Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Pelosi Optimism Triggers Massive Value Rotating Short Squeeze

Tyler Durden

Thu, 10/22/2020 – 16:04

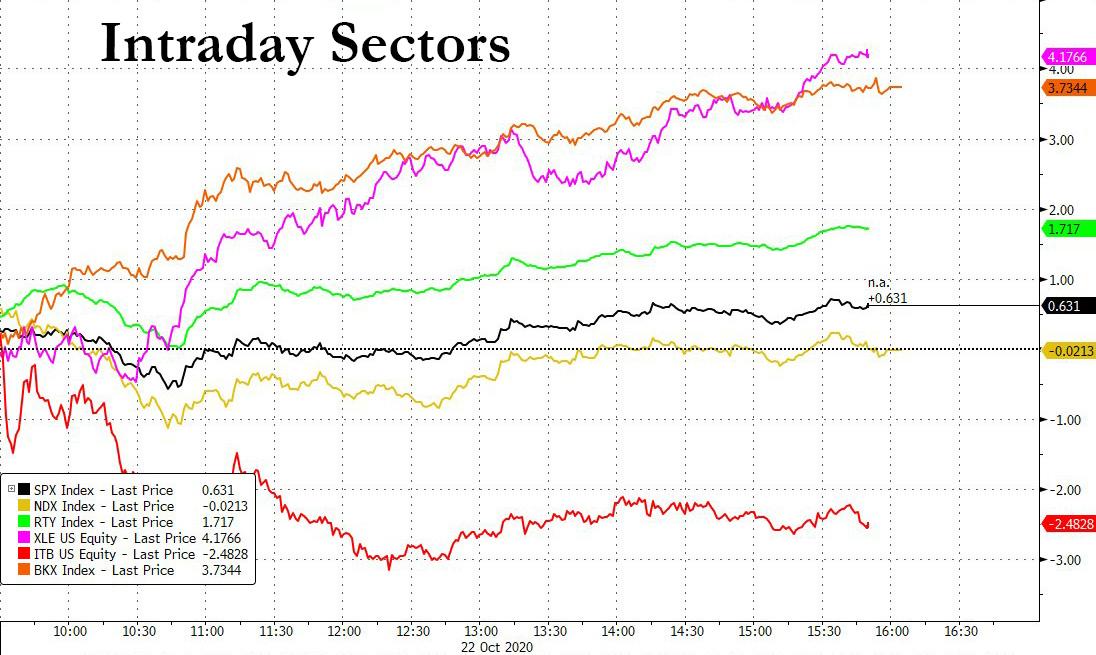

Markets continue to be transfixed by every twist and turn in the stimulus sage, whose latest installment today came form Nancy Pelosi who said that we are “just about there” on resolving a key piece of a coronavirus relief package, even as she again admitted that there are significant differences still being negotiated. ANd in what was otherwise a boring day for stocks, the real action was below the surface with the most shorted names surging higher by 2.5%.

And in a world where everyone hates value stocks, the squeeze meant that value was on a tear today, while growth sank in early trading and has been depressed…

