Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Deutsche Bank’s Top Credit Strategist Makes Stunning Admission: “I Am A Gold Bug; Fiat Money Is A Passing Fad In The History Of Money”

Tyler Durden

Wed, 07/22/2020 – 15:15

As covered here repeatedly over the past 24 hours, gold and silver (and oil) had a great day yesterday, with the rally continuing on Wednesday, sending silver nearly 100% higher than its March lows.

Furthermore, as DB’s Jim Reid notes, on a YTD basis, Gold (+21.4%) and Silver (+19.3%) have had standout moves compared with global risk – which as a reminder is what central banks are doing everything they can to prop up – even if WTI (-26.1%) is down.

What followed next was shocking as it came from the mouth of a respected legacy banker and not some tinfoil conspiracy theorist: admitting that he is “a gold bug”, Reid says that in his opinion, “fiat money will be a passing fad in the long-term history of money”, a shocking admission for most financial professionals who are expected who are expected to tow the Keynesian line and also believe in the primary of fiat and its reserve currency, the US Dollar.

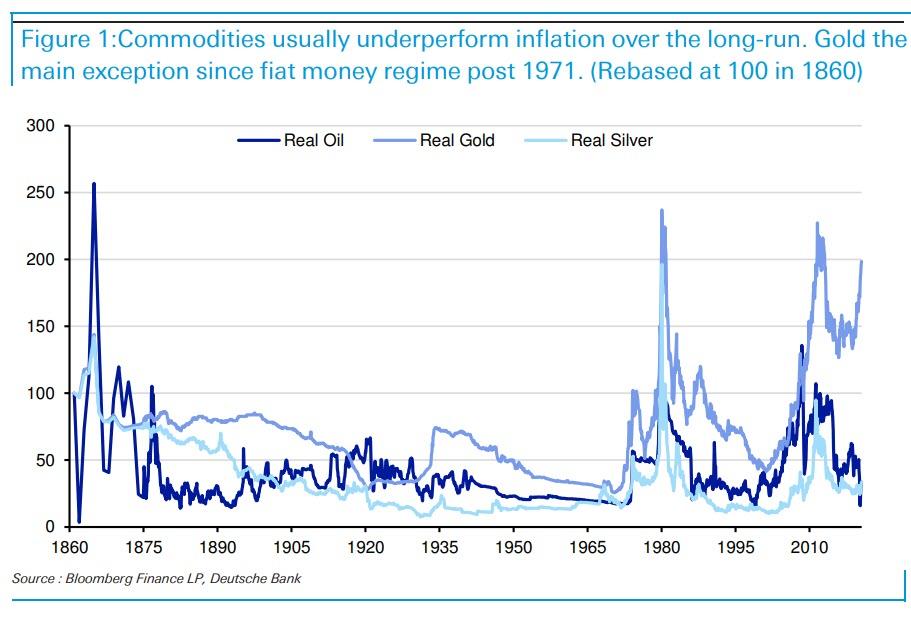

That said, he also concedes that in his long-term work “I’ve always found many commodities difficult to recommend on a buy and hold basis as most underperform inflation over the long run – probably as they are mostly used in production and alternatives are found if too expensive. We also become more efficient at using them.“

All… except gold:

Indeed, between 1860 and 1971 (move from a gold-based system to fiat money), Reid notes that the real price of Gold fell by 75% and over 80% for Oil and Silver. Since then, while oil and silver have only doubled in real terms and are still less than half their 1860 values, Gold is up 7 times, double its 1860s real level.

Some context: since 1971, the S&P 500 is up 22 times in real total return terms and 40,000 times since 1860, but one has to remember that whereas equities are actively pumped up by central banks, gold has been repeatedly hammered by monetary authorites, so its performance is nothing short of remarkable having had to “fight the Fed” for near 40 years.

Reid’s conclusion: “Gold is definitely a fiat money hedge” and not only that, but more importantly a transitionary asset to whatever monetary system is next.

Continue reading at ZeroHedge.com, Click Here.