Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Dow Dumps Below 30k As Huge OpEx Looms; Gold Gains, Greenback Gags

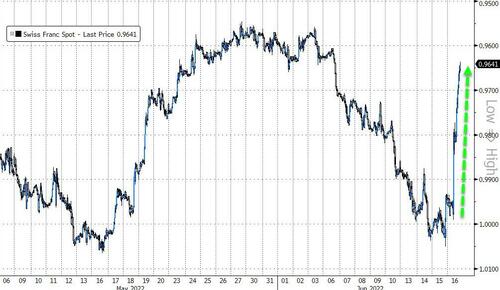

The SNB stole the jam out of The Fed’s donut overnight as it became obvious that many investors in the world had no idea just how many billions in US mega-cap tech the Swiss National Bank owned… and was standing ready to liquidate.

The unexpected 50bps hike sent Swissy soaring higher…

Source: Bloomberg

And Swiss 10Y yields spiked to 11 year highs…

Source: Bloomberg

And US futures tumbling lower. Nasdaq was down over 4.5%, S&P down over 3.5% and Dow over 2.5%…

Erasing all of yesterday’s post-Powell gains and then some (NOTE that futures were fading overnight before the SNB news hit as the post-Powell hangover hit)…

The Dow broke down below 30,000 today for the first time since Jan 2021 – hitting its lowest since Dec 2020 intraday (Dow is -19.5% from all-time highs, just shy of ‘bear market’ territory)…

Source: Bloomberg

Small Caps led the slump and now back below pre-COVID highs (Dow is just 1% above those highs)…

Source: Bloomberg

…and we note that Bloomberg found that the number of Russell 3000 (non-financial) companies trading for less than cash has surpassed the month-end record set during the Global Financial Crisis.

Source: Bloomberg

US equities were not helped by yet more dismal macro data (housing starts, permits, jobless claims, Philly Fed all disappointed), sending US Macro Surprise Index to its lowest since July 2019…

Source: Bloomberg

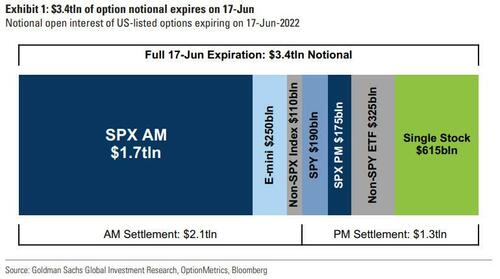

Adding to the chaos is the fact that tomorrow’s OpEx is a biggy: $3.4 trillion notional expiring (which as Goldman’s Rocky Fishman notes is more like a December size and the eradication oif large put positions has the possibly of sparking a major inflection point).

As SpotGamma noted, the very tricky part here is that, until puts are closed, they are going to drive a lot of volatility. As it appears the macro community wanted to sell today after digesting Powell, then these OPEX positions will excite that selling until they expire, and a tag of 3600 is easily in the cards. In that scenario SpotGamma would still be looking for a rally on Tuesday of next week.

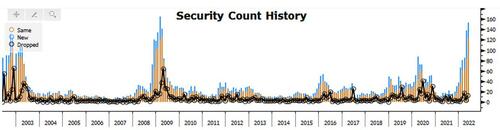

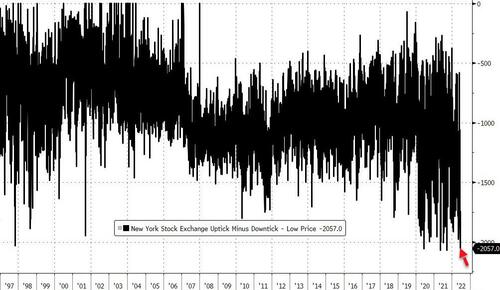

Today saw the 4th largest ‘sell program’ in history hit the stock markets early on…

Source: Bloomberg

US Treasuries ended the day lower in yield today with the short-end outperforming (2Y-8bps, 30Y -2bps), but all followed a similar pattern, dumped overnight then bid during the day…

Source: Bloomberg

30Y Yields almost tagged 3.50% today before reversing all the overnight rise and ending lower on the day (-19bps from the highs) and below the post-FOMC lows…

Source: Bloomberg

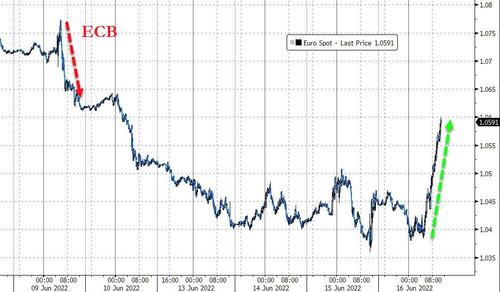

The Euro soared on comments by various ECB heads about their ‘anti-fragmentation’ tools…

Source: Bloomberg

…which did compress peripheral bond spreads somewhat…

Source: Bloomberg

This Euro strength sent the dollar down hard – its biggest daily drop since March 2020….

Source: Bloomberg

The Yen surged today after weeks of weakness…

Source: Bloomberg

Bitcoin erased yesterday afternoon’s gains, falling back below $22k again…

Source: Bloomberg

Gold extended yesterday’s gains, topping $1850…

Oil roundtripped to end the day around unchanged…

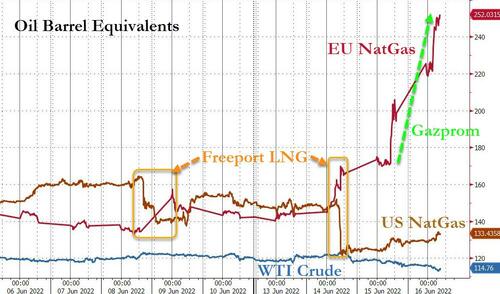

US NatGas rallied during the EU session (on the back of Gazprom supply cuts that sent EU NatGas soaring), but faded back to unchanged by the close. Between Freeport and Gazprom, the spread between EU and US NatGas has exploded wider…

Source: Bloomberg

Finally, America’s inflation and labor market situation has driven the ‘Misery’ Index (adjusted using CPI and LFPR) to its worst since Jimmy Carter was president…

Source: Bloomberg

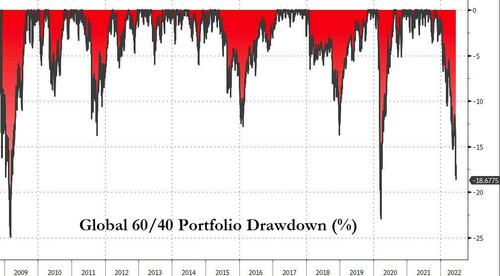

And, as if it’s any consolation, we note that the pain this year has been equally (almost) distributed as @Mike Zaccardi notes that Global 60/40 (stocks/bonds) are down almost 20% from their all-time-highs…

Source: Bloomberg

So much for diversification in a stagflationary environment.

Tyler Durden

Thu, 06/16/2022 – 16:01

Continue reading at ZeroHedge.com, Click Here.