Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Big-Tech, Bonds, Bitcoin, & Bullion Bid As Dollar Dive Continues

Tyler Durden

Thu, 08/20/2020 – 16:01

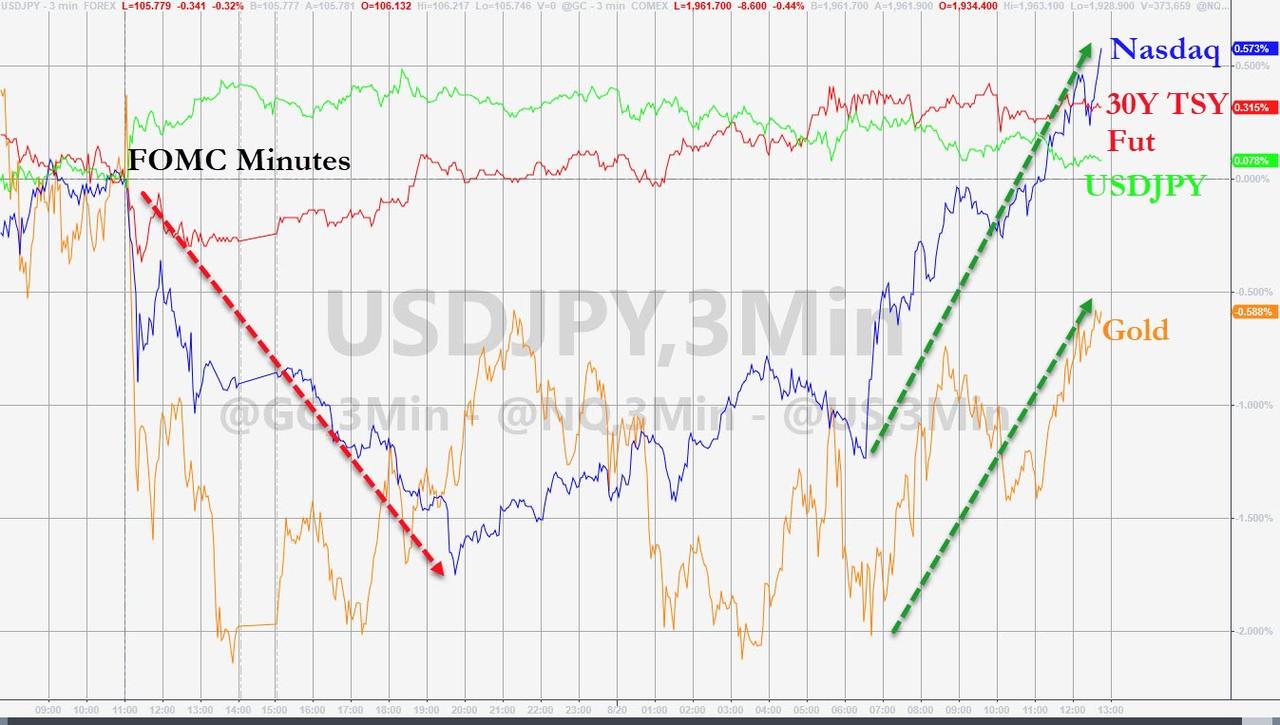

From the opening bell today, stocks – well, we should say mega-tech stocks – were utterly panic bid (catalyzed early by JNJ vaccine headlines), with the Nasdaq erasing all of the post-FOMC Minutes losses (NOTE that none of the other major indices managed to retrace the losses)…

On the day, it looked early on like The Dow may suffer its 4th losing day in a row – a terrible thing that has not been seen since February – but it, like everything else, was bid into the green and beyond. Small Caps closed red…

YTD, the Nasdaq is crushing Chinese stocks and Europe remains negative…

FANG stocks rallied back near its record intraday high and closed at a record closing high…

Source: Bloomberg

Bonds were also bid (after disappointing claims data showed an economy un-recovering), erasing all of the FOMC Minutes spike in yields…

