Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Gold Slips Most Since March As Stocks See Best 100-Day Run… Ever

Tyler Durden

Fri, 08/14/2020 – 16:00

Safe-havens were dumped and value stocks outperformed this week as equity markets saw notable rotations and real-yields spiked after generally positive economic data and the Russia vaccine headlines…

Gold was down 4.5% this week, breaking a nine-week winning streak and its worst week since the liquidation flush of mid-March (but did stage a decent comeback later in the week)…

Silver was slammed but also bounced back significantly, with futures ending the week above $26…

And bonds were puked with Treasury yields spiked this week by the most since early June with 30Y Yields up 19bps this week (2Y up only 2bps)

Source: Bloomberg

But putting the move in context…

Source: Bloomberg

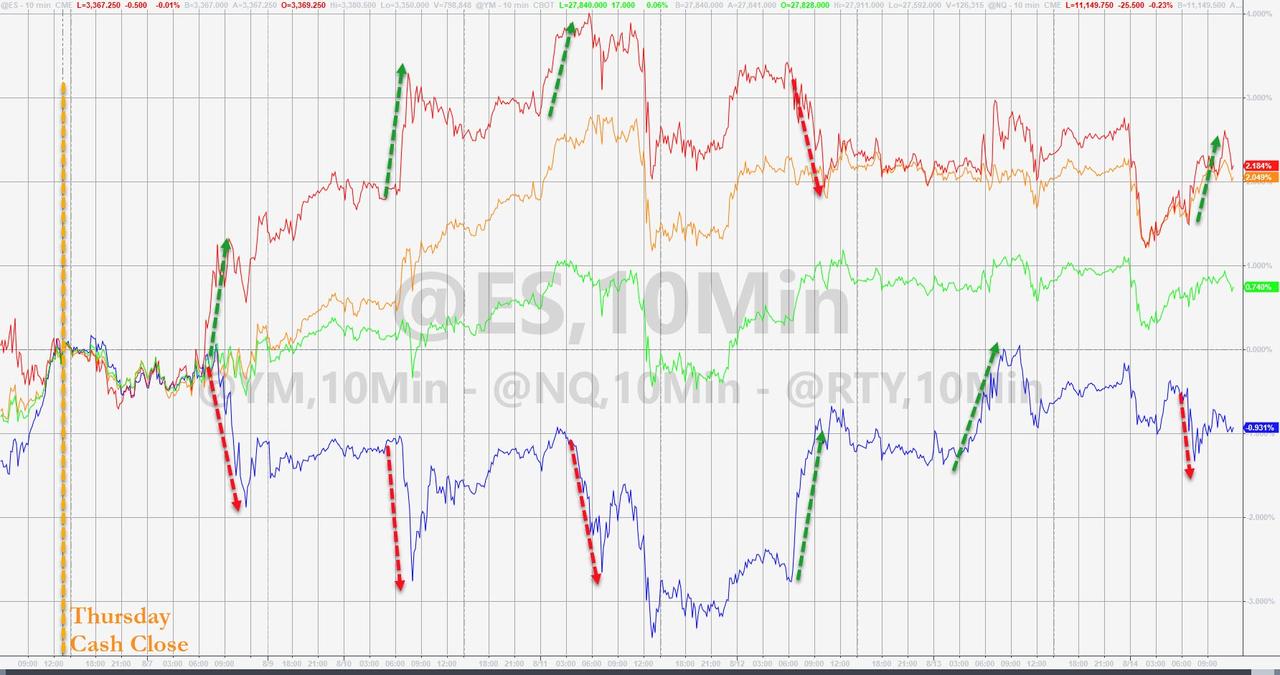

Small Caps and The Dow are the best performers since last Thursday’s close (when the value/growth rotation began) and Nasdaq is lower… (note this is not the weekly change)…

But the S&P 500 was unable to close above its previous record closing high despite testing it three times…

