Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Global Hawknado Hammers Stocks, Bonds, & The Dollar

EU consumer confidence crashed to a record low overnight and a veritable avalanche of interventions, rate-hikes, and hawkish jawboning did nothing to provide any BTFD bids for stocks… or bonds.

Source: Bloomberg

Interestingly, on the day, the market shifted notably more hawkish in STIRs with Fed Terminal Rate expectations rising to 4.66% and also the subsequent rate-cut expectations being hawkishly reduced…

Source: Bloomberg

US Treasury traders rejected the kneejerk bid for the long-end during yesterday’s post-FOMC chaos and puked bonds across the curve, with the long-end absolutely crushed (2Y +6bps, 10Y +17bps on the day). Post-Powell, the 30Y Yield is now up around 6bps and the 5Y yield is up around 16bps…

Source: Bloomberg

The 2Y yield traded above 4.00% all day…

Source: Bloomberg

Notably, this drastic selloff had other ‘sponsors’ including the post-BoE-hike UK bond market, a heavy slate of new corporate bonds for the first time this week, an auction of Treasury inflation-protected securities later in the day and speculation that Japan’s intervention to support the yen might entail selling of Treasuries.

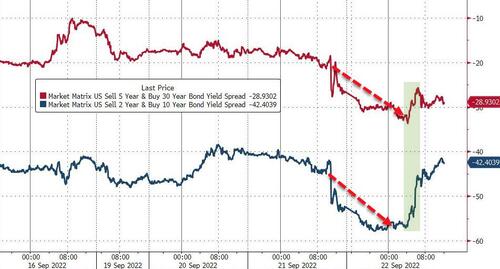

Yield curves steepened today, unwinding some of yesterday’s flattening. Intraday, the 30-year bond’s yield was 34 basis points lower the five-year note’s, its deepest inversion since 2000 and an incentive to exit curve-flattening wagers. The 10-year note’s yield was 58 basis points lower than the two-year note’s, within a basis point of the most since 2000.

Source: Bloomberg

10Y gilt yields exploded higher today (+19bps) to their highest since March 2011 after BoE hiked rates and promised more…

Source: Bloomberg

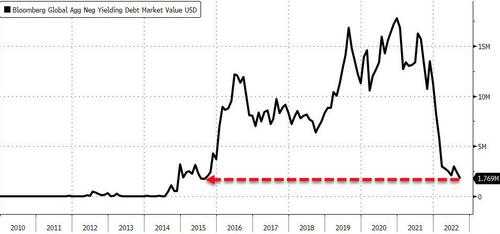

Finally, before we leave bond-land, remember the old “total global negative-yielding debt” index? A year ago there was still some $13 trillion worth of negative-yielding bonds, with securities from 47 different countries represented. Today, that total has fallen to $1.77 trillion … and Japan is the only country left in the index.

Source: Bloomberg

US Equities tumbled around the US cash open but caught a bid late on to get The Dow back to even on the day but some very late selling took that away. Small Caps were the ugliest on the day…

The dollar index was hammered overnight as Japan intervened in the FX markets for the first time since 1998 (officially), but by the close a USD bid had re-emerged and the DXY ended unchanged…

Source: Bloomberg

The Yen surged 6 handles on the intervention but had given almost half of it back by the end of the US session…

Source: Bloomberg

Bitcoin bounced back from yesterday’s ugliness, pushing up towards $19.500…

Source: Bloomberg

Crude prices managed gains today, despite another pump and dump profile, with WTI stuck in a $83-86 range…

Gold ripped back up towards yesterday’s post-Powell highs today, but remains below $1700…

Finally, we note that the S&P 500 has traded below its 200-day moving average for over 100 sessions – a streak that was previously breached only during the tech bubble and the global financial crisis in the past 30 years.

Source: Bloomberg

In both of those instances, the gauge posted most of its losses after surpassing that level, with the index declining by a further 50% in 2000-2003 and 40% in 2008-2009 before troughing, they said.

“The bad news is we are still in one of the weakest seasonal windows of the year, especially in a mid-term year,” said Jonathan Krinsky, chief market technician at BTIG.

“The good news is that it quickly reverses by mid-October. We think we test or break the June lows before then, which should set up a better entry point for a year-end rally.”

Additionally, as we noted earlier, that chasm between bond vol and equity vol (i.e. VIX, VVIX, SKEW/SDEX) remains extremely wide.

Nothing says this spread has to collapse, however we remain of the opinion that equities cannot hold a material, sustainable rally (5-10% equity rallies have been disappearing at lightning speed) until that MOVE index shifts back down

As long as the MOVE remains this elevated, tail risk remains elevated, and overall volatility likely remains high.

Tyler Durden

Thu, 09/22/2022 – 16:00

Continue reading at ZeroHedge.com, Click Here.