Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Stocks & Bonds Surge As Recession Fears Tank Rate-Hike Odds

Ugly PMIs in Europe and the US sent yields tumbling across both continents and rate-hike odds fell significantly as investors pivoted from inflation fears to growth scares. Copper and Crude sold off (growth fears) and while stocks ramped late in the afternoon, they were oscillating wildly early on as they weakened on recession anxiety then strengthened on the post-recession rate-cut/QE hope.

Nasdaq led the chaos with a late-day buying-panic (nope, no fundamental catalysts) as stocks seemed committed to the post-recession reaction function rather than the actual recession…

Aside from the COVID lockdowns, this is the weakest level for US Macro Surprise Index since Aug 2011…

Source: Bloomberg

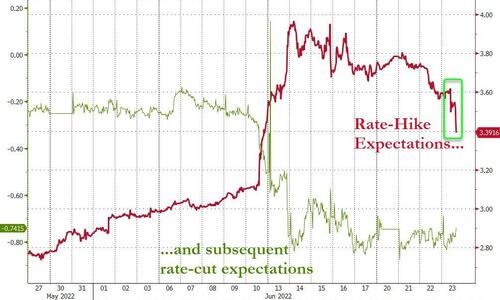

So it’s no wonder that rate-hike odds are sliding fast… despite Powell’s “unconditional” commitment to fight inflation…

Source: Bloomberg

The market has basically adjusted to price in rate-hikes into September (ahead of the Midterms) and then an increasing chance of either a pause or actual rate-cuts…

Source: Bloomberg

Crude slipped lower…

And so did Dr. Copper, crashing to the lowest since Feb 2021…

Source: Bloomberg

Bonds were bid across the curve with the belly outperforming the wings (5Y -10bps, 2Y -4bps, 30Y-6bps). Since CPI, 2Y is up 20bps, 30Y up around 4bps…

Source: Bloomberg

10Y Yields plunged back to tag 3.00% – erasing all of the 50bps post-CPI spike…

Source: Bloomberg

European bond yields also plunged today…

Source: Bloomberg

The dollar ended the day flat with another overnight Asia rally dumped during the European session…

Source: Bloomberg

Bitcoin ended the day higher, finding support at $20,000…

Source: Bloomberg

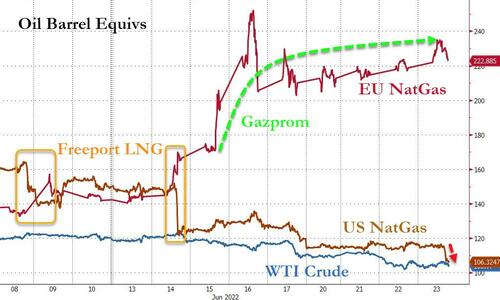

Elsewhere in the energy complex, US NatGas plunged 10% after inventories rose following the Freeport LNG closure and at the same time, EU NatGas soared after Germany elevated its ‘risk level’ on fears of Russian gas supply…

Source: Bloomberg

Gold rallied early on as rate-hike odds eased, but was hit lower after Europe closed to end the day down. Still holding above $1800 for now…

Finally, we note that DoubleLine’s Jeff Gundlach’s favorite bond indicator – Copper/Gold – is signaling a notable leg lower in yields is overdue…

Source: Bloomberg

Did Dr. Copper price in the recession first and bonds are yet to catch down?

Tyler Durden

Thu, 06/23/2022 – 16:01

Continue reading at ZeroHedge.com, Click Here.