Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Jeff Gundlach Live Webcast: “Hey Kid, Want Some Candy?”

Tyler Durden

Tue, 09/08/2020 – 16:31

One month after shocking Wall Street with his latest prediction that Donald Trump would win the Nov election, similar to Gundlach’s contrarian and correct forecast made ahead of the 2016 election, the DoubleLine founder is holding his latest live webcast, this time titled, “Hey Kid, Want Some Candy?” a reference to something which while good in the short term, ends up being catastrophic in the long-run, similar to the current market situation.

“You can teach a child: Don’t take candy from strangers” Gundlach said, comparing this to the UBI unemployment benefits workers have depended on.

Among the topics covered in the early minutes of the slideshow are global trade volumes, the South Korean Kospi index as a real-time indicator of the export picture, the US Growth forecast (he thinks it should be stronger), and a focus on the disconnect between the economic forecast and stocks, noting that the global GDP forecast for the year is -3.9%, while in the U.S. It’s -5.0%. He finds this strange as the U.S. response has “really been one of the highest for the world.”

Gundlach also said that the economy was obviously deteriorating for two years before the recession, but looking ahead discusses the strong rebound in PMIs.

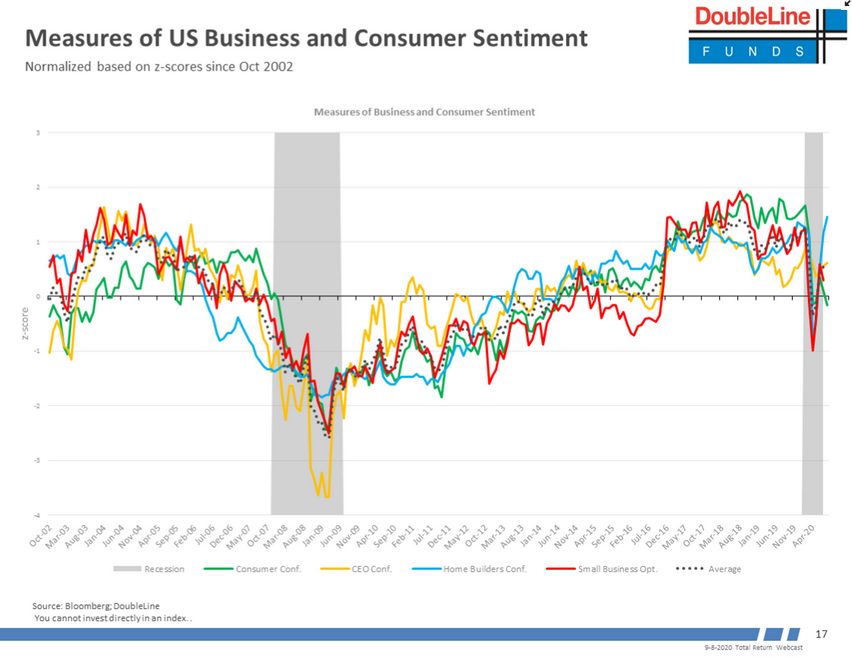

The DoubleLine CEO – who is flipping between slides at a furious pace- then points to the weekly hours worked as a recession indicator, which took a hit but has rebounded to its nearly 60-year average. At the same time, looking at consumer confidence, he says it fell off a cliff similar to the dot-com plunge, but has also since rebounded especially among homebuilders where it is near all time highs even as consumer confidence has once again contracted.

Readers can access the live webcast at the following link (free registration required).

We will share the full Gundlach presentation once it is available.

Continue reading at ZeroHedge.com, Click Here.