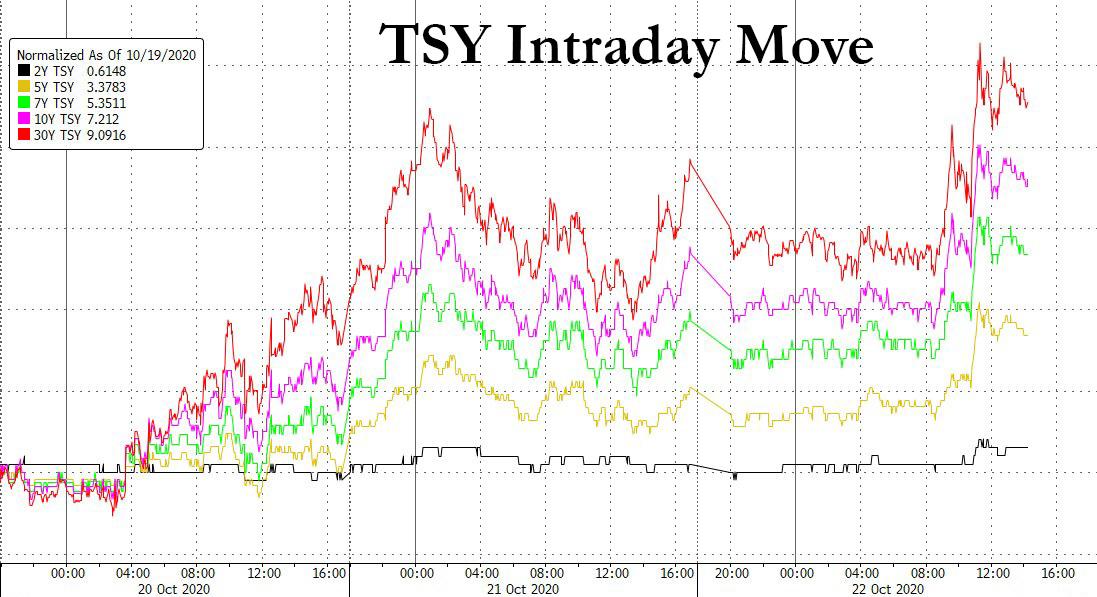

… largely as a result of a continued push higher in yields across the entire curve as the 10Y hit 0.85% this morning…

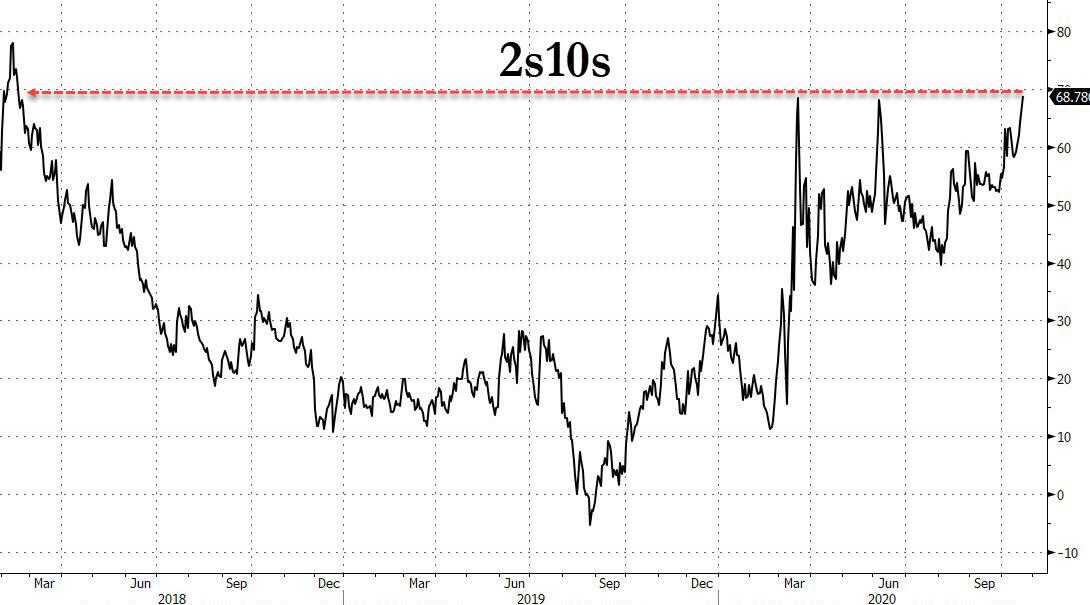

… pushing the 2s10s curve to what will either be a triple top just below 0.70%, or if this is breached, then the curve will likely steepen to the 78bps level hit in March.

Looking at individual sectors, the jump in yields and the return of the reflation trade, meant that banks and energy stocks surged rebounding from a prior day selloff.

This however leads to the question we first asked yesterday when yields shot up overnight and hit risk assets: are we finally approaching a level in yields that catalyzes a stock selloff? To be sure, the nominal 10Y may rise as high as 0.96% high seen in June, especially if fiscal stimulus is miraculously passed by Congress in the 11th hour.