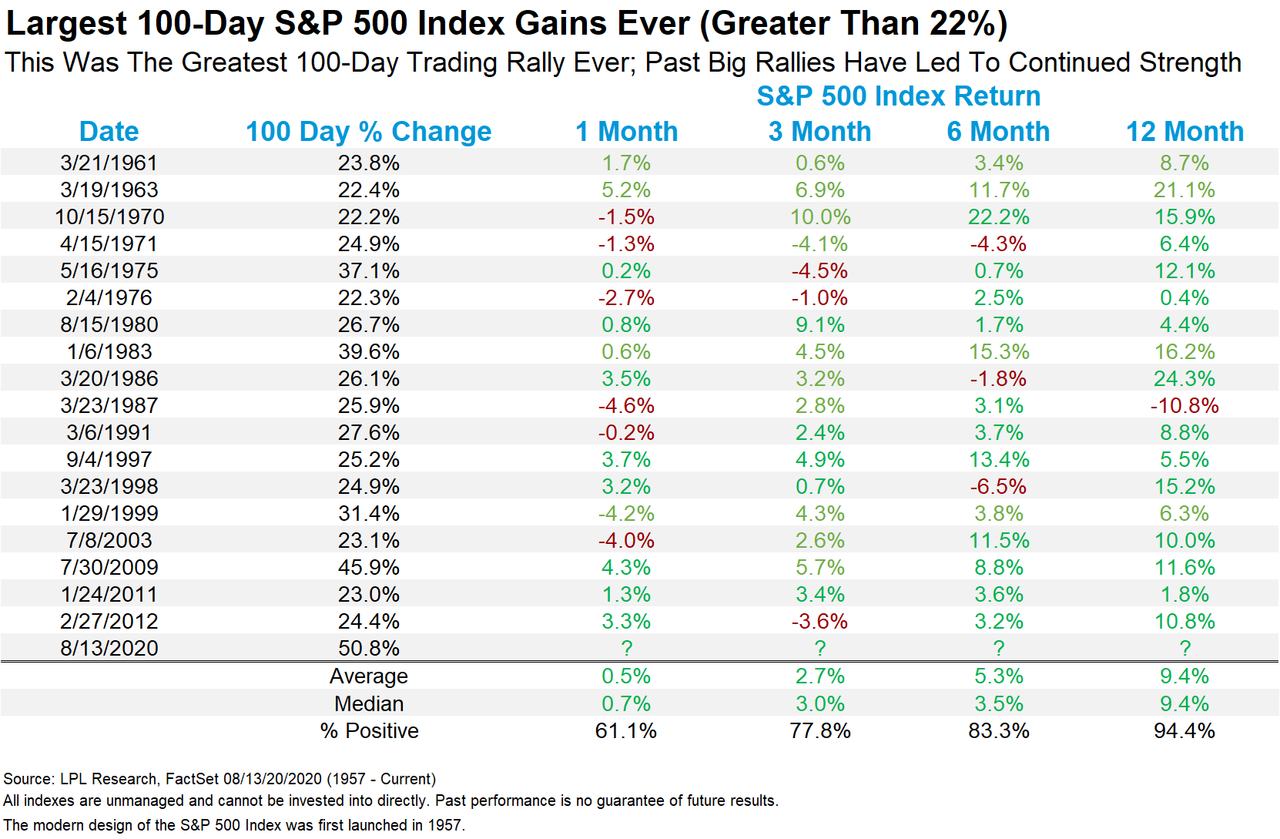

This completes the best 100-day rally for the S&P 500… ever…

Value stocks have significantly outperformed growth…

Source: Bloomberg

Momo has had a tough week (worst 2-week drop since June)…

Source: Bloomberg

Real yields spiked this week (inverse in the chart) and while Gold initially tracked them, the relationship has decoupled in the last two days..

Source: Bloomberg

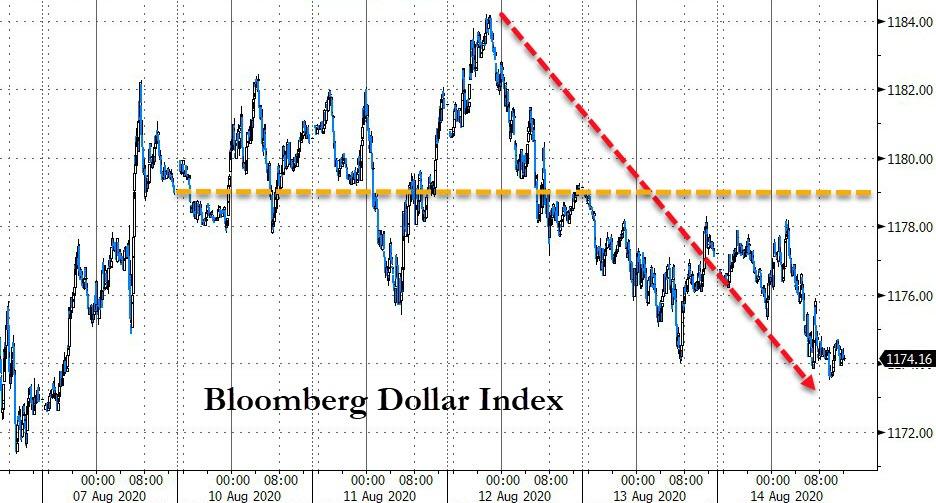

The Dollar ended the week lower – the sixth drop in the last seven weeks…

Source: Bloomberg

Ethereum had a big week – its 4th winning week in a row – pushing to its highest since Aug 2018…

