Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

WTI Dips After Surprise Crude Build

Tyler Durden

Tue, 10/20/2020 – 16:33

Oil prices rallied to seven-week highs today (WTI above $41.50) on the back of hope-filled headlines about US stimulus talks (and nothing out of the OPEC+ discussions).

“Anything that helps the economy do better is going to be helpful for crude,” said Bill O’Grady, executive vice president at Confluence Investment Management in St. Louis.

“Still, driving activity is down and people are not as global as they were. It may get better, but not back to where it was before.”

API

-

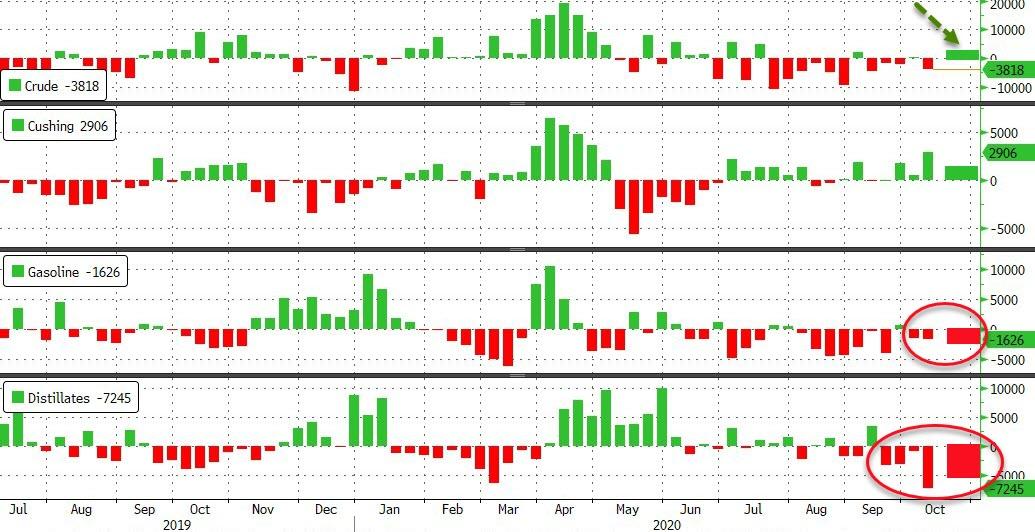

Crude +584k (-1.9mm exp)

-

Cushing +1.174mm

-

Gasoline -1.622mm (1.6mm exp)

-

Distillates -5.938mm (-3.0mm exp)

Analysts expect more inventory draws (even after the previous week’s big drop in crude and distillates stocks), but API reports that crude stocks actually rose by 584k barrels. API also reported another big distillates draw.

Source: Bloomberg

Notably, according to the EIA’s Today in Energy report, increased demand from the agricultural and residential sectors will help draw down distillate fuel stocks in coming months but not by enough to boost prices:

“These initially relatively high inventories, along with lower crude oil prices, will continue putting downward pressure on distillate fuel oil prices through the 2020–21 winter season,” EIA says.

EIA says inventories remained high through the summer as production outpaced demand.

As Bloomberg notes, U.S. crude futures have struggled to make a sustained break above $40 as governments try to control new flareups of the virus. The worsening virus in Europe is sapping momentum from an already fragile demand recovery. Still, the prospect of a long-awaited stimulus deal in Washington would provide a much-needed boost to demand in the U.S.

WTI was hovering around $41.50 ahead of the print and slipped lower after

“According to the current OPEC+ deal, we are going to see 2 million barrels a day come in January, and we’re not so sure the market can handle this,” said Bart Melek, head of global commodity strategy at TD Securities. “We’re also going to need more clarity where the fiscal plan is going. So there are a lot of uncertainties out here.”

Continue reading at ZeroHedge.com, Click Here.