Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Global Stocks Hit Record High, Gold Spikes Ahead Of Powell Speech

Tyler Durden

Wed, 08/26/2020 – 16:00

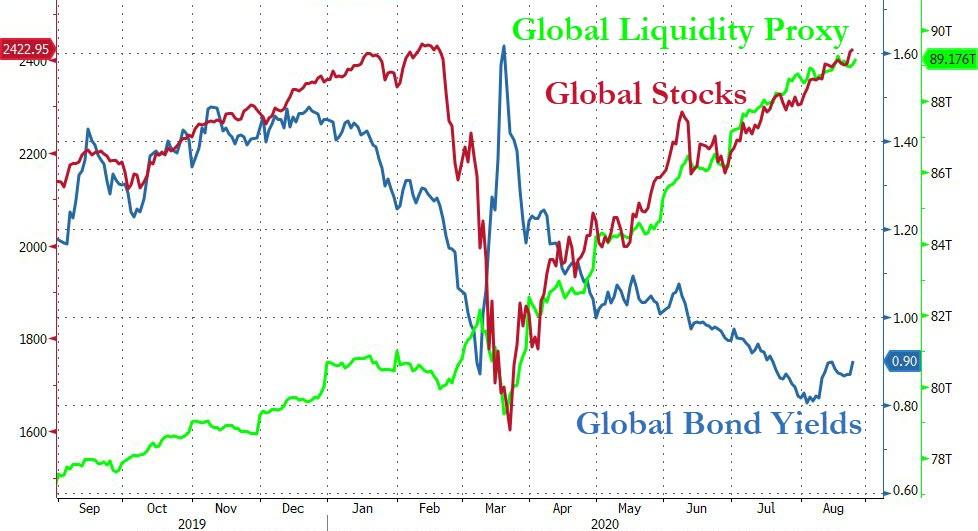

Global stocks finally took out their old record highs today (as measured by the MSCI World Index)…. and all it took was almost $10 trillion in global liquidity…

Source: Bloomberg

Global sovereign bond yields (blue above) are at the same time hovering near record lows (though have lifted a little in the last week ahead of Powell’s “I Promise Inflation” speech tomorrow).

“You are meddling with the primary forces of nature, Mr Powell, and I won’t have it! Is that clear?”