Source: Bloomberg

Copper and Crude rallied on the week while PMs were weak…

Source: Bloomberg

WTI ended the week back above $42…

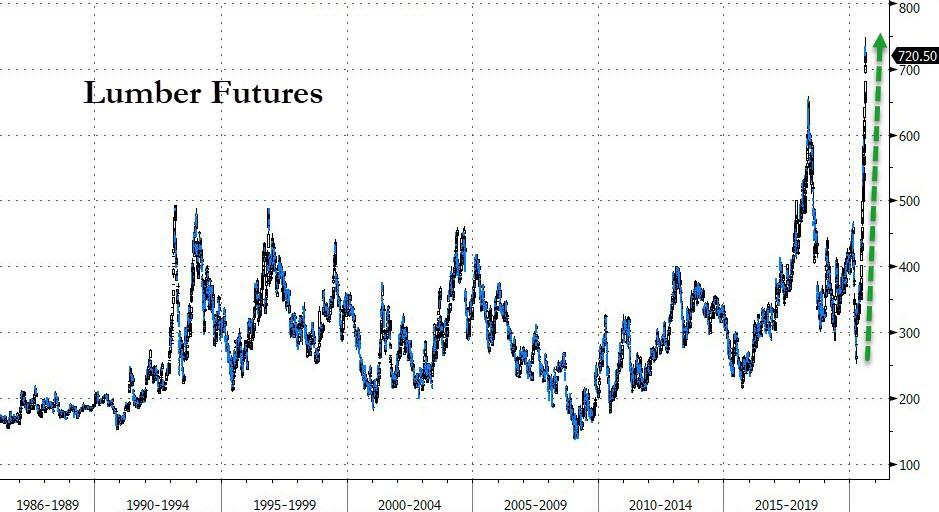

And supply chain malarkey sent Lumber futures soaring to a new record high…

Source: Bloomberg

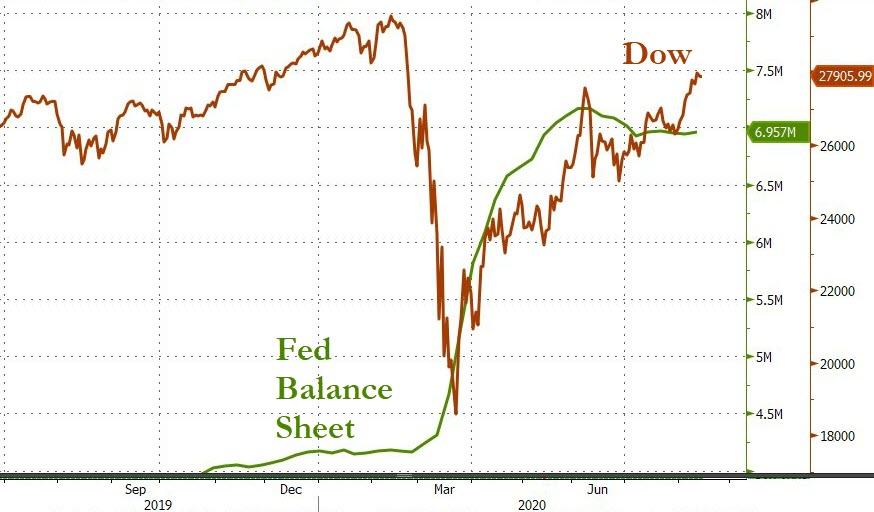

Oh, and finally, Nancy Pelosi let slip some ‘truth’ this morning (in an effort to denigrate Trump of course), telling MSNBC that “the stock market is only doing well because The Fed bolsters it.” She is right, of course, but the question is…

Source: Bloomberg

…will she demand The Fed stop printing money when The Dems sweep in November?

Continue reading at ZeroHedge.com, Click Here.