Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Here Is The Strategy Of The Best Performing Hedge Fund Of 2020

Tyler Durden

Wed, 07/29/2020 – 19:05

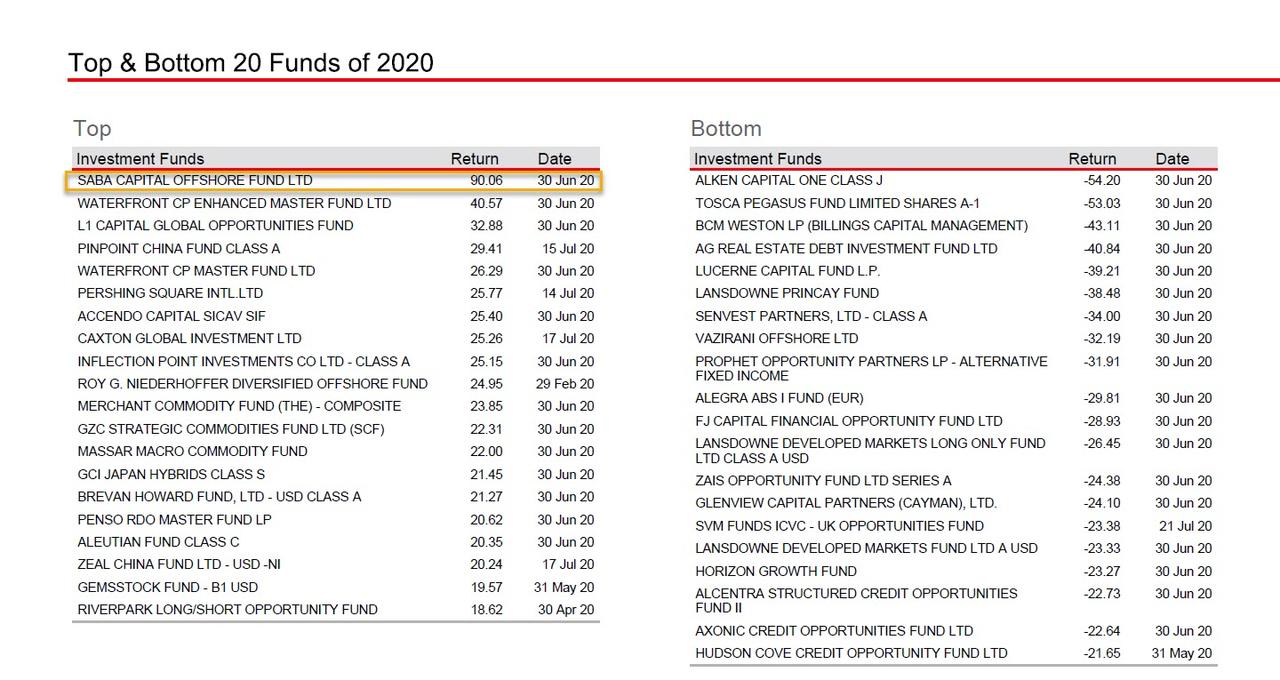

Sure, there are probably a handful of hedge funds who have generated even higher returns, but for the purpose of this post we are going off the latest HSBC hedge fund weekly report, according to which Boaz Weinstein’s Saba Capital is the best performing hedge fund of 2020 with a staggering 90% YTD return.

