Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Nasdaq Surges To Another Record High Despite Dollar Surge

Tyler Durden

Mon, 08/03/2020 – 16:01

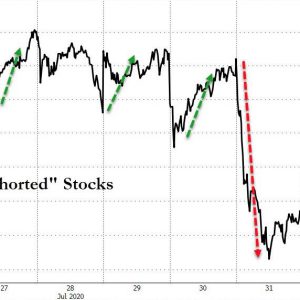

Another day, another nicely engineered short squeeze…

Source: Bloomberg

Oh and a panic bid into the world’s biggest market cap company (after it already rose over 10% on Friday), but a lot of that faded as the day went on…

And a better than expected ISM print (ignoring the decline in the Markit PMI) sparked a bid in value/cyclical stocks…

Source: Bloomberg

All helped lift the broad markets today (despite a late-day drop on McConnell comments about the Democrats “not budging” on negotiations… (Small Caps managed to outgain tech on the day thanks to that late drop)

NOTE the cash open saw an immediate panic-bid in Nasdaq and dump of Small Caps, but the latter quickly reversed.

AAPL & MSFT accounted for more than half of The Dow’s gains today, but gun stocks surged more on the back of huge surge in background checks…

Source: Bloomberg

Momentum continues to keep the dream alive…

Source: Bloomberg

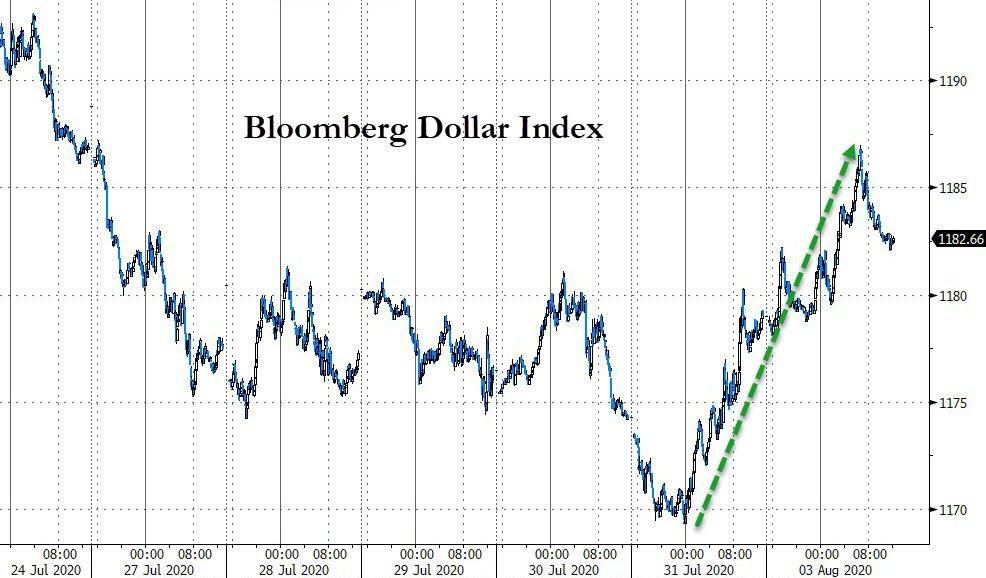

The rally in stocks held up despite a big surge in the dollar (which has been highly inveresely correlated with stocks for much of the last four months)…

Source: Bloomberg

Biggest 2-day jump in the dollar since early June..