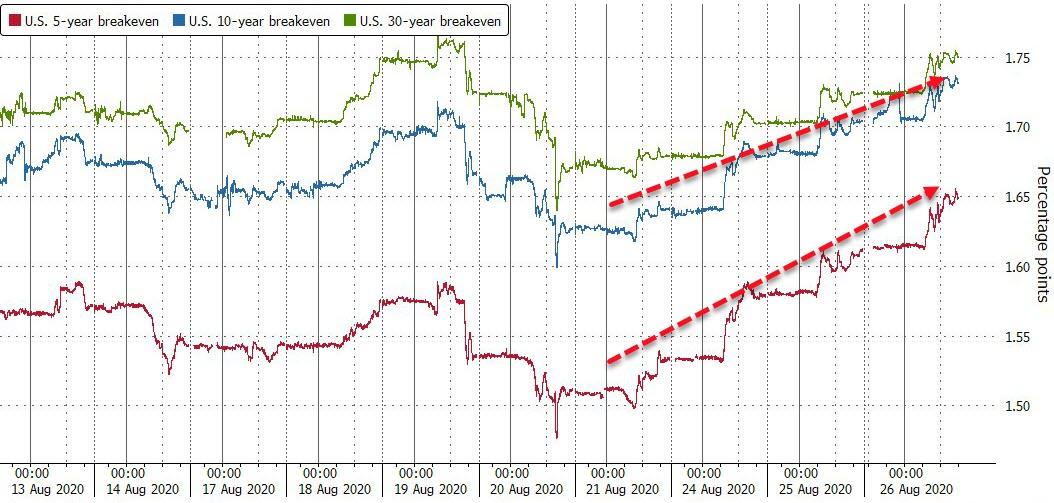

Reflecting that somewhat, Breakevens continued to rebound notably today…

Source: Bloomberg

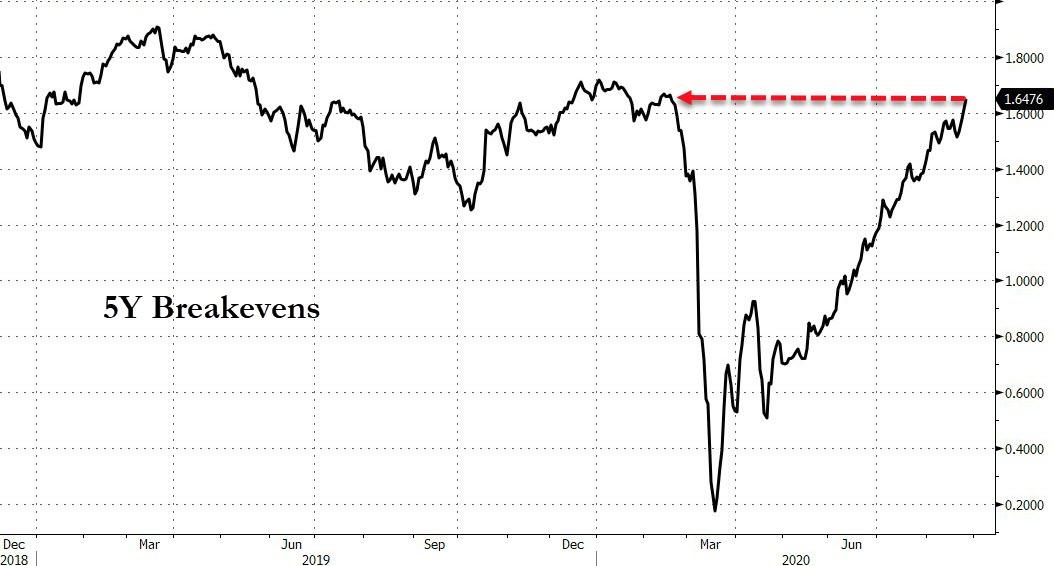

Sending 5Y Breakevens (strong TSY auction today) back to pre-COVID levels…

Source: Bloomberg

Which sent real yields tumbling (back to -1.05%), and grabbed gold higher…

Source: Bloomberg

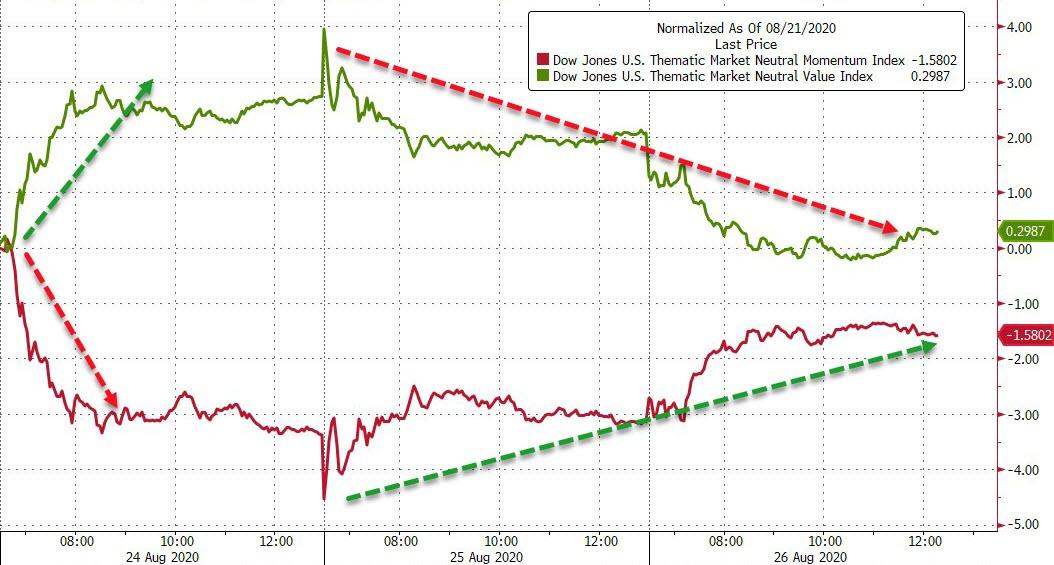

The momo/value ‘rotation’ from Monday has been unrotated…

Source: Bloomberg

Leaving Nasdaq (blue) soaring and Small Caps (red) slammed… S&P was up over 1% and The Dow managed modest gains…