However, as Bloomberg’s Richard Jones writes, beyond those yield and curve levels, “stocks will probably struggle for further upside” as even higher yields and steeper curves “could start to eat into the excessively supportive rates backdrop underpinning equities” as the equity risk premium is hit. Of course, if stocks do begin to sell off on these dynamics, this will drive flows into bonds and those yields will drop along with equities, short-circuiting the process. Ultimately, as Jones concludes, “much depends on stimulus timing and the election result, and additional upside for yields may not be as forthcoming as in recent weeks. Nonetheless, the reflation trade has driven both stocks and bond yields higher won’t last forever.“

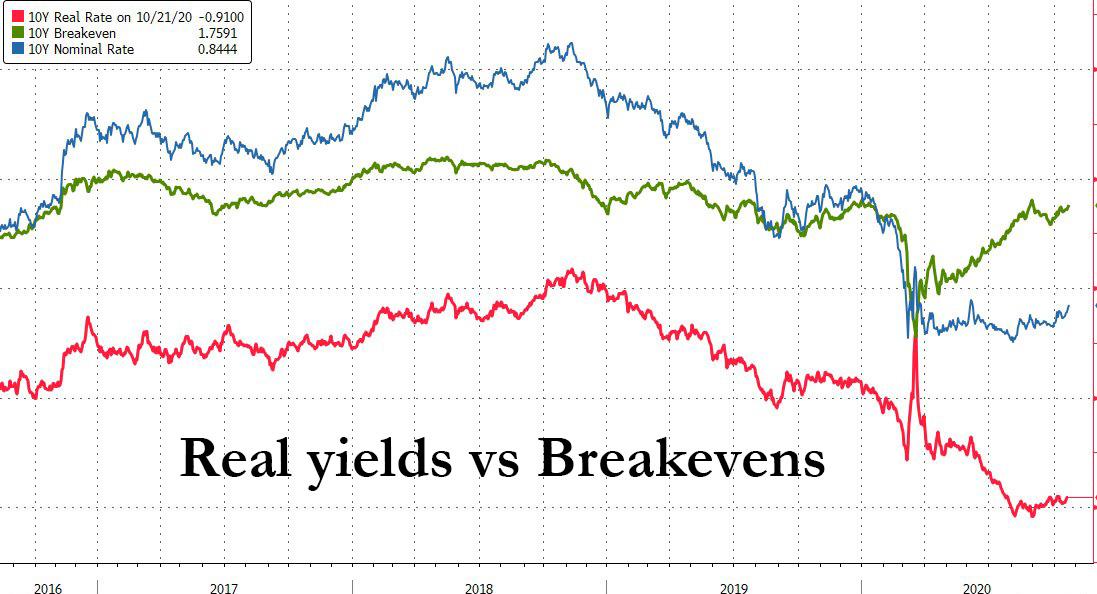

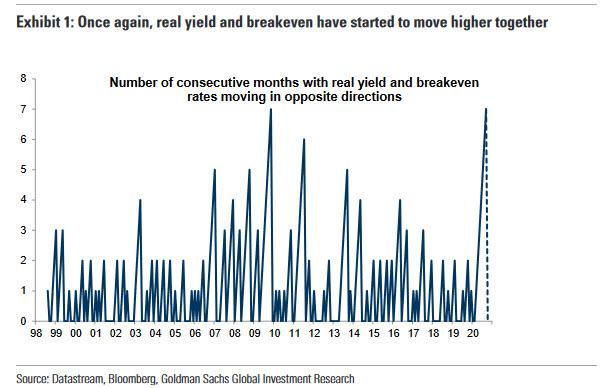

Meanwhile, looking below the surface of the move higher in nominal yields we find a continuation of the recent convergence between real rates and breakevens…

… both of which have continued to move higher ending the “bizzare” divergence which as Goldman observed two days ago lasted for a record 7 consecutive months after the March crash.

It was the move higher in real rates that also explained much of the drop in gold today (real rates inverted in chart below).

