Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Tesla Soars After Reporting 4th Consecutive GAAP Profit, Is Eligible For S&P500 Index Inclusion

Tyler Durden

Wed, 07/22/2020 – 16:28

Among the companies reporting earnings, few will be watched as closely as Tesla, whose stock has quadrupled since hitting a March low, rising to a mind-boggling market value of $290 billion, surpassing the market cap of every other automaker in the world, and making it the 15th largest company in the S&P500 index, if it was in the index that is.

According to the LA Times, that surge makes Tesla the world’s highest valued car company — if far from the largest. Of the 90 million cars sold around the world in 2019 Tesla sold 367,000. Take the two top-selling carmakers in the world, Toyota and Volkswagen, toss in Ford; the stock market still values Tesla higher than all three combined.

In recent weeks, Tesla has also become a retail daytrading favorite with the number of Robinhood accounts holding Tesla shares rising to an all-time high of 496,890, making Tesla the second-most popular stock on the platform over the last 24 hours, and the 19th-most popular stock over the last 7 days. This flood of new retail money has certainly helped send the stock surging, although many have speculated that gamma manipulation in TSLA options has been critical to facilitate the recent surge.

To be sure, Tesla’s crazy stock moves continued this week: on Monday, Tesla stock climbed nearly 10%, adding $26.5 billion to its market value in a single day. It pulled back 4.5% on Tuesday, to $1,568.36 a share. Even Jim Cramer who has hyped Tesla stock plenty in the past, is astounded. Asked about Tesla stock on Twitter on Monday, he wrote: “I don’t even know if it is a stock. it is something else entirely, like a new species discovered in the wild.”

Commenting on the move, Russ Mitchell wrote that “Tesla’s bewildering ascent makes more sense when you think of it as a hyper-exaggerated product of — and maybe metaphor for — a stock market that itself has stopped making sense, at least by conventional measures.”

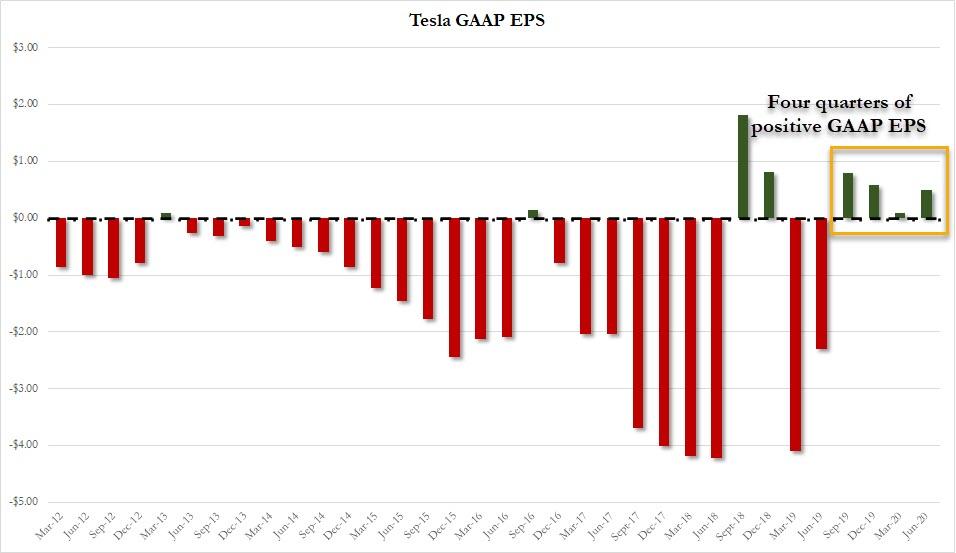

Still, Q2 earnings will matter if only to determine if Tesla will be allowed to join the S&P500: should Tesla report a Q2 profit it would be the fourth consecutive quarter of reported profitability on a GAAP basis would make Elon Musk’s electric car company eligible to join the S&P 500 index which could mean a sudden jump in demand from passive funds that track the benchmark.

Still, as CNBC noted earlier this week, index inclusion is not a done deal, and even if the company does report a fourth consecutive quarter of GAAP profits, there’s no guarantee that it will be added to the S&P 500, as inclusion in the index is based on quantitative as well as qualitative factors.

Even if a company meets these criteria as well as the other stipulations, however, it still does not guarantee inclusion in the index, according to Howard Silverblatt, senior index analyst at S&P Dow Jones Indices.