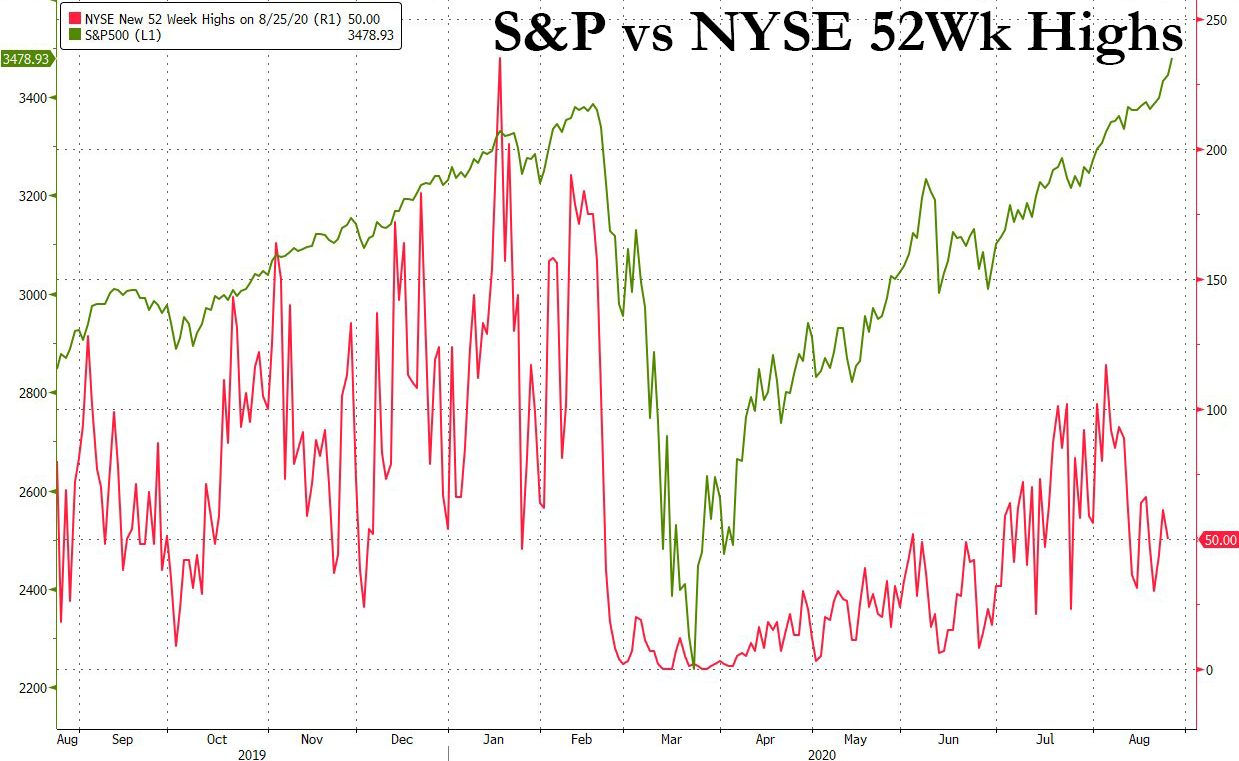

“Another day, another new record as internals continue to get more lopsided…”

