Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

WTI Holds Losses As Surprise Gasoline Build Raises Demand Questions

Tyler Durden

Tue, 07/28/2020 – 16:35

Oil prices fell during the day session today as stimulus hopes faded amid big differences on each side of the aisle, which along with the MLB “pause” raised questions of the strength of demand rebound.

“Demand for crude oil right now, whether it’s driving or especially on the airline front of it, is definitely a little bit weaker,” said Tariq Zahir, managing member of the global macro program at Tyche Capital Advisors LLC. “We’re kind of in a range here right now, at least until the EIA numbers come out.”

All eyes once again on inventories to see if the rebound in demand is holding up…

API

-

Crude -6.829mm (-1.2mm exp)

-

Cushing +1.144mm

-

Gasoline +1.083mm (-2mm exp)

-

Distillates +187k (unch exp)

After last week’s surprise crude build, analysts expected a draw this week (and a draw for gasoline stocks) but while crude did see a notably bigger than expected drop in stocks, gasoline demand may be in question as stocks unexpectedly built last week…

WTI traded back below $41 ahead of the API print and barely budged on the mixed picture…

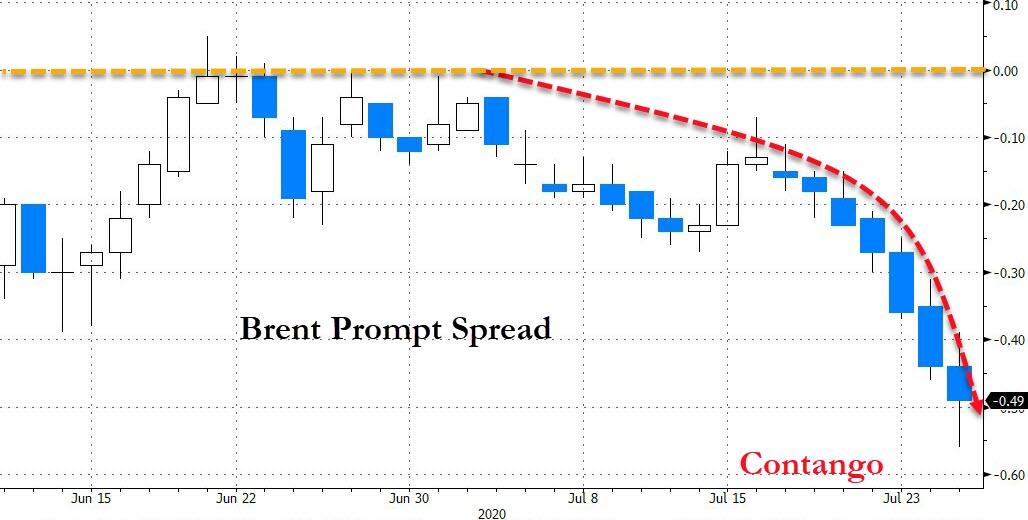

However, the futures curve is also showing signs of weakness…

The widening discounts, known as contango, is typical of a supply glut.

“No matter how you cut it, contango encourages storage,” Bob Yawger, director of the futures division at Mizuho Securities USA, said in a note. “Until that math is eliminated from the energy patch, prices will struggle to rally to the next level. Prices are more likely to break down.”

Continue reading at ZeroHedge.com, Click Here.