Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Stocks & Silver Soar For 5th Straight Month, Bonds & Dollar Dumped

Tyler Durden

Mon, 08/31/2020 – 16:01

August 2020’s 7.3% surge in the major US market index is the largest August gain since 1984 (when the S&P 500 rose 10.63%), but as the chart below shows Trannies almost doubled those gains…

Source: Bloomberg

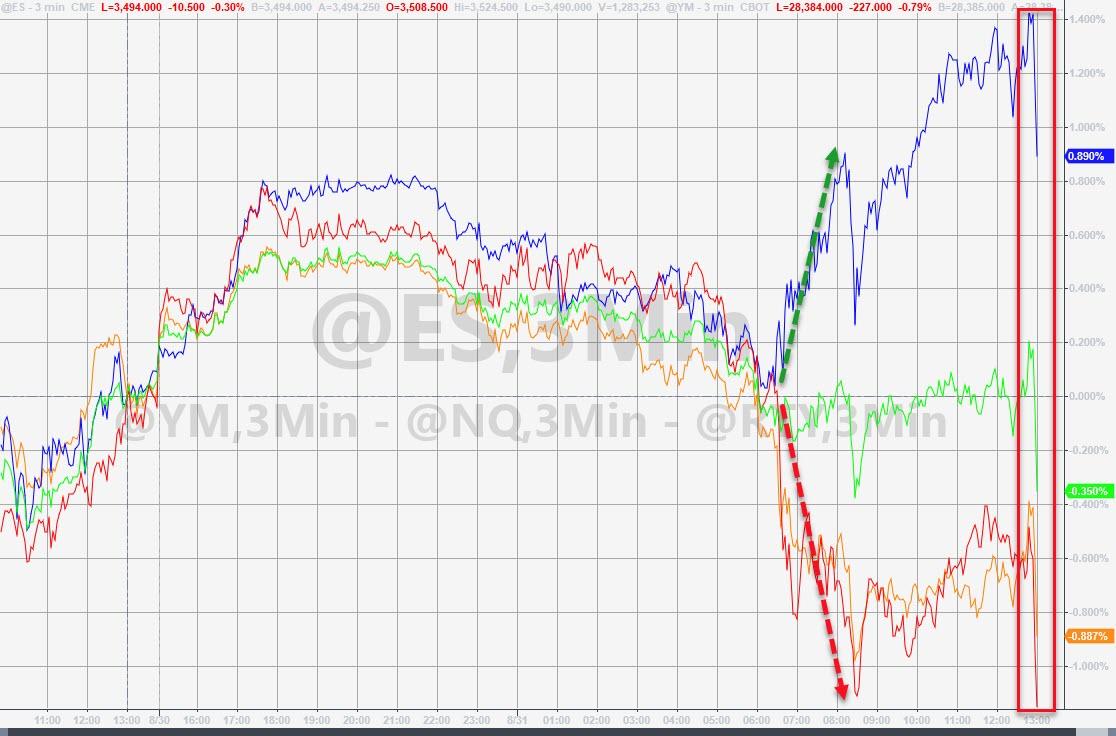

Crazy rotation day today (Nasdaq ripped and Dow and Small Caps slammed at the cash open as S&P clung to unch) but everything collapsed into a really ugly close…

While this broke the S&P’s streak of gains (would have been the longest streak since April 2019), it was still the 5th straight monthly gain…

“Do you want to play this game?”

