Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

New Jersey Governor “Very Seriously” Considering Tax On High-Frequency Trades

Tyler Durden

Mon, 08/31/2020 – 15:50

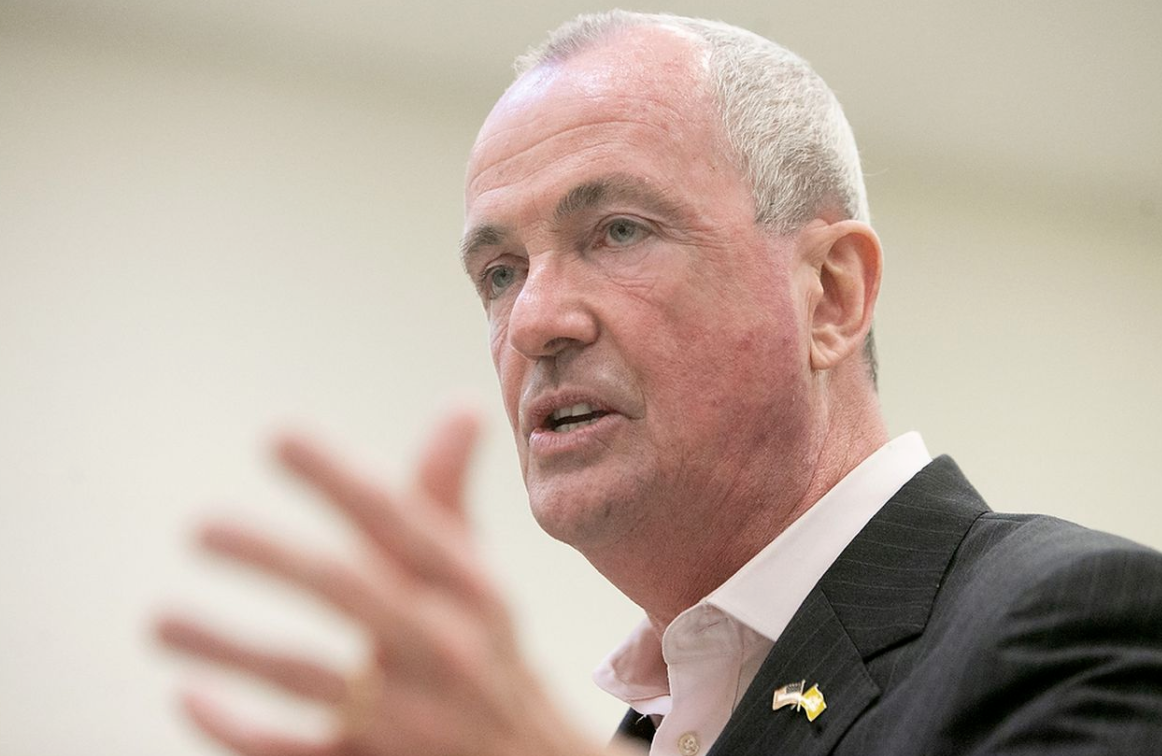

Money managers and wealthy individuals don’t need another reason to leave the Garden State. But Democratic Gov. Phil Murphy – yet another Goldman Sachs alum who found his way into politics – might just give them one.

Hours after unveiling plans to reopen indoor dining in his state on Friday (although restaurants will be limited to just 25% capacity, making it effectively impossible for most to even do business), Gov Murphy announced during a press briefing Monday afternoon that he was mulling a ‘high frequency trading tax’.

Keep in mind: The New York Stock Exchange is mostly an expensive TV set for CNBC. All the real trading takes place across the Hudson in New Jersey, in heavily fortified data centers in Seacaucus, Carteret Mahwah and other North Jersey data centers.

Assemblyman John McKeon, a Democrat from West Orange, introduced the bill on July 16. An identical version – sponsored by Senate President Steve Sweeney, a Democrat who is New Jersey’s highest-ranking state lawmaker – followed. Neither version has been heard in committee, making the governor’s sudden endorsement all the more notable.

“The notion is something we like a lot,” Murphy said on Monday, although litigation from the industry would be almost guaranteed.

Under the current plan, firms would be charged 0.25 cents per trade if the HFT tax bill became law. Similar plans considered in other states have called for a 1.25 cent tax on the sale of stock worth $5 or less, and a tax of up to 5 cents for stock worth over $20 per share.

It should go without saying that such a tax could create serious problems for HFT firms.

Of course, Murphy isn’t alone: Lawmakers in New York State are also looking into resurrecting a tax on stock trades to help replenish its COVID-depleted coffers.

