Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

In FX, It’s “All About One Thing Now”

Tyler Durden

Thu, 11/05/2020 – 15:40

Having made waves across FX desks with his Wednesday call to end his long-running dollar short trade (ironically just one day before the biggest drop in the BBDXY since August), Deutsche Bank’s FX strategist George Saravelos today asks with the US election (very) slowly edging to a conclusion, what is the next focus for the market?

His answer: Carry trades.

Explaining this view, Saravelos first reminds client why he argued in favor of closing out a US-centric dollar-negative reflation theme:

- divided Congress,

- a larger-than-expected winter COVID wave, and

- elevated political polarization

… all of which argue for continuity in the structural themes that have dominated the market for the last ten years: the primacy of monetary over fiscal policy; disinflation over inflation; secular stagnation over cyclical rotation. And as observed earlier, judging by the surge in risk assets – especially tech names – as well as hard currency alternatives such as gold and cryptos, he is spot on.

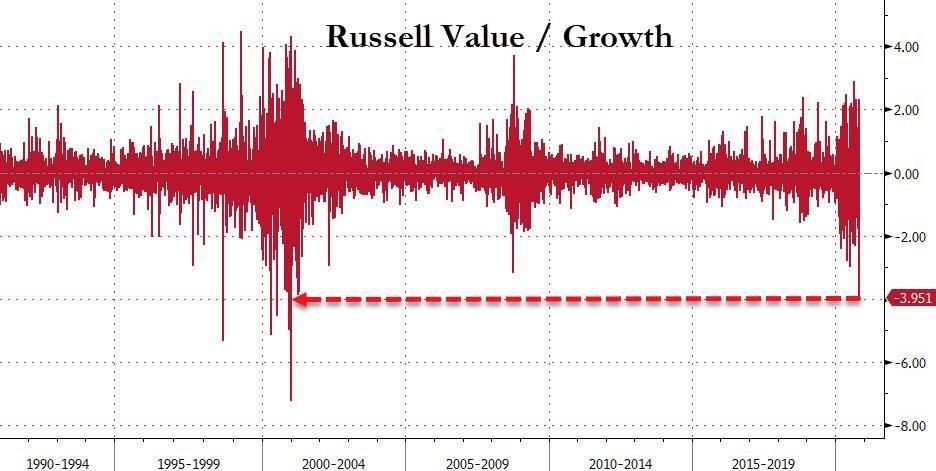

Picking up on this, this morning Saravelos writes that “continuity is exactly what the equity market has been pricing overnight with the relative move in growth (tech) over value (reflation) stocks the biggest in over two decades.

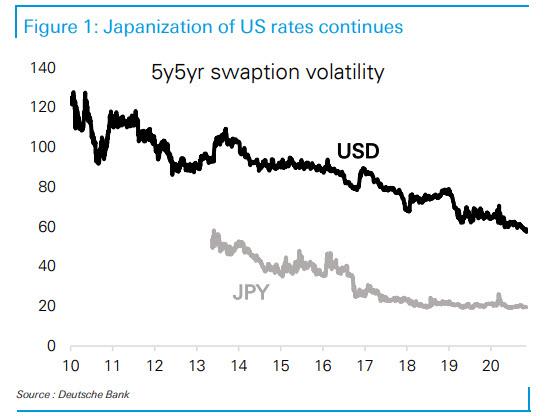

As the DB strategist adds, in FICC, “it will (unfortunately) all be about low volatility and financial repression as central banks suppress yields in an effort to squeeze out the last bit of monetary stimulus.” Clearly, this mix is very bearish for volatility and sure enough, US 5y5y swaption rates volatility collapsed yesterday to the lowest on record, as shown below, as volatility is literally drained from the FX market on a daily basis.

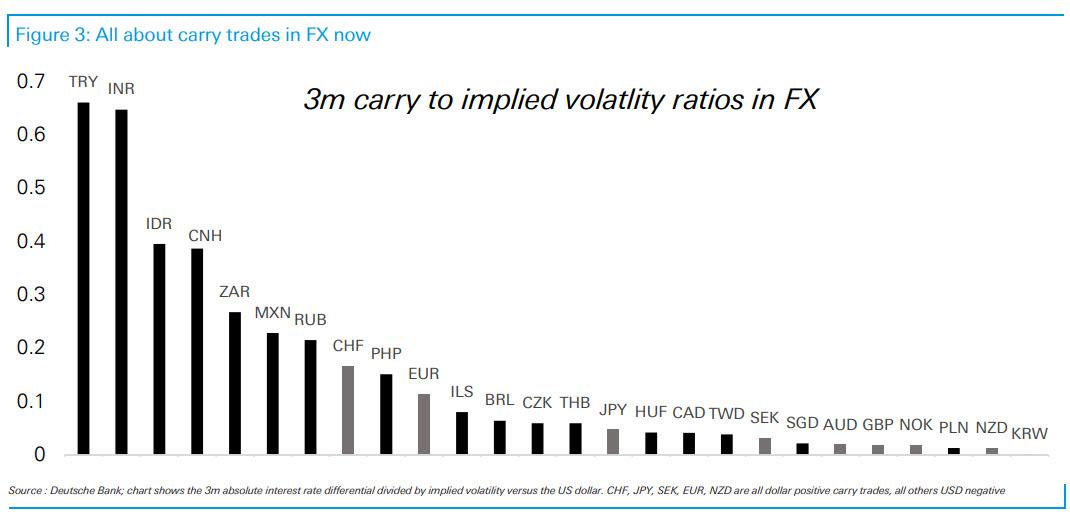

Of course, traders can’t make money without volatility, which means that in FX, going forward it will be about the search for carry or any positive idiosyncratic stories that differentiate a country from the “low growth, low inflation, stuck politics” pack.

Unfortunately, according to Saravelos, “there is very, very little carry left in G10 FX but three countries that stand out with a positive growth outlook for the next few months are Australia, Sweden and Norway.” The Deutsche Banker therefore remains bullish on AUD/USD (despite the RBA’s recent expansion of QE and hint that negative rates may be coming), and Scandies.

Meanwhile, in EM, there are many more carry candidates, with most in Asia FX as shown below.

Summarizing his thoughts, “Asia is the one place that continues to (positively) differentiate compared to the rest of the world, especially CNH. Carry and growth outperformance is a good mix to have over the coming winter months: those are the currencies that will outperform.” And in a world where central banks have taken over virtually every other aspect of markets, he is probably right.

Continue reading at ZeroHedge.com, Click Here.