And that strong month sent The Dow back into the green for 2020… but today’s weakness took it back red…

Source: Bloomberg

All thanks to an epic squeeze in the most-shorted stocks (more than doubling the S&P’s performance)…

Source: Bloomberg

The 5th month in a row closing at record highs…

Source: Bloomberg

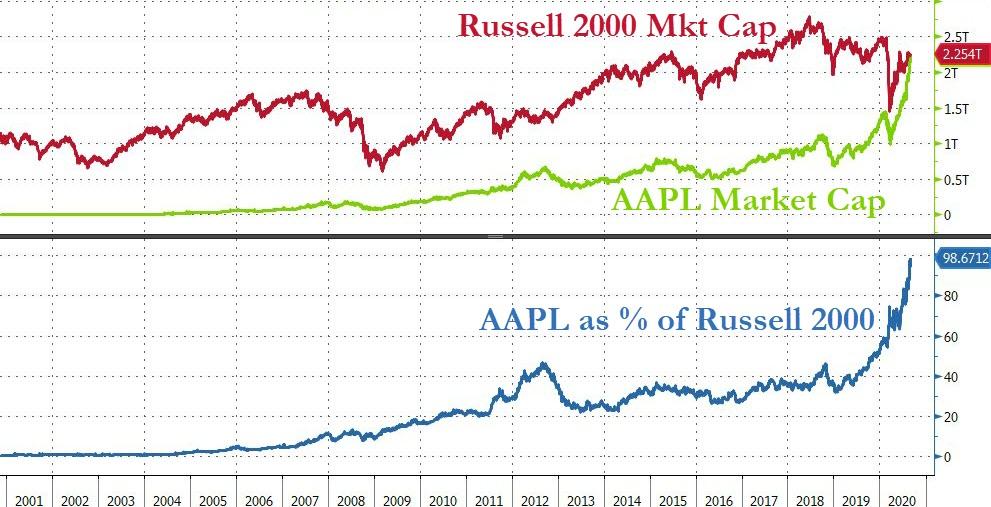

With the strength being concentrated in fewer and fewer stocks…

Source: Bloomberg

As AAPL nears the same size as the entire Russell 2000!!!!

Source: Bloomberg

TSLA up 75% in August… bwuahahaha!!!

Source: Bloomberg

VIX was up on the month (despite soaring stocks)

VIX was higher on the day again (biggest jump since July 13th), continuing to decouple with stocks…

Source: Bloomberg

As the correlation between stocks and VIX reaches its highest since volmageddon in 2018

Source: Bloomberg

It was an ugly month for bonds with the long-end up over 25bps (small rotation in the last day helped a lot as rotation began…

Source: Bloomberg

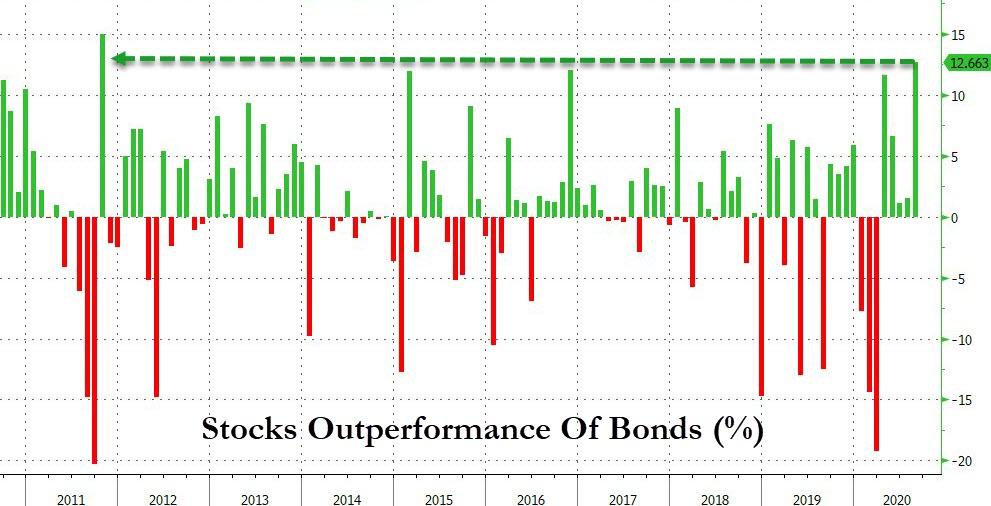

In fact August was the worst relative performance of bonds to stocks since Oct 2011…