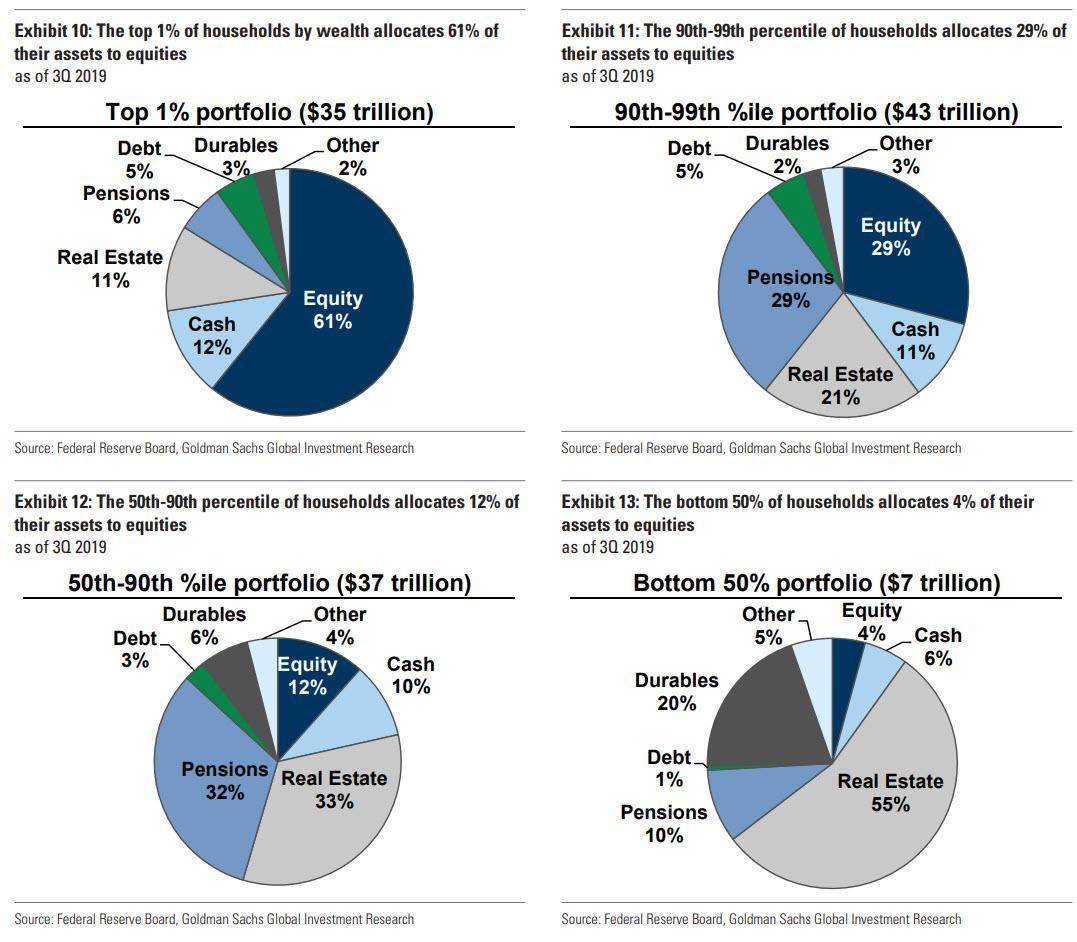

As we’ve explained, the left’s argument for these types of taxes is that in 2016, the wealthiest 10% of Americans owned 84% of stocks. The author of the study argued this: “Every single significant exchange in the world has a financial transaction tax save one, which is Germany, and they’ve proposed it there. Is the London Stock Exchange out of business? Have they moved to Dublin?”

Under Murphy, NJ has already adopted a new millionaires’ tax and a 25% gas-tax increase in a state that was already one of the most heavily taxed in the nation.

Should Murphy decide to move forward, expect to see more Wall Street luminaries give up on the Garden State for sunnier pastures down south.

They’ll have plenty of company.

Then again, a tax that effectively outweighs the advantages of HFT, or simply renders it impractically expensive, could go a long toward eliminating the practice, ridding the market of a parasitic practice of unbridled “rent seeking”.

HFT has been a parasite on this market for years, pretending to provide liquidity in exchange for frontrunning orderflow with political blessings and much behind-the-scenes corruption.

Eliminate it and start from scratch.

— zerohedge (@zerohedge) August 31, 2020

Though that wouldn’t exactly go too far toward replenishing New Jersey’s drained treasury.

Continue reading at ZeroHedge.com, Click Here.