Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

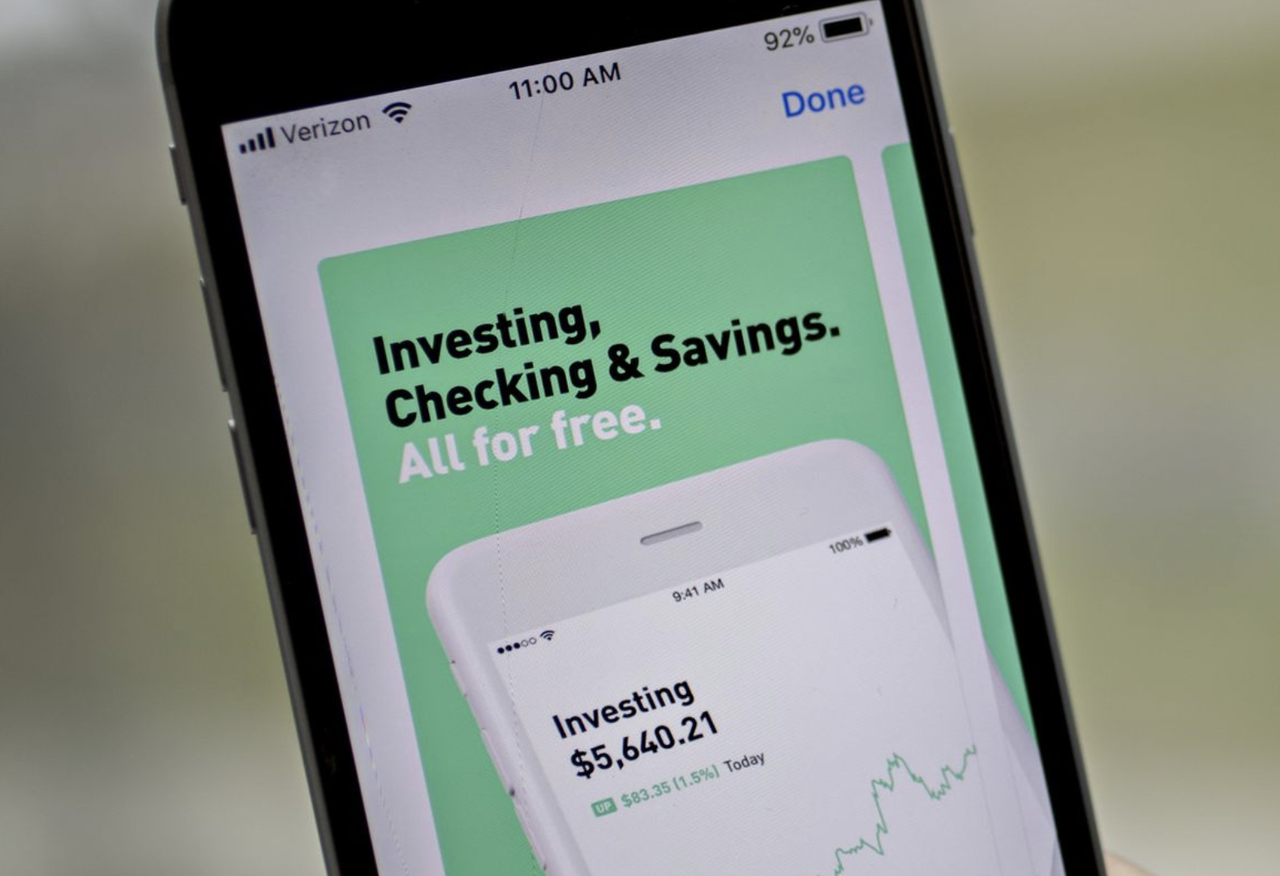

Robinhood Faces SEC Probe For Misleading Customers About HFTs Frontrunning Their Orders

Tyler Durden

Wed, 09/02/2020 – 15:52

A few months ago, we published an amusing account of how the Ken Griffin-owned HFT firm Citadel sicced its army of white-shoe lawyers on Zero Hedge after we dared to explain to our audience exactly why RobinHood – and now its discount brokerage predecessors, all of whom have followed RH’s lead and abandoned trading fees – can afford to charge its clients nothing: Because the company takes all of that retail order flow and auctions it off to the highest HFT bidder, enabling them to profit by – and we want to be very careful with our language here – “trading ahead of customer orders,” a practice otherwise known as “front-running”.

With so many mom-and-pop traders parlaying their stimulus checks and enhanced unemployment benefits in the stock market, our warnings were promptly ignored (hardly a surprise – nobody cares when things are going good).

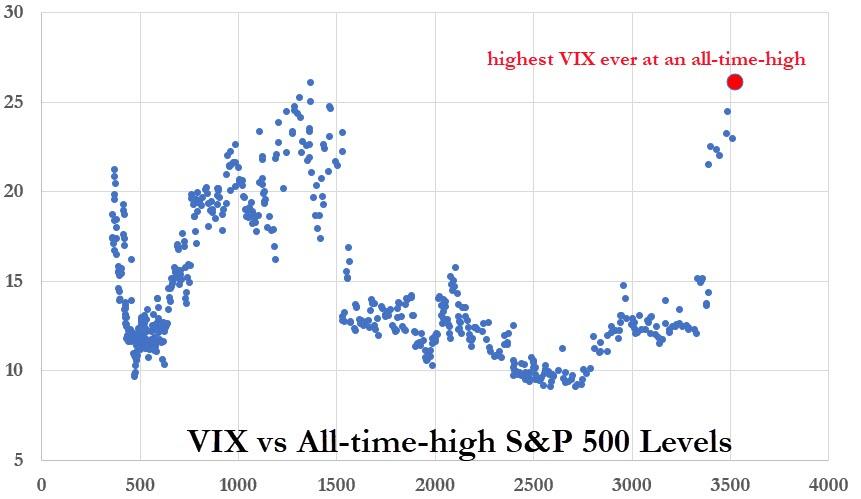

But as the S&P 500 roars to yet another record high – accompanied this time by a disconcerting rebound in the VIX – WSJ reports that the SEC is almost ready to slap Robinhood with a $10 million fine for failing to disclose to its customers exactly how their order flow would be packaged and sold to the HFT firms.

To be sure, a deal likely won’t come this month – and the fraud investigation is ‘civil’ in nature.

Of course, as one twitter user pointed out, the fine is just another slap on the wrist, before everybody carries on with business as usual.

Robinhood will get a little fine and biz as usual will continue.

— Zr1Trader (@ZR1Trader) September 2, 2020

That is, until the music stops.

Continue reading at ZeroHedge.com, Click Here.