Source: Bloomberg

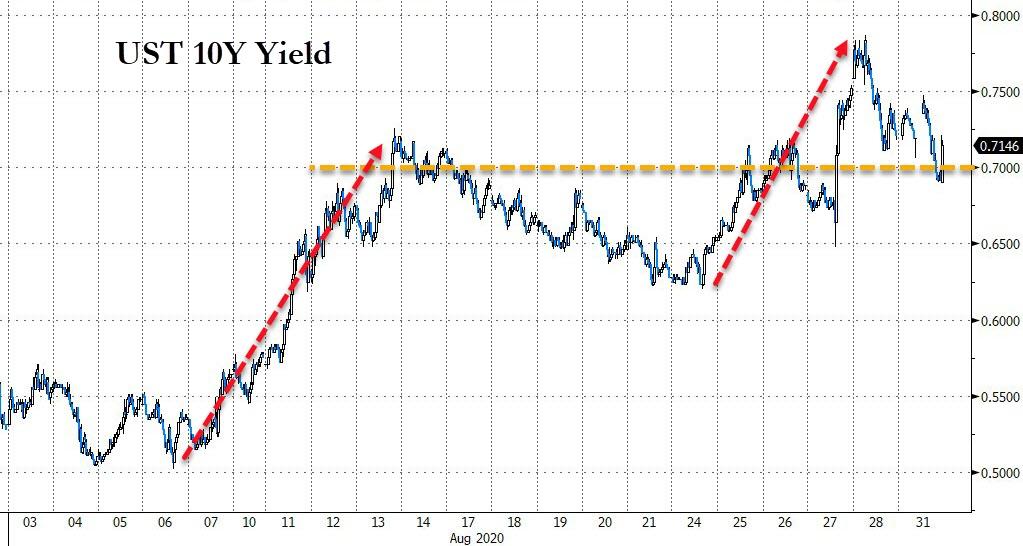

10Y Yields spiked 17bps on the month – the biggest absolute monthly spike since Sept 2018 – and oscillated around 70bps thanks to some rotation today (30Y back above 1.50%)…

Source: Bloomberg

But still some context for this rate move is needed…

Source: Bloomberg

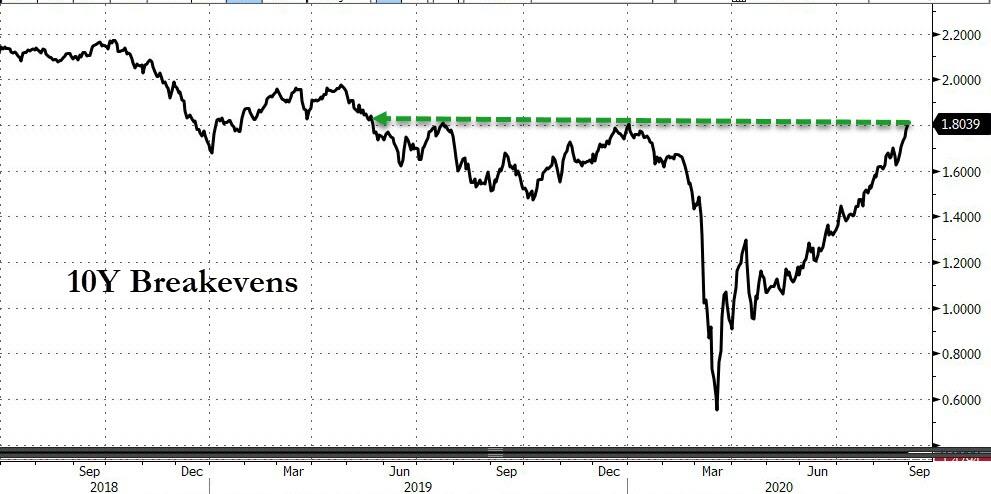

Breakevens ripped higher for the 5th straight month (and up 7 days in a row) to their highest since May 2019…