Source: Bloomberg

Despite Nasdaq’s big surge, there were 578 more decliners than advancers…

Source: Bloomberg

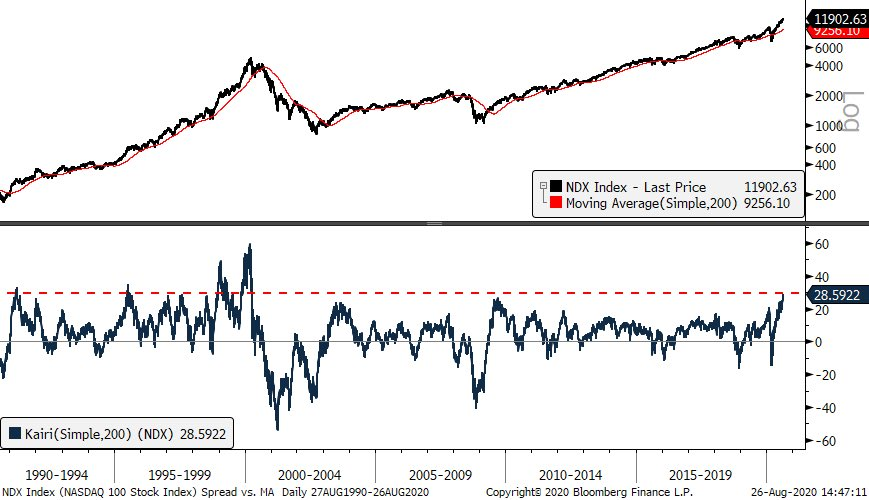

NDX is now 28% above its 200 DMA, the widest spread since 2000… Can it get wider? Of course, it went to ~60% at the peak in 2000. “But this is certainly rarified air” over last 30 yrs.

Source: Bloomberg

This didn’t seem to spook stocks at all:

1035ET *FED’S BARKIN: BIG TECH DONE WELL IN PANDEMIC, REFLECTED IN STOCK MKT, THERE CLEARLY IS SOME RISK AS VALUATIONS GET ELEVATED

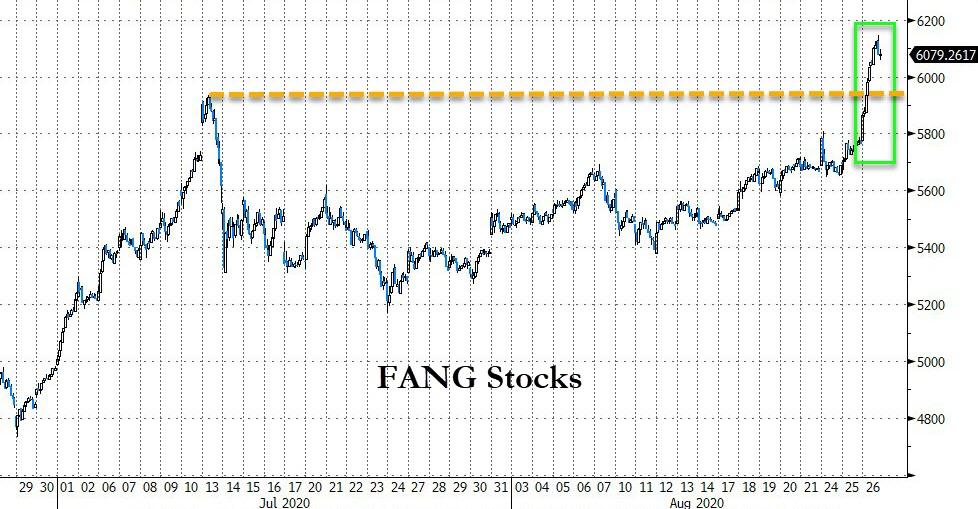

As FANG stocks soared by the most since April 6th to a new record high…

Source: Bloomberg

TSLA did what TSLA does…

And then there’s Salesforce!!!!! Up fucking 26% today!!!!!! And it announced layoffs!!! Bwuahahaha

Small Caps very volatile around the cash open.

There was a big short-squeeze at the open but it faded the rest of the day…

Source: Bloomberg

VIX and stocks decoupled today but once again we caution readers of the record low put/call ratio as traders buy calls not downside protection (which also bids up vol, and thus VIX)…

Source: Bloomberg

Very strong 5Y auction reversed the trend higher in yields.

