Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Precious Metal Pummeling Continues In Early Asia Trading

Tyler Durden

Tue, 08/11/2020 – 22:45

As Bloomberg’s Mark Cranfield noted this evening, small reversals are just not gold’s style after a major advance (typically somewhere between a 15% and 20% drop is more common), and the selling pressure on precious metals has continued as Japan and then China opens this evening with Silver futures back at a $23 handle and Gold futures back below $1900.

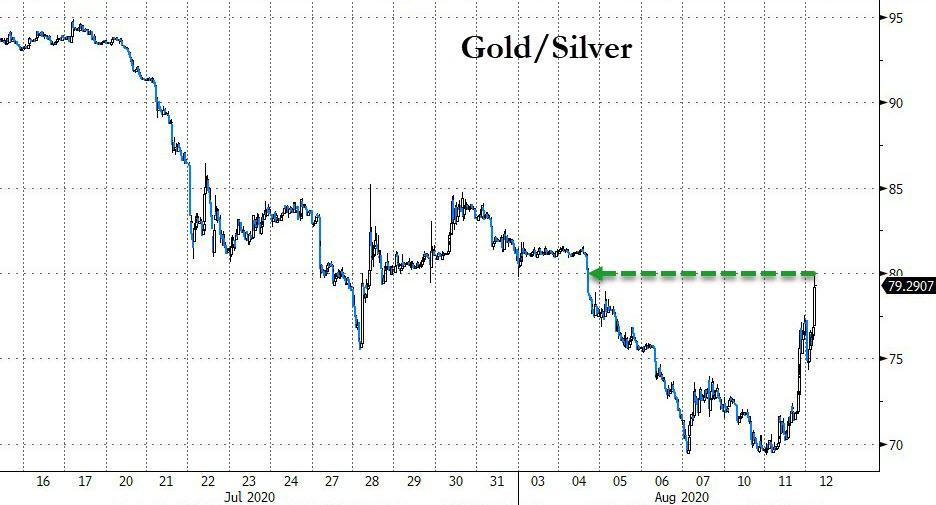

Sending the gold/silver ratio soaring…

After finding support at 2017 lows…

As Peter Schiff noted earlier:

Nothing goes up every single day, and gold and silver are not going to be the exception to that rule. There are no bull markets that are up every day. You’re always going to have down days.”

Peter said the fundamentals are better than any he’s ever seen.

The Federal Reserve is printing trillions of dollars. Fed Chair Jerome Powell has said it isn’t even thinking about thinking about raising interest rates. And there are reports that the central bank is set to make a commitment to ramping up inflation. All of this is extremely bullish for gold.

In a CNBC interview, US Global Investors CEO Frank Holmes said he can see $4,000 gold in the relatively near future with G-20 finance ministers and central banks “working together like a cartel and they’re all printing trillions of dollars.”

We’ve not seen this level where central banks are printing money at a zero interest rate. At zero interest rates, gold becomes a very, very attractive asset class,” Holmes said.

You have to focus on the fundamentals. A lot of investors aren’t doing that.

They’re not looking into the future and realizing the monetary fiscal policies that have already driven gold past $2,000 are going to continue and drive it past $3,000, $4,000, $5,000… And therein lies the opportunity.”

Finally, we note that Central banks added another net 18.1 tons of gold to their reserves in June, according to the latest data from the World Gold Council, who also found that 20% of central banks globally plan to expand their gold holdings in 2020.

Factors related to the economic environment – such as negative interest rates – were overwhelming drivers of these planned purchases. This was supported by gold’s role as a safe haven in times of crisis, as well as its lack of default risk.”

This year’s surge in precious metals, as Peter Schiff warns, is not a happy occasion because it really portends some real big problems on the horizon. I mean, most Americans don’t have any gold. There is severe economic hardship that the vast majority of Americans are going to be enduring, and gold is basically letting you know that that hardship is on the way.”

Continue reading at ZeroHedge.com, Click Here.