Source: Bloomberg

Real yields ended notably lower (down from -1.00% to -1.10% on the month) signaling more upside for gold…

Source: Bloomberg

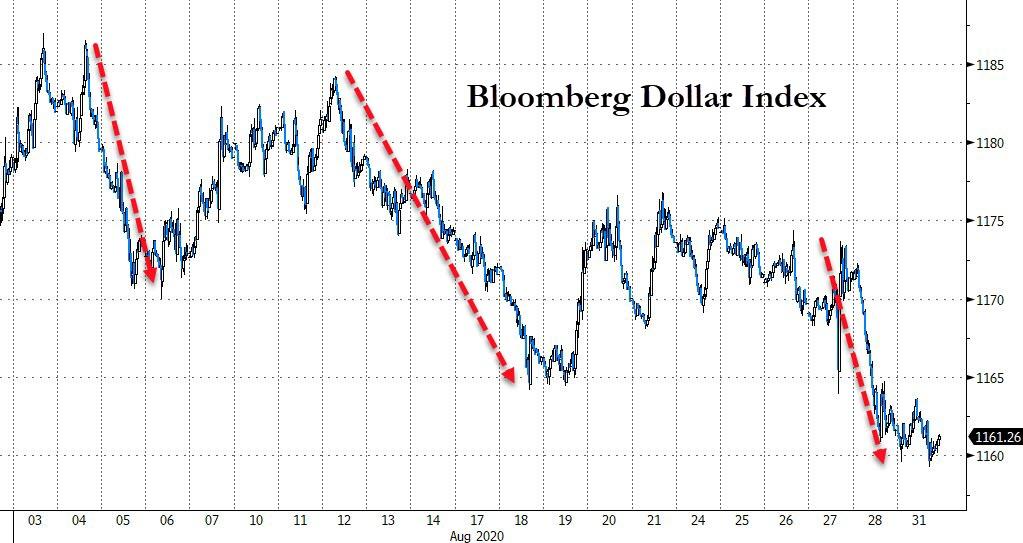

The dollar was pummeled for the 5th straight month to its lowest since May 2018…

Source: Bloomberg

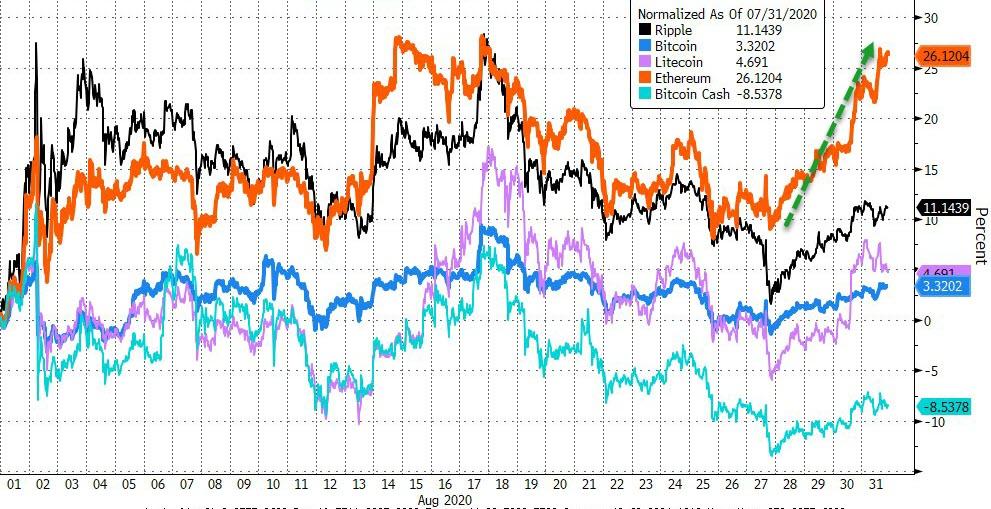

Cryptos were mixed with Ethereum strong (DeFi boom), Bitcoin Cash weak, and Bitcoin small gains…

