Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Big-Tech, Bitcoin, & Bond Yields Surge Higher As Macro Malaise Continues

Ugly home sales data and a collapse in the Chicago Fed’s National Activity Index pushed the US Macro Surprise Index down to fresh cycle lows. Judging from the last decade or so, the current level may be ‘as bad as it gets’ as analysts adjust their own forecasts down from over-optimism, but as March 2020 shows, sometimes even that can be overshot…

Source: Bloomberg

After the worst week for stocks in over two years, US equity futures drifted higher yesterday (with US cash markets closed) and then surged higher at the cash open this morning, led by Nasdaq. We do note that late-day weakness pushed Small Caps to reverse all of their post-cash-open gains by the close (but was still up strongly from Friday’s close)…

Today’s rip extended a major short-squeeze around Friday’s huge OpEx, but we note that the ‘most shorted’ stocks stalled their ramp today after filling last week’s gap down…

Source: Bloomberg

US Treasuries were sold with the long-end dramatically underperforming with 2Y up only around 1.5bps while 30Y yields rose over 10bps…

Source: Bloomberg

European bond spreads have stalled their post-ECB-emergency promises compression, hovering at around one-month lows (still quite ‘fragmented’ from traditional norms)…

Source: Bloomberg

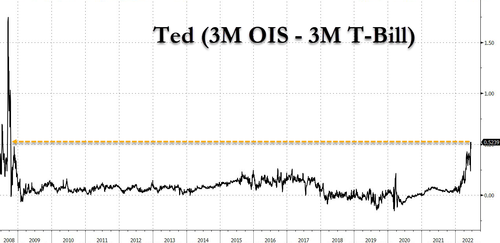

And if you’re not worried about EU defragmentation, then the US TED spread blowing out should raise your fear level that something is going on behind the scenes…

Source: Bloomberg

Rather notably, broker credit spreads are exploding wider…

Source: Bloomberg

The dollar has limped very modestly lower since Friday’s close…

Source: Bloomberg

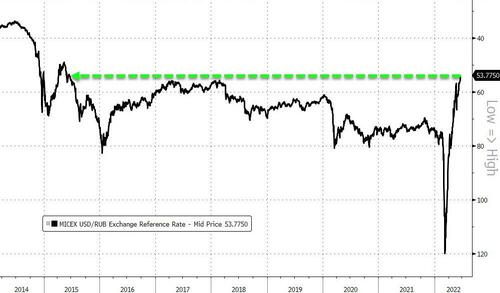

Meanwhile, the Ruble soared to its highest relative to the dollar in 7 years…

Source: Bloomberg

A really ugly weekend for crypto saw Bitcoin puked down to a $17,000 handle on Saturday before staging a strong comeback above $21,000…

Source: Bloomberg

Also of note that is that the correlation between Bitcoin and Nasdaq has dropped significantly…

Source: Bloomberg

Gold is lower from Friday’s close, back below $1850…

Oil prices are modestly higher from Friday’s close but were unable to hold above $110 (WTI)…

European NatGas remains dramatically decoupled from US NatGas but both were relatively stable over the last two days…

And some good news…

🚨 For the first time in nine weeks, the national average price of gas has dropped. It might not feel like much, but prices are back under $5/gal on average, and could drop as much as 15-30¢/gal more by Independence Day. More here: https://t.co/RG636cQSBx #gasprices pic.twitter.com/TueUmQV0g0

— GasBuddy (@GasBuddy) June 20, 2022

Finally, some context for that has happened so far this year. Since the pre-COVID highs, global stock and bond capital markets are up around $9 trillion still (but have lost around $36 trillion from their highs)…

Source: Bloomberg

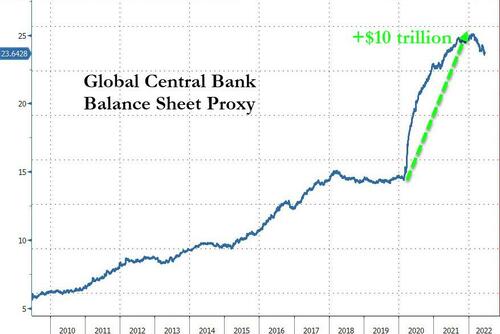

And global central bank balance sheets are up over $10 trillion since that time…

Source: Bloomberg

So, all in all, a giant f**king waste of time to delay the inevitable. No wonder they need another crisis.

Tyler Durden

Tue, 06/21/2022 – 16:00

Continue reading at ZeroHedge.com, Click Here.