Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Daly Dumps On Dovish Dreams But Stocks Scream Higher Anyway

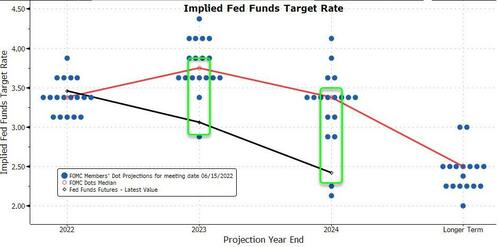

Reiterating what Fed Chair Powell said last week – and the market completely ignored – SF Fed’s Mary Daly stated that the June DotPlot remains a “reasonable guide” to The Fed’s actions going forward. That is a clear message to the market that it’s offside…

Source: Bloomberg

She also added that she is “optimistic to get inflation down without a deep recession,” and that “we’re not even at the neutral rate yet.” All suggesting The Fed is far from the ‘pivot’ everyone has been hoping for over the last week as she concluded that The Fed “won’t bring rates down in just a few months.”

Jim Bullard was alos extremely hawkish and Neel Kashkari confirmed that “2023 rate-cuts seem like a very unlikely scenario.”

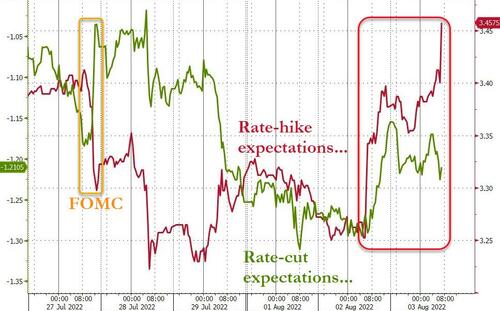

Rate-hike expectations soared today – now more hawkish than before Powell started speaking…

Source: Bloomberg

…but so did stocks, decoupling from the STIR market’s hawkish tone for the 3rd time…

Source: Bloomberg

Nasdaq was the day’s biggest winner, up a shocking 3%, but all the majors just ripped at the cash market open and never looked back…

Thanks to another massive short-squeeze – “most shorted” stocks are up a stunning 11% from yesterday’s gap-down opening…

Source: Bloomberg

All the US Majors have squeezed back above their 100DMAs (having all broken above their 200DMAs last week). The green line at the top is the 50DMA target…

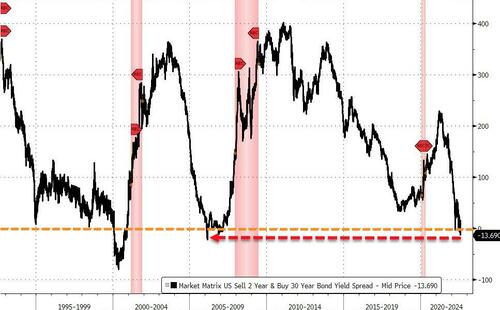

US Treasuries were mixed today with the long-end outperforming while the short-end extended yesterday’s bloodbathery (30Y -5bps, 2Y +4bps), somewhat helped by late-day buying. Notably on the week, 30Y yields remain lower (-6bps) while the 2Y is up 20bps…

Source: Bloomberg

This crushed the yield curve and sent 2s30s to its most inverted since

Source: Bloomberg

The dollar closed very modestly higher today – after spiking higher after the ISM/PMI data it gave it all back as stocks ripped…

Source: Bloomberg

Bitcoin rallied back above $23,500 today…

Source: Bloomberg

Gold closed lower once again, losing ground on the ISM data after rebounding overnight

WTI Crude dumped after being pumped on the OPEC+ statement (and capacity constraints)…

WTI closed back below the 200DMA and closed back below pre-Putin-invasion levels for the first time…

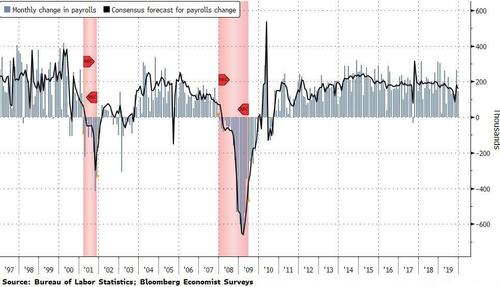

Finally, amid all the gaslighting over recession calls, the Biden admin has desperately clung to the mantra that ‘we cannot be in a recession because jobs are so awesome’. The problem is, as Bloomberg reports today, although it’s a major US economic report, the monthly change in payrolls has little value for forecasters trying to predict a recession.

Companies are reluctant to let go of workers even as business starts to slow (and will likely be more reluctant now, given the current labor shortage). The report is also backward-looking, with data gathered in the first half of the month prior to its release. As a result, recessions have already started before payrolls start to shrink.

Tyler Durden

Wed, 08/03/2022 – 16:01

Continue reading at ZeroHedge.com, Click Here.