Source: Bloomberg

Copper and Crude had a strong month, gold ended flat, silver the big winner…

Source: Bloomberg

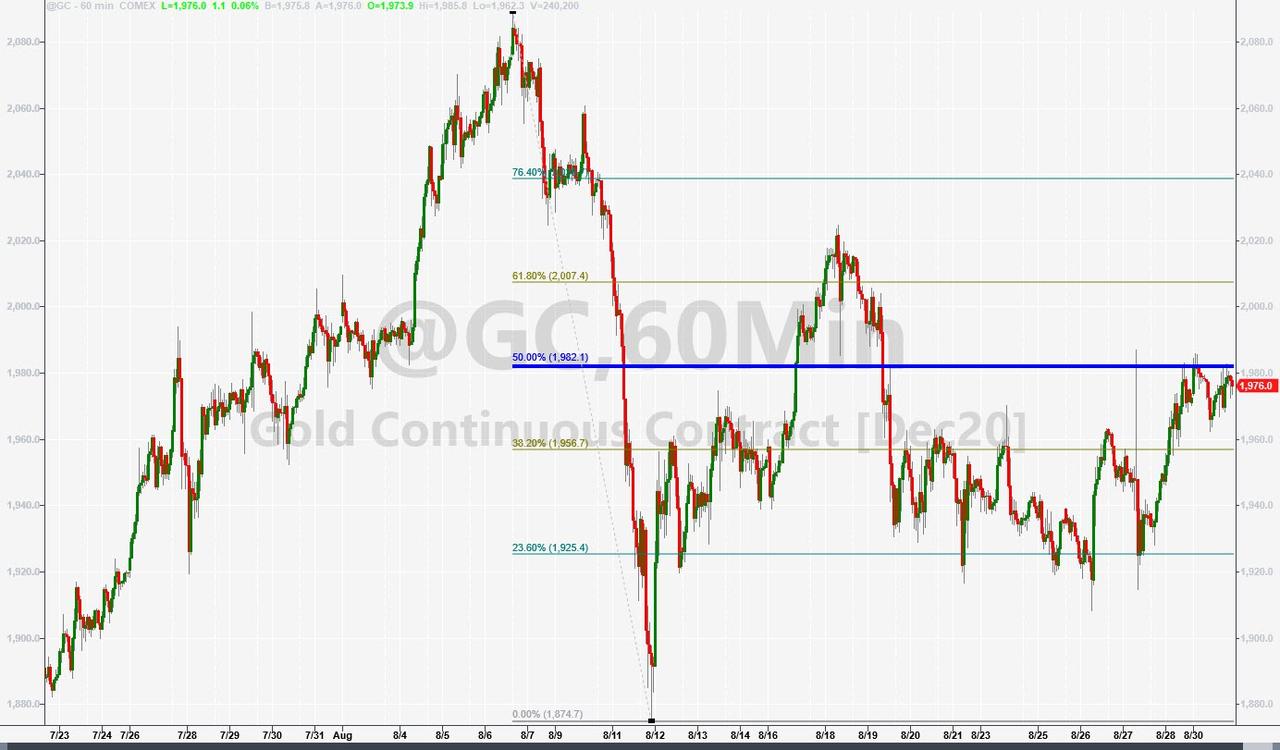

Gold rallied back to last week’s Powell-spooked highs today…

But Gold ended the month unchanged…

Source: Bloomberg

But despite a big roundtrip early on, Silver rallied notably on the month…

Source: Bloomberg

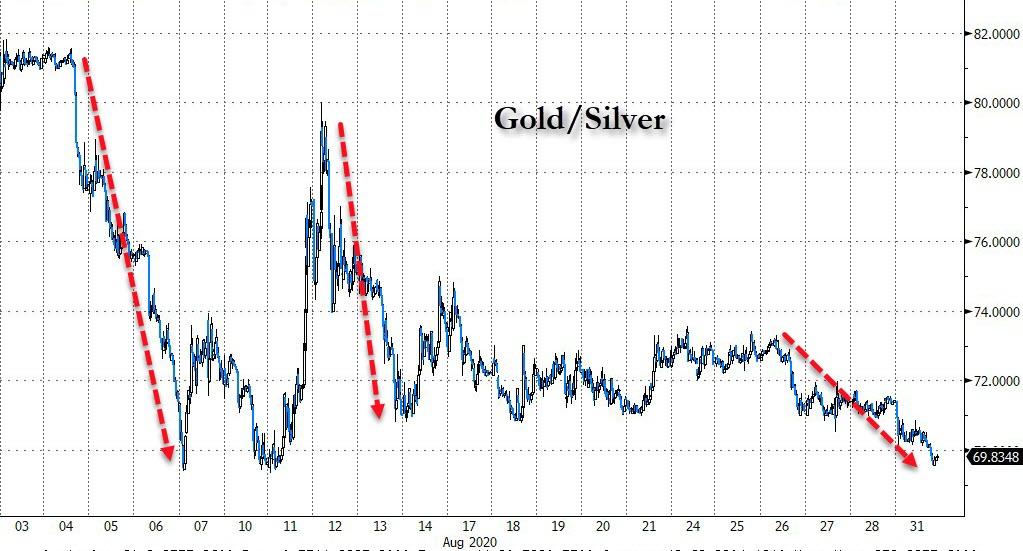

