Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

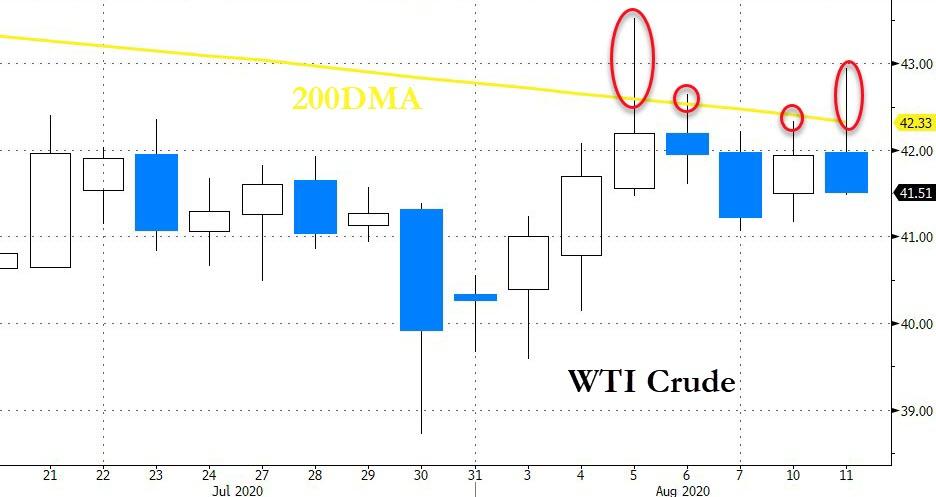

WTI ‘Off The Lows’ After Bigger Than Expected Crude Draw

Tyler Durden

Tue, 08/11/2020 – 16:34

Despite an early bounce on vaccine headlines, WTI reversed lower (again) at a key technical level (200DMA)…

“We still continue to have an overhang and a significant amount of spare capacity within OPEC,” said Bart Melek, head of global commodity strategy at TD Securities.

“It’s going to be tough to get out of that trading range.”

Additionally, as Bloomberg reports, OPEC and its allies will ease their historic output curbs this month in a test for a market already devastated by the pandemic; and finally, on the ‘bearish side, U.S. crude oil production in 2021 is forecast at 11.14m b/d, compared with 11.01m b/d projected in July, EIA says in monthly Short-Term Energy Outlook.

For now, inventories are all that matters for the algos…

API

-

Crude -4.40mm (-3.2mm exp)

-

Cushing +1.073mm

-

Gasoline -1.31mm (-1.50mm exp)

-

Distillates -2.949mm (-100k exp)

Expectations were for a 3rd week of crude inventory draws and API reported a larger than expected drop of 4.4mm barrels (vs 3.2mm exp)…

Source: Bloomberg

WTI hovered around $41.50 ahead of the API print and lifted very modestly on the data…

“Oil could not ignore the big correction in precious metals,” said Phil Flynn, senior market analyst at The Price Futures Group. The sharp selloff in gold and silver Tuesday “led to some trickle over margin selling on oil,” he told MarketWatch.

Continue reading at ZeroHedge.com, Click Here.