Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Citigroup Shutters Retail Options Market-Making After Losing War Against HFTs

Tyler Durden

Wed, 09/23/2020 – 18:20

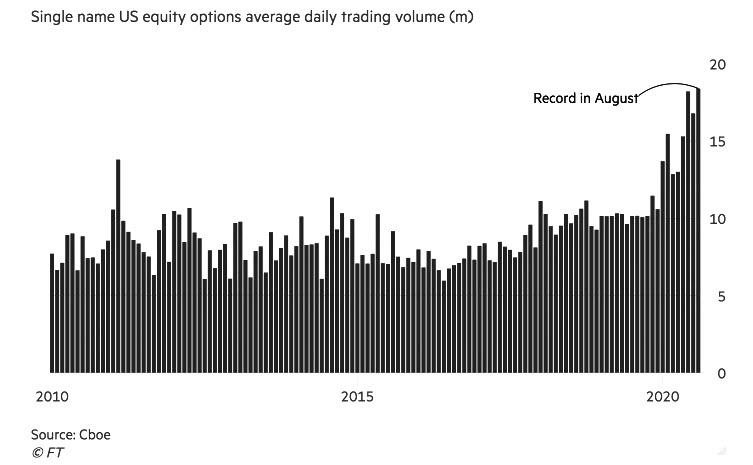

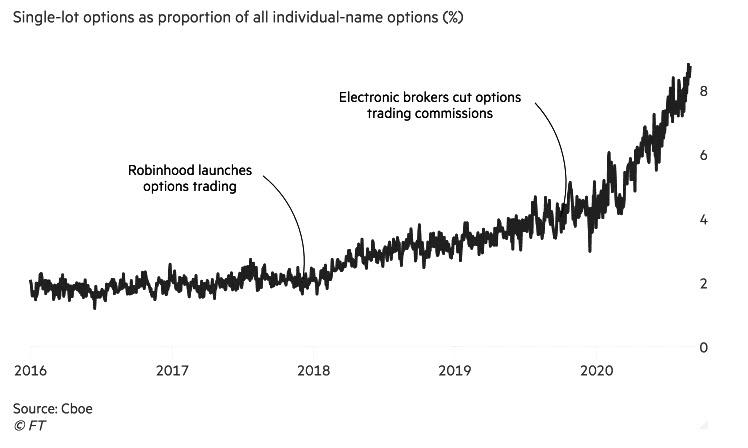

Anyone following market dynamics in recent months would have been left with the impression that whereas other securities may have had a rather somnolent third quarter, option market makers would be printing cash hand over fist, thanks mostly to the recent boom in retail call option buying, which as shown in the chart below, has seen nearly a doubling in option trading volumes in the past few months and hitting a record 18.4 million in August.

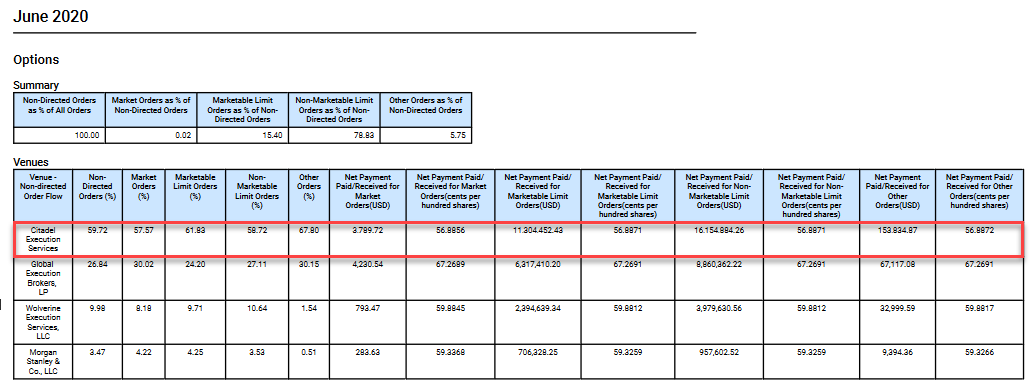

But while that may be true for Citadel, Wolverine, Susquehanna, Simplex and Optiver and various other HFT-hybrids which dominate retail option trading as their generous payments for Robinhood orderflow demonstrate…

… it is not the case for Citigroup, which as the FT reports overnight, has shuttered its market making business in retail options “in a move that underscores how the boom in zero-commission trading has squeezed the profitability of the industry’s middlemen” despite the unprecedented surge in option trading.

Citing three sources, the FT reports that Citi closed the business – which serves retail broker-dealers such as Charles Schwab and Fidelity – at the start of last month. At the same time, Citi maintained its market making operations for institutional investors and high-net-worth customers, who still pay commissions.

The stated reason for the pullout is that Citi was unable to compete in a technology arms race to be among the fastest and most reliable venues on Wall Street, which is to be expected when Citi’s competition was pureplay HFT firms.

“Citi does periodic reviews of its business lines,” the company said. “As part of its review of derivatives it was determined to exit the servicing of broker dealers for option executions. The resources are better redeployed to serve clients in other areas of our equities division.”

Following the withdrawal of Citi from retail options market making, only Morgan Stanley will remain as a major Wall Street bank in the business, which is dominated by such HFTs-in-market-makers-clothing as Citadel Securities, Susquehanna, Simplex Trading and Optiver. Incidentally, options trading is likely a loss-leader for Morgan Stanley as well, which remains in the business mostly because of its large wealth management offering and the sizeable amount of options orders generated by E*Trade, one of the big online retail trading platforms the bank acquired earlier this year.

Ultimately, Citi’s downfall is due to its inability to chase market share amid a free-for-all targeting retail investors that has erupted among online brokers such as Charles Schwab, ETrade, Interactive Brokers and Robinhood. To remain competitive, brokers have offered low-cost, or sometimes zero-fee trading to entice retail investors, which in turn have collapsed profits of the market makers.

The demise of Citi’s retail option business should not come as a surprise in a market where HFTs have unleashed unprecedented cannibalization among legacy participants and new market entrants. As the FT notes, the retreat of the Wall Street banks from retail options market making mirrors the way hyper-fast computerised traders have loosened the banks’ hold on the equities market. HFT firms such as Citadel Securities and Virtu have “elbowed” the banks aside to grab the largest slices of the US retail share trading market.

Ironically, in 2016 Citigroup sold its automated market making operation for equities to Citadel, sparking an unprecedented ascent for the Chicago-based broker and making Ken Griffen one of the richest people on Wall Street.

Continue reading at ZeroHedge.com, Click Here.