Which meant the Gold/Silver ratio cratered (for the 4th month in the last 5)…ending the month below 70x at the lowest level (silver strongest relative to gold) since March 2017…

Source: Bloomberg

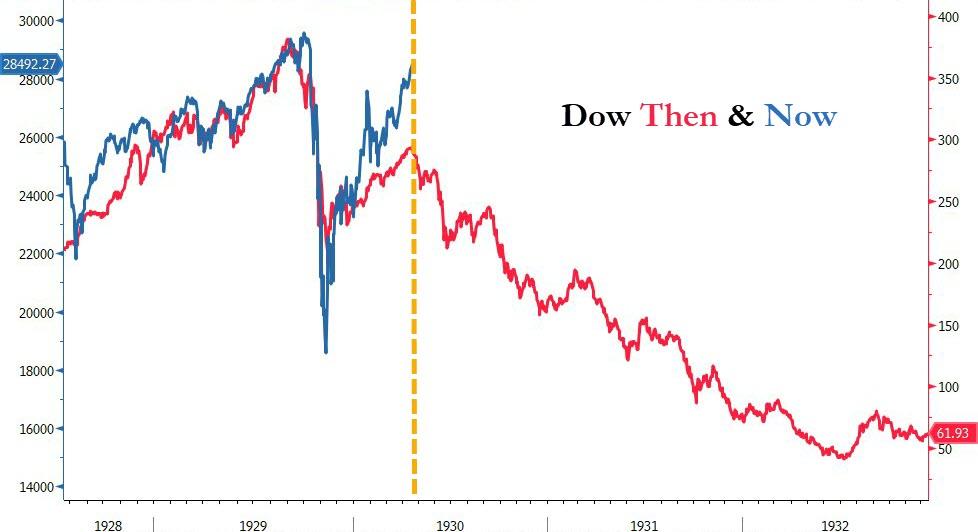

And finally there’s this!

Source: Bloomberg

And this…

Source: Bloomberg

And this…

- *BULLARD: WANT TO GUARD AGAINST ASSET BUBBLES GOING FORWARD

Because it’s different this time…

Source: Bloomberg

Probably nothing!

Continue reading at ZeroHedge.com, Click Here.