Source: Bloomberg

…though it started to give back some gains after Europe closed…

Source: Bloomberg

But the bounce was from a serious point of support…

Source: Bloomberg

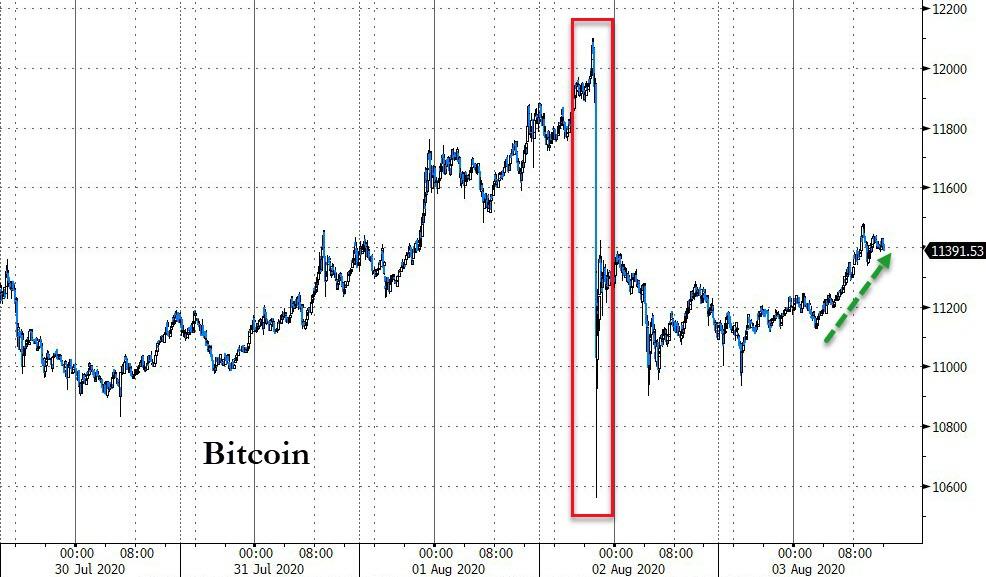

Bitcoin continued to recover from its flash-crash over the weekend…

Source: Bloomberg

And Ethereum even more so…

Source: Bloomberg

Treasury yields were higher on the day skewed to long-end underperformance amid the massive Google issuance (2Y +0.5bps, 30Y +4bps)…

Source: Bloomberg

But even with those rate-locks and rotation, 10Y yields barely budged by the close…

Source: Bloomberg

Gold scrambled into the green as the dollar started to leak lower…

Source: Bloomberg

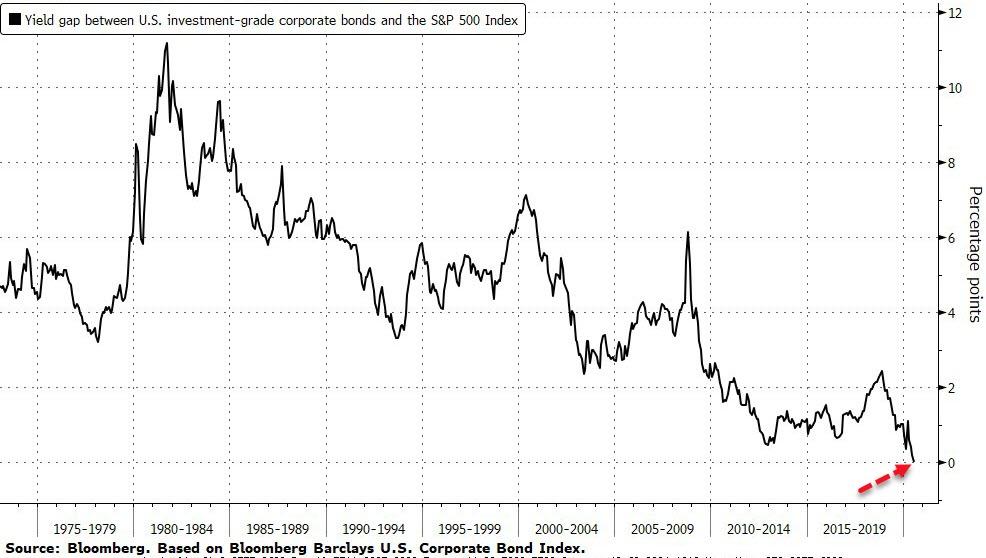

Finally, there’s this: Bloomberg reports that income-oriented investors have less reason than ever to favor U.S. corporate bonds over stocks. The gap between the yield on the Bloomberg Barclays U.S. Corporate Bond Index and the dividend yield for the S&P 500 Index shows as much. Both yields were about 1.9% at the end of last week, according to data compiled by Bloomberg.

Source: Bloomberg

Corporate yields have been as much as 11 percentage points higher on a monthly basis since the 1970s, as shown in the chart. The most recent peak was 2.4 points, reached in November 2018. But then again with The Fed’s foot on the throat of all price discovery, it makes sense that everything is the same, no matter the risk differentials.

That’s all that matters.

Continue reading at ZeroHedge.com, Click Here.