Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Risk Of Global Recession In 2023 Rises Amid Simultaneous Rate Hikes

Authored by Mike Shedlock via MishTalk.com,

Central banks cut in unison in response to Covid. They are now hiking in unison. What can go wrong?…

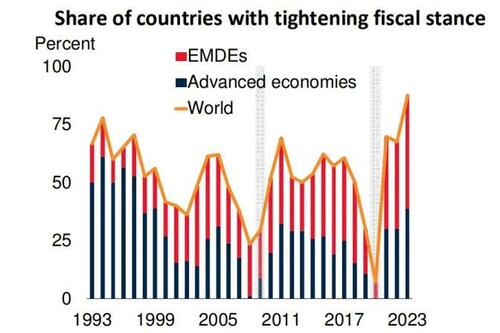

World Bank chart on tightening fiscal stance

Super Thursday Actions

The Wall Street Journal reports Interest-Rate Hikes Come Thick and Fast

-

Switzerland: Raised rates by 0.75 point to 0.5%, making it one of the last central banks to exit negative territory.

-

U.K.: The Bank of England raised its key rate by 0.5 point to 2.25%, and will start selling some of its bond holdings.

-

Norway: Increased rates by 0.5 point to 2.25%.

-

Indonesia: Raised its benchmark rate by 0.5 percentage point to 4.25%.

-

Taiwan: Moved its discount rate up by 0.125 point to 1.625%.

-

The Philippines: Upped its benchmark overnight borrowing rate by half a point to 4.25%.

-

South Africa: Took the main repo rate up 0.75 point to 6.25%.

-

Japan: The Bank of Japan kept its benchmark rate at minus 0.1%. Tokyo later intervened to shore up the yen.

-

Turkey: Cut its main rate by 1 percentage point to 12%, continuing its contrarian easing campaign.

Risk of Global Recession in 2023 Rises Amid Simultaneous Rate Hikes

The World Bank says Risk of Global Recession in 2023 Rises Amid Simultaneous Rate Hikes

Central banks around the world have been raising interest rates this year with a degree of synchronicity not seen over the past five decades—a trend that is likely to continue well into next year, according to the report. Yet the currently expected trajectory of interest-rate increases and other policy actions may not be sufficient to bring global inflation back down to levels seen before the pandemic. Investors expect central banks to raise global monetary-policy rates to almost 4 percent through 2023—an increase of more than 2 percentage points over their 2021 average.

Unless supply disruptions and labor-market pressures subside, those interest-rate increases could leave the global core inflation rate (excluding energy) at about 5 percent in 2023—nearly double the five-year average before the pandemic, the study finds. To cut global inflation to a rate consistent with their targets, central banks may need to raise interest rates by an additional 2 percentage points, according to the report’s model. If this were accompanied by financial-market stress, global GDP growth would slow to 0.5 percent in 2023—a 0.4 percent contraction in per–capita terms that would meet the technical definition of a global recession.

“Global growth is slowing sharply, with further slowing likely as more countries fall into recession. My deep concern is that these trends will persist, with long-lasting consequences that are devastating for people in emerging market and developing economies,” said World Bank Group President David Malpass. “To achieve low inflation rates, currency stability and faster growth, policymakers could shift their focus from reducing consumption to boosting production. Policies should seek to generate additional investment and improve productivity and capital allocation, which are critical for growth and poverty reduction.”

The study highlights the unusually fraught circumstances under which central banks are fighting inflation today. Several historical indicators of global recessions are already flashing warnings. The global economy is now in its steepest slowdown following a post-recession recovery since 1970. Global consumer confidence has already suffered a much sharper decline than in the run-up to previous global recessions. The world’s three largest economies—the United States, China, and the euro area—have been slowing sharply. Under the circumstances, even a moderate hit to the global economy over the next year could tip it into recession.

Is a Global Recession Imminent?

The World Bank Report ponders the question Is a Global Recession Imminent?

-

Kenneth Rogoff, April 26, 2022: The odds of recession in Europe, the United States, and China are significant and increasing, and a collapse in one region will raise the odds of collapse in the others… The risks of a global recession trifecta are rising by the day.

-

Jeffrey Frankel, August 25, 2022: A global recession is entirely avoidable… Even by laxer criteria like GDP growth below 2.5 percent, global recession is very far from inevitable.

-

Anne O. Krueger, August 25, 2022: Whether the balance of risks is toward inflation, recession, or a smooth landing from current turbulence depends on unknowns such as the duration of the Ukraine war… …. But a global recession is certainly not inevitable.

-

Jim O’Neill, August 25, 2022: If these two economies (the US and China) are both in their respective versions of recession, then that will virtually guarantee a global downturn. Given their current weaknesses and challenges, such a scenario is quite possible… But I am less convinced of this than I probably was a few months ago…

-

Stephen S. Roach, August 25, 2022: Notwithstanding the pitfalls of forecasting anything these days, my cracked and worn crystal ball sees a global recession occurring in the next year…. Collectively, Europe, the US, and China make up about half of world GDP on a purchasing-power-parity basis. With no other economy able to fill the void, I am afraid a global recession does indeed appear inevitable.

Global Recession Definition

There is no consensus on the definition of a global recession.

Some economists suggest anything under 2.5 percent growth, some use per-capita growth, some mean declining real GDP.

Fantasyland Projections vs the Inevitable

Jeffrey Frankel is in pure Fantasyland believing 2.5 percent growth is possible. Roach is undoubtedly correct.

China is in the midst of an imploding property bubble. Europe will have a severe recession due to a war-related energy crisis, and the US consumer is struggling under the weight of Fed rate hikes and a housing crash.

First we had unprecedented fiscal and monetary stimulus. Now we have unprecedented monetary tightening but still loose fiscal conditions.

The Real Question

In general, central bankers shifted from the stern to the bow and back again, in unprecedented amounts, hoping first to cause inflation, now to stop it.

When does this central bank massive flip-flopping cause a global currency crisis?

That’s the real question because a major global recession is inevitable.

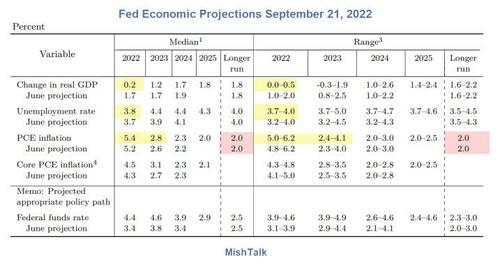

Meanwhile, we have wildly optimistic Fed forecasts.

Examining Fed GDP Projections For 2022 and 2023

Please consider Wildly Optimistic Forecasts: Examining Fed GDP Projections For 2022 and 2023

100% of Fed participants expect no less than an all-time GDP high in the 4th quarter! The median expectation is greater.

The Fed is not making predictions, the Fed is making Fantasyland wishes.

What an incredulous hoot.

* * *

Like these reports? I hope so, and if you do, please Subscribe to MishTalk Email Alerts.

Tyler Durden

Fri, 09/23/2022 – 15:25

Continue reading at ZeroHedge.com, Click Here.