Source: Bloomberg

10Y Yields fell back below 70bps (again)…

Source: Bloomberg

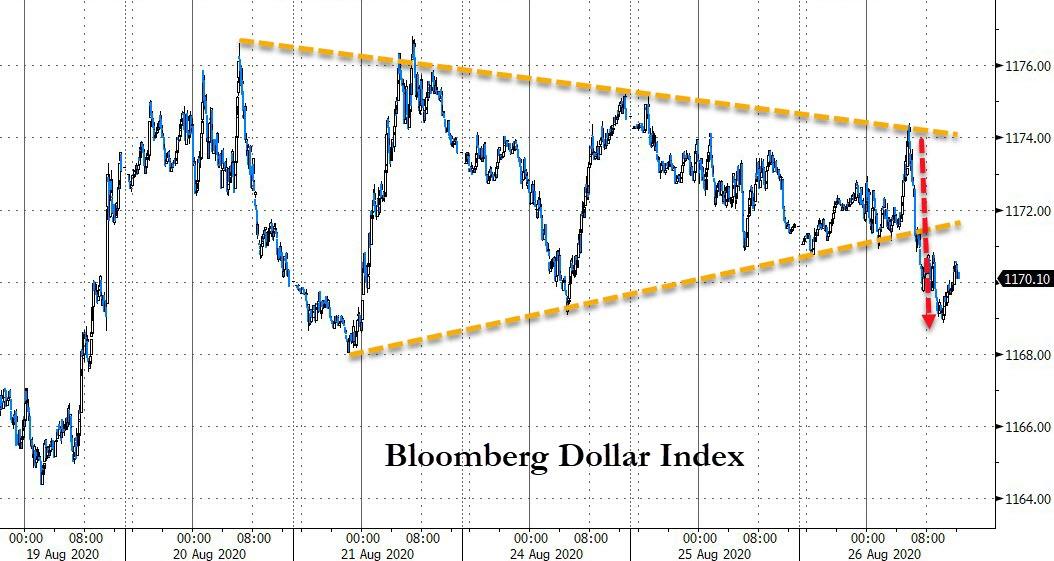

Dollar dumped after briefly spiking at 0830ET on the durable goods orders beat (it appears it was fake breakout of that coiling pattern we suggested yesterday)…

Source: Bloomberg

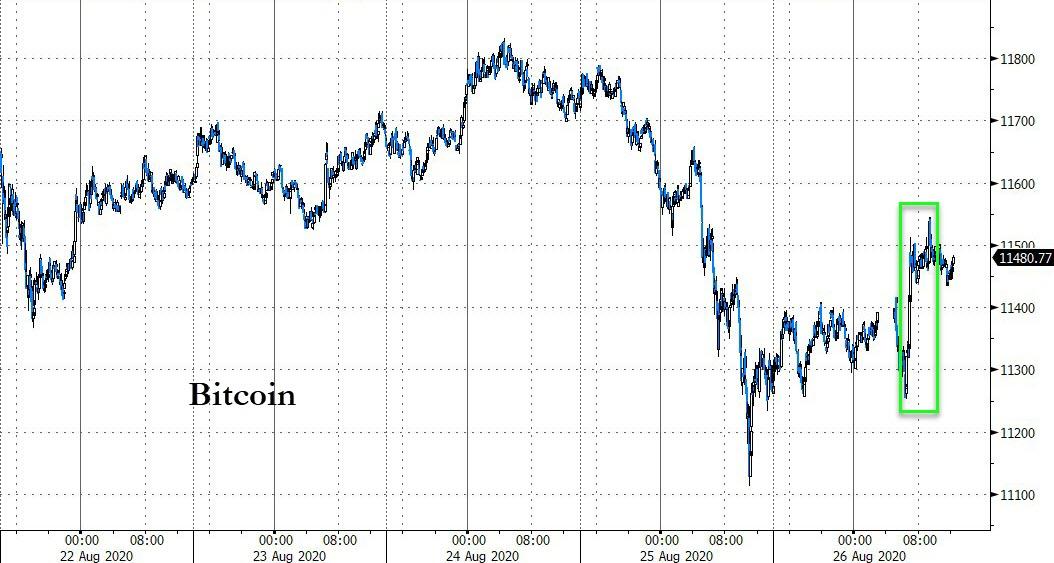

Cryptos bounced back today with Bitcoin testing back up to $11,5000…

Source: Bloomberg

Oil was flat on the day, Silver the big gainer with gold and copper stronger by around 1%…

Source: Bloomberg

Finally, year-to-date, global investors (in bonds and stocks) have made almost $10 trillion ($6.66 trillion from bonds and $3.07 trillion from stocks), after being down over $25 trillion at the trough in March…

Source: Bloomberg

Continue reading at ZeroHedge.com, Click Here.