Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Hope For Hedge Funds? Market Volatility Has Investors Seeking Long-Short Strategies

Tyler Durden

Sun, 09/27/2020 – 16:15

Few in the finance industry have suffered at the hands of Fed policy that has driven the stock market nowhere but up over the last decade more than hedge funds. Investors have left hedge funds in droves as the appeal of passive investing has grown, resulting in growing outflows and lower fees.

But now, with volatility returning to the market, it seems as though there could be some hope for hedge funds after all.

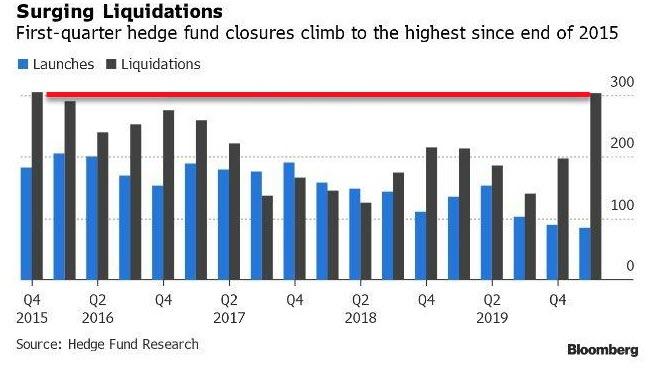

Recall, we noted this summer that hedge fund liquidations had soared to their highest level since 2015. HFR released a report in late June that showed 304 funds liquidated in 1Q20. This was the highest level of fund liquidation since the fourth quarter of 2015, when 305 funds shut down. Shown below, the number of closures in 1Q20 is about 50% higher than the last quarter in 2019.

The recent pullback in the market has some investors seeking out long-short fund strategies, according to Reuters. The S&P has fallen 10% from its Softbank-induced highs on September 2 and the aggressive valuations, mixed with the volatility, has many investors seeking protection.

Long-short equity hedge funds fell 5.75% in March, while the market plunged, but also posted a gain of 13.67% in the first 8 months of 2020. They were the best-performing strategy in August, according to Nomura. Hedge fund assets amount to $3.6 trillion, globally.

Philippe Ferreira at fund of hedge fund Lyxor Asset Management said: “We see great demand for strategies that protect from great volatility.”

He continued: “We are seeing flows into strategies that bring some form of protection. We are not seeing flows into strategies that are highly correlated to the market environment. There are many long-short that have a long bias and they are left by the sidelines at the moment. Long-short equity that is less correlated is in high demand.”

Long-short funds offer hedges (hence the name ‘hedge fund’) by shorting stocks and other strategies that give firms exposure to when markets move lower.

Industry tracker eVestment shows searches for long-short equity funds at 17%, up from 11.1% in July.

Rob Christian, co-head of research and investment management at hedge fund solutions group K2 Advisors, said: “Broadly, equity investors are trying to reduce their equity risk using long-short managers.”

Nigel Gliksten, partner at Toscafund Asset Management, said: “My view overall is that long-short equity generally fell out of fashion a few years ago and there is just starting to be a little bit more interest, from our experience.”

Matt Rowe, chief investment officer at asset-management firm Headwaters Volatility, concluded: “We have seen a big increase in inbound enquiries from family offices, institutional investors and banks, to layer in long volatility risk-reducing positions that would effectively create a long-short trade.”

Continue reading at ZeroHedge.com, Click Here.