramp as shorts are crushed presumably and panic buyers chase price and then nothing. Rinse and repeat. There is no market history that shows such price action to be sustainable or even desirable.

Jay Powell bragged of having achieved “smooth market functioning” last week. Yea. Really smooth.

Today’s gap into new all time highs takes the cake then. Via Sentimenttrader:

“Since 1982, the largest positive opening gap the S&P 500 contract has enjoyed on a day it hit a 52-week high was 1.6%. So yeah, this time is different. By a factor of 3.”

Smooth market functioning.

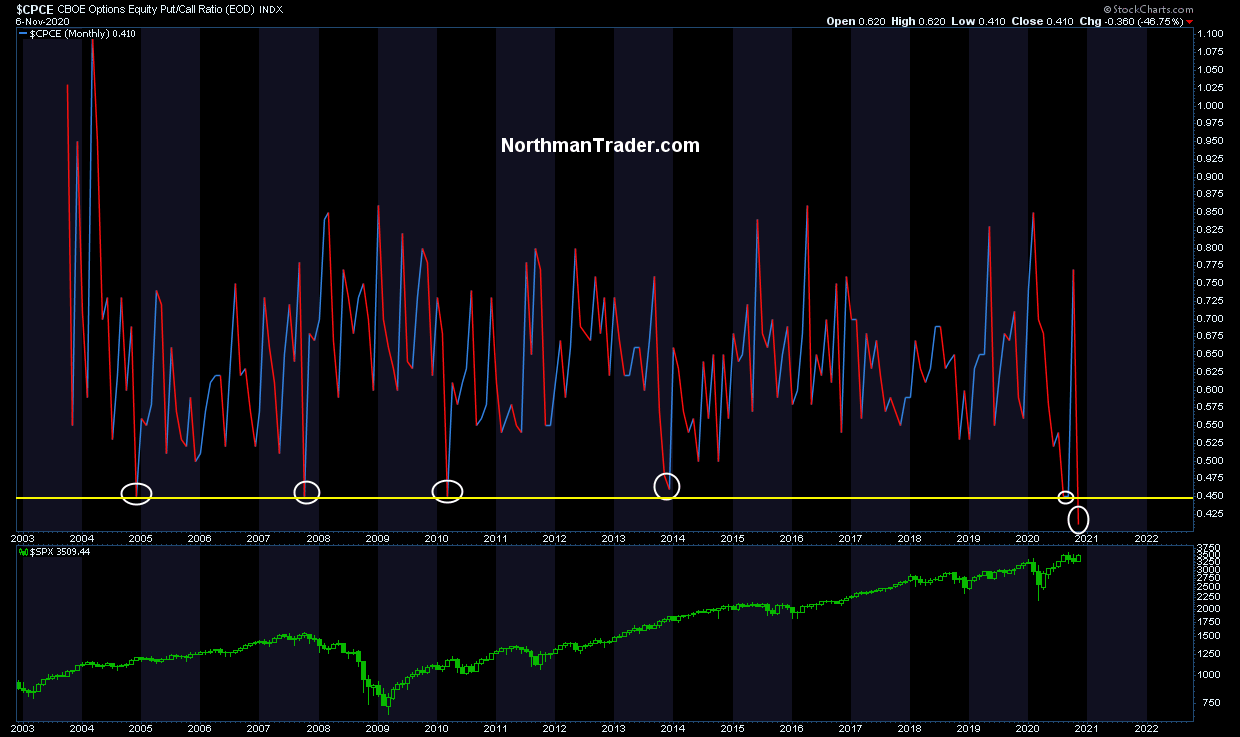

So clearly bulls remain in control pushing prices into key technical resistance unperturbed by historic valuations lapping up every optimistic interpretation one can imagine with not a worry in the world as put call ratios are back in the cellar:

The seasonality chart I highlighted in the bull case appears to be playing out, but let me just highlight a few words of caution: The combination of this market structure here, with massive open gaps, historic resistance, wild optimism and massive complacency leaves a lot of room for surprises and backtesting.

And extended charts that reverse tend to produce technical damage that can be consequential, especially now that the technical bull targets have been reached.

And given all the good news I’m also reminded of this:

Old saw:

Bear markets end on bad news.

Bull markets end on good news.— Sven Henrich (@NorthmanTrader) November 9, 2020

I don’t know how many of these gaps below will fill, but my technical sense is quite a few in due time and quite a few of them may even fill before the end of 2020.

* * *

For the latest public analysis please visit NorthmanTrader. To subscribe to our market products please visit Services.

Continue reading at ZeroHedge.com, Click Here.