“The purpose of the index is to emulate the U.S. domestic common market,” he said. “When you go to put a company in — to actually select it — it’s got to fit into the algorithm in that it represents the market, it has liquidity, it has size,” he added.

The committee meets on a quarterly basis to rebalance the index, and the next meeting is scheduled for the third Friday in September. But Silverblatt said companies can be added or removed from the S&P at any time.

On the other hand, in a note published this morning, Morgan Stanley analyst Adam Jonas wrote that “in the event Tesla posts a loss and has to wait for S&P500 index inclusion… while this would be a short-term disappointment, we doubt the market would see this as narrative changing at all” (Jonas is Underweight the stock and has a $740 price target)

Besides GAAP earnings, Jones said that other things to look for in Q2 earnings include update to guidance, timelines of new production facilties (Texas, Berlin), Cybertruck order book and launch timline, gross margins and FCF and software business model updates.

To hit its earnings bogey, a revenue source Tesla can tap into that’s difficult for analysts to model for are the regulatory credits the company sells to other automakers that need them to comply with emissions standards. Tesla generated $354 million in revenue from these credits in the first quarter. Analysts expect this business to grow, as Europe and China are making their car-pollution rules stricter.

Meanwhile, as Bloomberg adds, another key question will be how many cars it will deliver: in January, the company said full year vehicle deliveries “should comfortably exceed 500,000 units.” In April, Tesla said it had “capacity installed to exceed 500,000 vehicle deliveries this year” despite factory shutdowns because of the coronavirus. So far, Tesla has delivered about 179,050 vehicles through the first half of the year. If the company reaffirms its guidance for more than 500,000, analysts will be keen to hear more color including a regional breakdown.

* * *

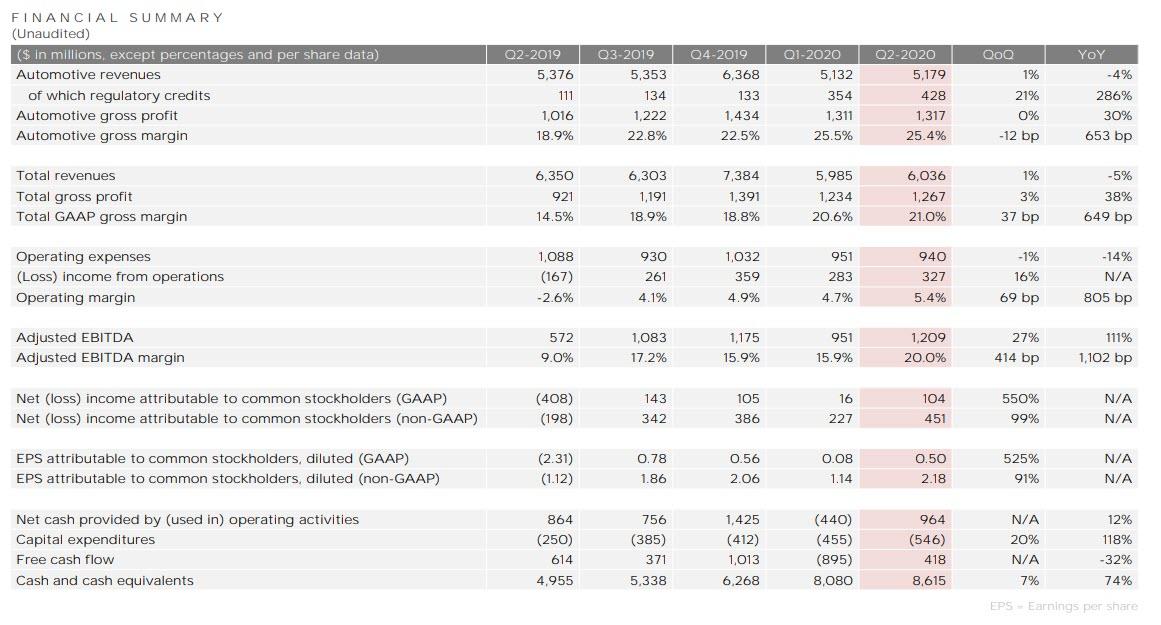

So with all that in mind, here is what Tesla just reported for the second quarter:

- Q2 GAAP EPS of $0.50, up sharply from a GAAP loss of $2.310 a year ago, and beating expectations of an 11 cent loss

- Q2 Revenue of$6.04BN, down 4.9% Y/Y, but above the $5.4BN estimate.

