Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Bitcoin, Brent, & Big-Tech Bid As Putin-Promises Trumped Piss-Poor Permits

Europe led US stocks higher after Reuters reported that NS1 will reopen gas glows as planned on Thursday. Germany and Italy led the way…

Source: Bloomberg

US stocks shrugged off ugly housing data that showed single-family home starts and permits crash and exploded higher after the NS1 headlines amid a massive short-squeeze. Small Caps were the day’s biggest gainers followed closely by Big-Tech (Nasdaq was up over 3% today!!)…

“Most Shorted” stocks soared over 6% off their opening lows…

Source: Bloomberg

All the US majors broke back above the key technical 50DMA level…

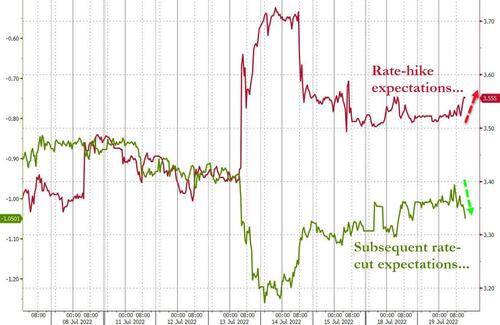

Short-term rates shifted hawkishly today but next year’s rate-cut expectations also increased…

Source: Bloomberg

Treasury yields rose today with the short-end underperforming (2Y +5bps, 30Y +1bps) with the 10Y Yield back above 3.00%. The entire curve is up around 10bps on the week…

Source: Bloomberg

The dollar slipped lower for the 3rd straight day, back near two-week lows…

Source: Bloomberg

Cryptos surged today with Bitcoin back above $23,500 – six-week highs…

Source: Bloomberg

And Ethereum topped $1600…

Source: Bloomberg

Gold ended basically unchanged, managing to hold above $1700…

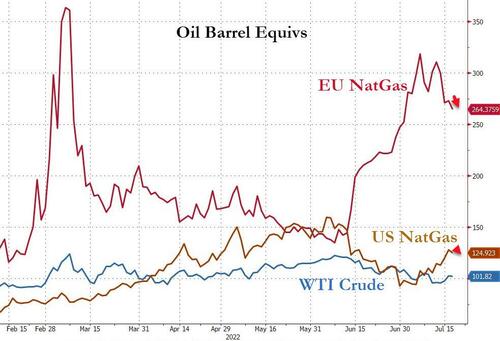

US and EU NatGas prices slipped modestly lower on the day after the NS1 headlines…

Source: Bloomberg

WTI closed back above $100…

Finally, the good news continues with gas prices now at their lowest in just over a month (back below $4.50)…

Source: Bloomberg

Bear in mind though that for the week ending March 28, the week before President Joe Biden announced that the government would release a million barrels of oil per day from emergency stockpiles, gasoline prices were $4.231, according to weekly EIA data – 25.9 cents less than prices at the pump today.

BUT, given WTI’s move, we suspect this slump in pump prices could be over (and the mini-bounce in Biden’s approval ratings dies in darkness).

REPORTER: “Aren’t you having it both ways, Jared? Because when the gas prices go up, it’s got nothing to do with the president. When we see some decline, you want him to get the credit.”

BERNSTEIN: “Uh, look, uhhh..”

— Benny Johnson (@bennyjohnson) July 19, 2022

Tyler Durden

Tue, 07/19/2022 – 15:16

Continue reading at ZeroHedge.com, Click Here.