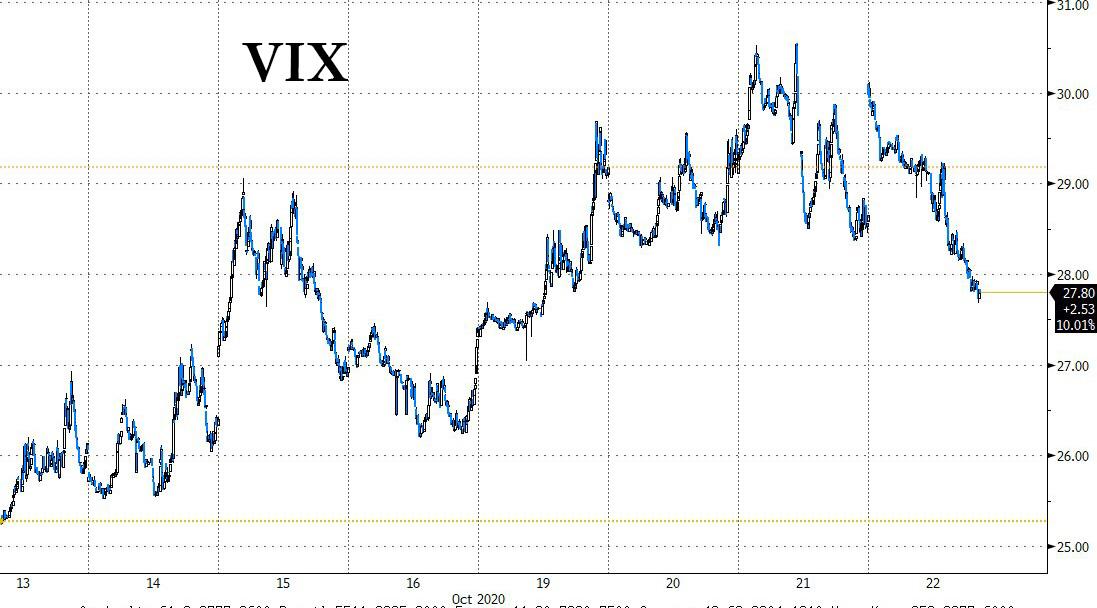

Today’s rotation into value stocks also meant that the VIX dropped sharply after its recent gains, and was last below 28 after briefly rising above 30 yesterday.

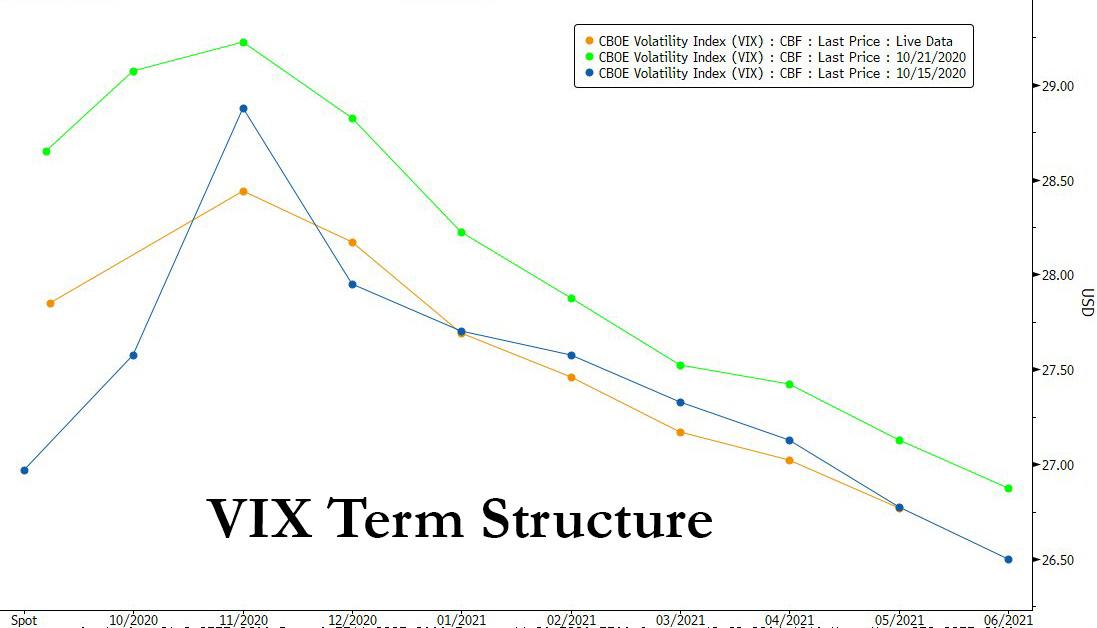

The decline was not just in spot, but across the entire term structure which eased from yesterday levels to one week low.

Yet even so, the divergence that we discussed earlier between equity and credit VIX and which Boaz Weinstein is hoping to profit from as it converges, continues apace.

Continue reading at ZeroHedge.com, Click Here.