Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Stocks, Bonds, & Bullion Rally After Powell’s Perjury-Prone Presser

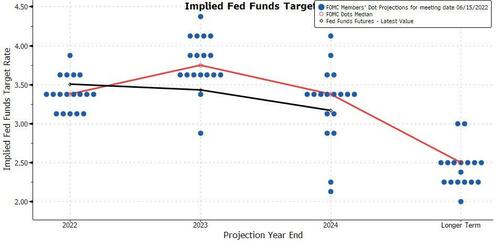

The Fed hiked rates by 75bps – the most since 1994 – and the dotplot signaled a much more aggressive Fed rate trajectory than at the last SEP release… but The Fed sees only marginal impacts of these aggressive “strongly committed” inflation-fighting rate-hikes on the unemployment rate.

Former NY Fed president Bill Dudley said “I think the Fed’s forecasts are still remarkably optimistic… This is a very ‘soft landing’ sort of forecast.”

Powell prevaricated all over the place during his presser to persuade listeners that the US economy the US economy “is in a strong position” and “well-positioned to deal with higher interest rates.”

He then shifted from prevarication to total perjury when – on the day that retail sales printed negative and the Atlanta Fed GDPNOW model forecast tumbled to 0.0% – he dared to utter the following words:

“There is no sign of a broader slowdown in the economy that I can see.”

There’s just one thing, the US economic data has done nothing but signal collapse for over a month now… (remember when he kept saying that inflation was “transitory’ too?)

Source: Bloomberg

If everything’s so awesome, why are major firms announcing mass layoffs? And cutting guidance?

Anyway, it’s unclear if the markets paid much attention to anything he said as it all sounded like noise as stocks rallied, bond yields tumbled, the dollar plunged, and gold ripped…

so @TruthGundlach and @BillAckman were right: if Powell had hiked 1000bps, we would be back at all time highs thanks to the depression

— zerohedge (@zerohedge) June 15, 2022

The Nasdaq rallied over 3.8% at its peak today and was the best performer while The Dow managed solid gains over 2% at its best but was the laggard. The last 15-30 minutes saw profit-atking on the post-fed kneejerk

Treasuries were aggressively bid with the short-end yields crashing almost 25bps (while the long-end only fell around 4-5bps)…

Source: Bloomberg

The yield curve steepened dramatically with 5s30s un-inverting for the first time since CPI…

Source: Bloomberg

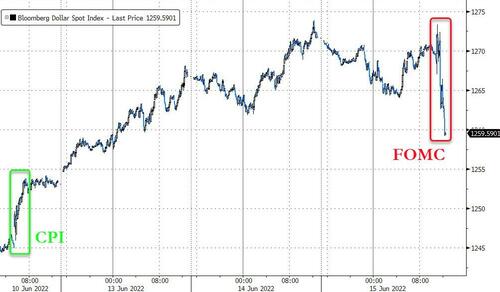

The dollar index puked on the statement…

Source: Bloomberg

Gold ripped after the FOMC statement…

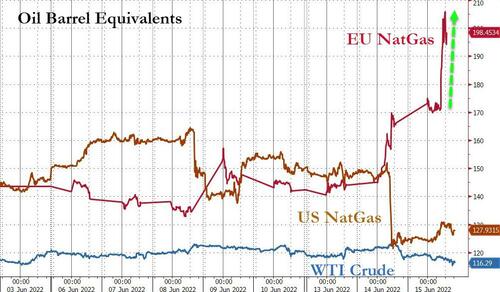

Oil prices extended losses today…

US NatGas prices were up modestly while EU NatGas prices soared on the back of further restrictions in gas flows into Europe from Gazprom…

Source: Bloomberg

Finally, why wouldn’t you be a buyer of stocks and bonds when the country is on the verge of the worst recessionary stagflation since the 70s…

Source: Bloomberg

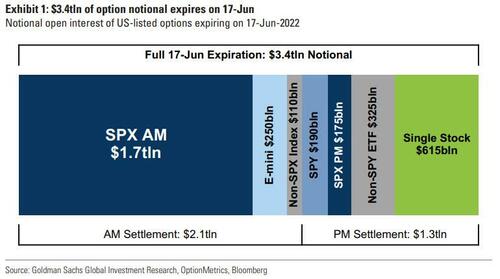

Bear in mind that the next two days have a massive $3.4 trillion of options expiring…

Do we think today’s 4% buying panic in Nasdaq is for feeding or fading?

Ultimately SpotGamma thinks this OPEX (plus the June 30th) removes a lot of put hedges, which we think opens the market to lower lows heading into July.

Over the past year, the S&P 500 Index moved higher after six out of eight Fed rate decisions… only to make new lows.

Tyler Durden

Wed, 06/15/2022 – 16:01

Continue reading at ZeroHedge.com, Click Here.