Source: Bloomberg

The dollar chopped around early on but tumbled after Europe closed…

Source: Bloomberg

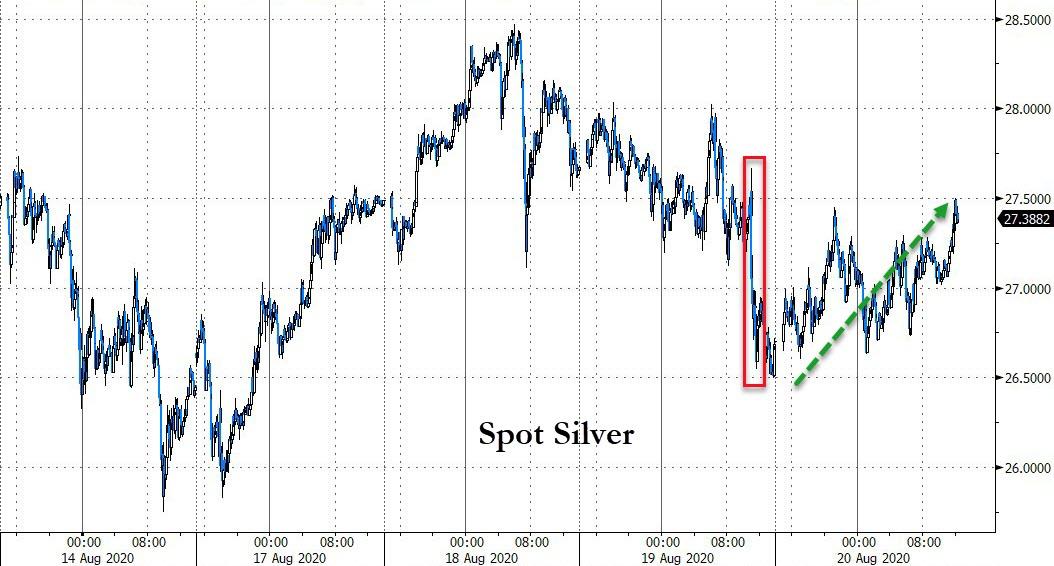

And as the dollar slipped, gold rallied back from yesterday’s dive…

Source: Bloomberg

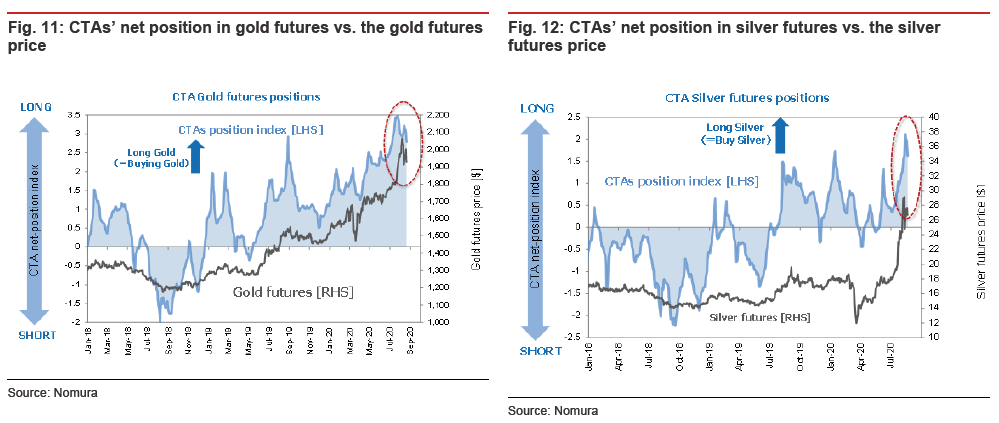

CTA positioning in gold fits with the price move but silver seems to suggest there is room for more as CTAs are squeezed in….

As did silver…

Source: Bloomberg

Since the FOMC Minutes suggested no YCC, only gold is still lower as Nasdaq ripped back to catch up and overtake the dollar and bonds…

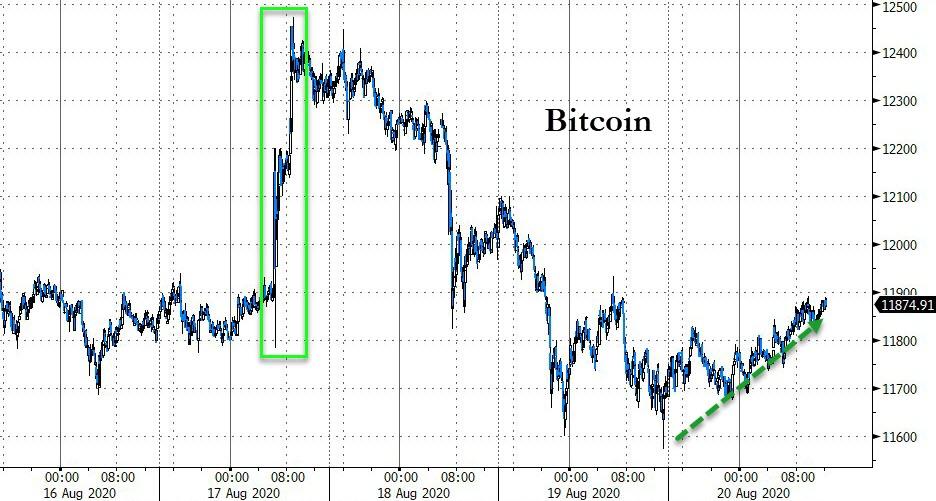

Bitcoin also rallied on the day…

Source: Bloomberg

Oil prices dumped and pumped today and ended lightly lower…

Finally, remember tomorrow is opex and there’s a metric fuckton of gamma due to lift on QQQs…

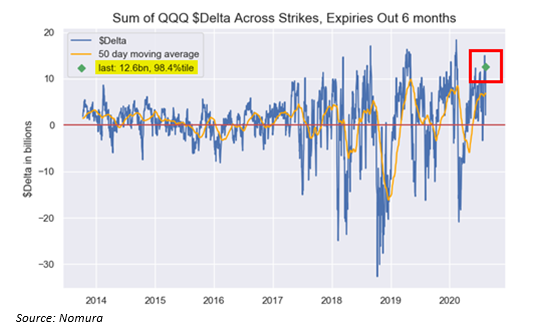

What is perhaps more notable is the potential for this to end… soon. Nomura’s Charlie McElligott writes today about the impact of tomorrow’s options expiration given the derivative market’s exposure goinb in. The $Gamma seen in QQQ (Nasdaq) options remains rather “extreme” at 87.3%ile (was 95th %ile into yday) as we have rallied violently to upper strikes.

This, McElligott warns, in conjunction with 99.3%ile $Delta and now an expected 58% of the Gamma rolling-off after this Friday’s expiration (!!!) makes the case for potentially “binary” price-action next week with a catalyst in either direction, as Dealer “long Gamma” hedging flows should collapse thereafter and allow for a much larger range of movement.

Additionally, the cross-asset strategy MD notes that he currently sees QQQ Gamma “flipping” below $272.06, ex tomorrow’s expiry.

And there is an increasingly ominous major (bearish) divergence between the ‘price’ of the index and the breadth of its underlying components (in this case, the % of names above their 50-day moving average) suggests trouble ahead…

Source: Bloomberg

It certainly did not end well in February as the index continued to rise in the face of growing virus headlines from around the world (but under the hood, a growing number of names were doubting the index’s apparent omnipotence).

Continue reading at ZeroHedge.com, Click Here.