- Q2 Adjusted Net Income $451MM, vs exp loss of $74MM. However, Tesla sold $428MM in regulatory credit this quarter, a new record ; of not Q2 Net income was just $104MM.

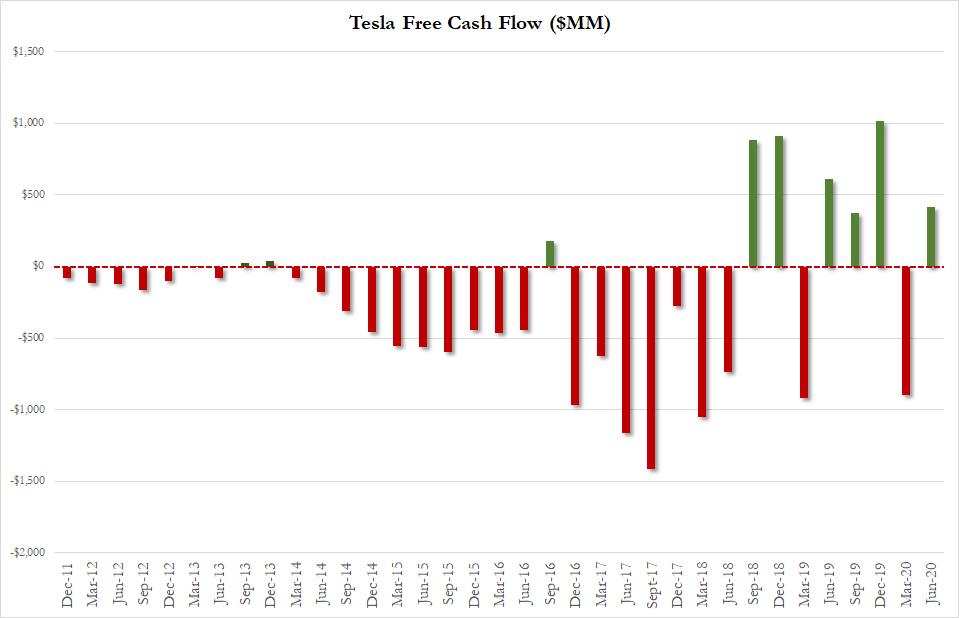

- Q2 Free Cash of $418MM, vs Exp. cash burn of $617.9MM.

So how did Tesla report positive EPS? It generated a record $428MM from sale of regulatory credits. This means that without a record $421MM in regulatory credit sales it would have negative GAAP earnings

Some more details from the second quarter earnings report:

- Delivering Half Million Vehicles in 2020 Remains Target

- Capacity Installed to Exceed 500k Deliveries This Year

- Shanghai Factory First Deliveries Expected in 2021

- Capacity Installed for Over 500,000 Deliveries This Yr

- Says Semi Deliveries to Begin in 2021

- Shanghai Factory Is Progressing as Planned

No matter the details, however, Tesla now officially has 4 consecutive quarters of positive GAAP earnings, which explains why the stock is up as much as 5% after hours.

Putting the company’s Q2 revenues in context:

- Q2 2020: $6.0 billion

- Q2 2019: $6.3 billion

- Q2 2018: $4.0 billion

- Q2 2017: $2.8 billion

- Q2 2016: $1.3 billion

- Q2 2015: $955 million

- Q2 2014: $769 million

- Q2 2013: $405 million

- Q2 2012: $27 million

And here are the company’s Q2 auto deliveries:

- Q2 2020: 90,891 vehicles

- Q2 2019: 95,356 vehicles

- Q2 2018: 40,740 vehicles

- Q2 2017: 22,000 vehicles

- Q2 2016: 14,370 vehicles

- Q2 2015: 11,532 vehicles

- Q2 2014: 7,579 vehicles

- Q2 2013: 5,150 vehicles

- Q2 2012: 12 vehicles

- Q2 2011: 0 vehicles

One big surprise in the report was Tesla’s free cash flow, which soared from a cash burn of $895MM in Q1 to a positive number of $418MM in Q2, surprising Wall Street which expected a burn of $74MM.

Continue reading at ZeroHedge.com, Click Here.