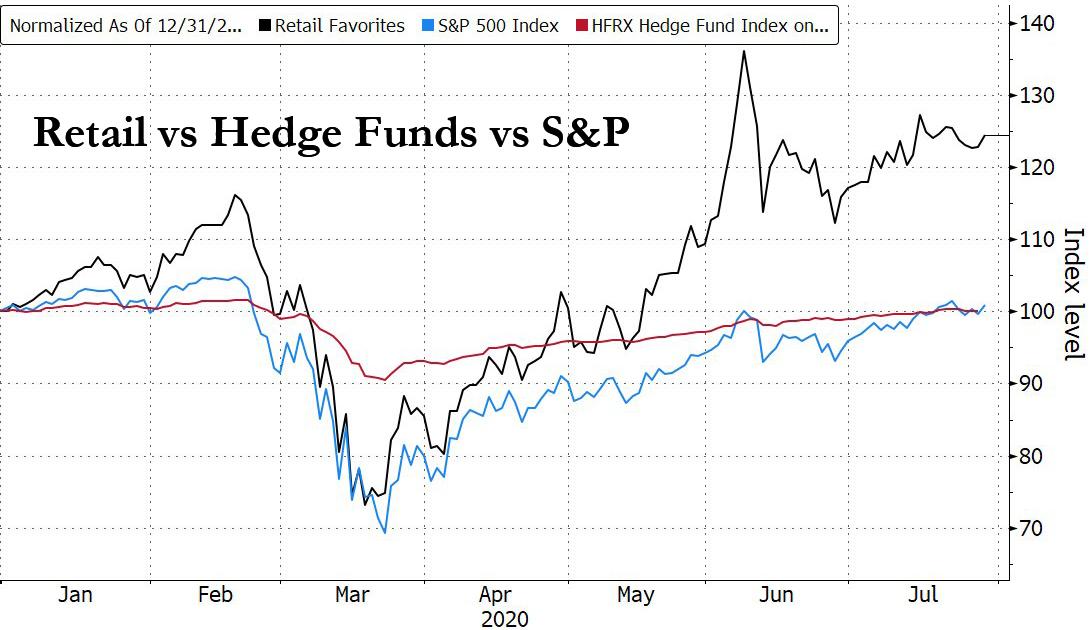

But how is the former Deutsche Bank prop trader making a killing when most of his hedge fund peers are struggling to post a positive return for 2020, let alone beat the S&P500?

Conveniently, we have the answer courtesy of a Bloomberg profile digging deep into Weinstein’s current living conditions, which just incidentally also happens to discuss his latest – and perhaps greatest – trading strategy.

Bloomberg starts off by chronicling Weinstein’s current living conditions which in this time of pervasive coronavirus lockdowns, are whimsical, even by a hedge fund manager’s standards:

Weinstein has repaired to his gated estate in Sagaponack, replete with tennis court, pool and a Vegas-style card room. When New York shut down, he left his office in the Chrysler Building and decamped to Long Island, like others from high-caste Manhattan. Unlike much of that crowd, however, Weinstein has settled here to make money — lots of it.

He certainly has: according to HSBC, his 90% YTD return is the best of all self-reporting hedge funds this year, which is remarkable for two reasons: i) the HFRX Global Hedge Fund index is basically unchanged for the year, and ii) for much of the past decade Weinstein was stuck on low gear, unable to generate the kinds of returns that brought him to hedge fund fame around the time of the financial crisis when he left Deutsche Bank to start Saba Capital (Weinstein made about $40 million in annual pay in his 20s and early 30s while still employed by Deutsche). However, before 2020, an investor who signed up on day one of his fund in 2009 would have made an annualized return of only about 3% (sure enough, see one of our first posts from 2009 “The Rapid Rise and Blistering Fall Of Boaz Weinstein“).

Weinstein more than redeemed himself in 2012 when he famously took the other side of outsized derivatives trades placed by JPMorgan’s prop trader Bruno Iksil. Those trades were so ill-advisedly large that they earned Mr Iksil the nickname “London whale” and ended up costing his bank $6bn in losses, as well as netting Weinstein a huge profit.

However, after successfully taking down Jamie Dimon’s secret prop trading desk, Weinstein once again quietly drifted into obscurity for several years. And indeed, for a firm whose investment thesis is to capitalize on volatile times, the decade following the financial crisis offered scant opportunities as the Fed kept interest rates near zero. Saba assets dwindled from a peak of $5.6 billion in 2012 as Weinstein lost money in five of the last 11 years.

All that has changed in 2020 when the pandemic set off the most violent market moves in more than a decade, allowing the poker-playing money manager to thrive by trading credit and derivatives of companies including uberfraud Wirecard, retailers Staples and Macy’sand loading up on cheap closed-end mutual funds according to Bloomberg. And, not surprisingly, his stellar YTD returns have put him front and center of the map for LPs seeking to allocate new funds: “He’s attracting new money, pulling in $1 billion to his now $3 billion Saba Capital Management. And he sees room to profit, even as stocks and bonds rebound.“

“Markets are at an unstable place right now. I look out at the next five months, and there are lots of known unknowns,” he told Bloomberg over the phone, pointing to everything from the course of the pandemic to the U.S. election and relations with China.

“There are dislocations today that are as large as they were three months ago” Weinstein said, predicting that there will be more moves to make as default rates mount.

2020’s market turmoil is a welcome change P&L-wise for the former chessplaying prodigy from what happened in 2008, when he lost $1.8 billion for his former employer, Deutsche Bank just months before he launched his Saba trading unit.

So how did Weinstein make his stellar YTD return? By going back to his CDS roots: according to Bloomberg, many of Weinstein’s trades revolve around credit-default swaps, which he had been trading since his Deutsche Bank days. One especially lucrative trade was the arbitrage offered by basis trades: Weinstein has been selling CDS on investment grade companies like AT&T and Verizon (the equivalent of buying bonds) which now have the explicit backstop of the Fed which is buying their bonds in the open market; at the same time he has been buying CDS of junk bond companies such as Devon Energy and Targa Resources (for the explanation why, read our March 25 article explaining how the Fed singlehandedly tore the bond market in two: “Distressed Debt Is Cratering, As Fed Buying Of Investment Grade Sends LQD NAV Soaring.“)

Weinstein has also been engaging in cross-asset arbs in names where one asset ends up being far more volatile than others, such as Wirecard: Weinstein sold CDS expiring in December, and used the premium to buy puts on the stock, which were cheap because the company has been a darling for German retail investors. “Even if the bonds went to zero you still make money. It’s a solid gain for us,” he said.

Then there is the plain vanilla bond-CDS basis trade, which arbs cheap bonds with rich (due to its liquidity) CDS. The point is to take both long and short positions and profit no matter what as the two securities converge. Weinstein has been doing such trades with Staples, Rite Aid Corp. and Macy’s.

Speaking to Bloomberg, Weinstein said his summer of profits has only begun.

“June has been one of our best months of the year, even though markets have been buoyant,” said Weinstein. “It’s a messy market, and it serves our strategy well.”

Then there is the good, old “fat tail” bet on higher vol, a trade which hurts for year on end, then generates massive gains overnight: while it is unclear if Weinstein has traded the VIX directly, it is implied that he did in fact dabble in the fear index, and sure enough, with the VIX plunging from 80 to 25, in the first half of July, Weinstein’s fund gained only 3 basis points. The two may be linked.

Finally, Saba has also been busy buying high-yield closed-end funds which trade at a 14% to 16% discount to the value of their holdings, a gap Weinstein expects will close sooner rather than later. In all, the firm owns $1.4 billion of closed-end funds across multiple portfolios according to Bloomberg.

“He has been good with coming up with clever trades that are long volatility explicitly or implicitly,” said Ermenio Schettino, a partner at Falcon Money Management, an early investor. While Schettino has cut his position with Saba over the years as opportunities dried up, he’s now so optimistic that Weinstein’s winning streak will continue that he’s added to his investment. Steve Cohen’s hedge fund and Bill Ackman also have entrusted money to him this year.

And while we expect Weinstein’s winning streak to continue (unless, of course, he suffers a repeat of 2008 when a basis-trade gone horribly wrong cost his then employer Deutsche Bank a $1.8 billion loss), it’s not like he needs the money:

Weinstein has been laying low as his wife, Tali, has been spending more time in New York City, preparing a run for the powerful Manhattan district attorney’s office. His in-laws have been living with him since he moved to his Long Island base. They have been raising vegetables and chickens on the two-acre estate next to billionaire hedge fund manager David Tepper’s summer pad.

A tennis court on the property is an ode to his competitive playing days at the nerdy Stuyvesant High. The poker room in his man-cave has seen busier days, but he has switched to occasionally playing over Zoom with hedge fund pals including Marc Lasry.

Of course, to Weinstein – who became a chess “life master” at 16, a card-counting blackjack ace when he was 20 and CDS trader at 24 when he joined Deutsche Bank – it’s not about the money but winning the game: “Poker is very analogous to life,” said Phil Hellmuth, a professional poker hall-of-famer who has been invited to some of those online gaming sessions. “In poker you develop a style that works. Boaz has been really smart in being able to find the right style.”

Continue reading at ZeroHedge.com, Click Here.