Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Bitcoin & Bond Yields Soar As Stocks Puke Post-Payrolls-Gains

For once US Macro data did not disappoint today… because there were none.

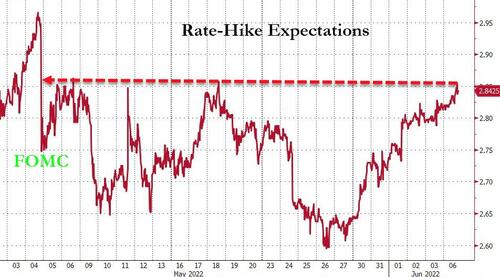

Rate-hike expectations continue to rise (hawkishly) to its highest level since the May FOMC meeting and press conference…

Source: Bloomberg

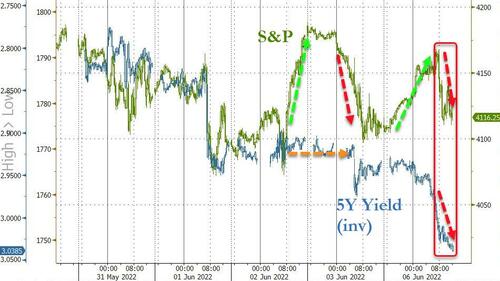

Stock surged overnight (driven by enthusiasm about easing COVID restrictions in China, plus an influx in activity after several exchanges around the globe were closed last week for public holidays), recovering all the post-payrolls losses from an ugly Friday and prompting more asset-gatherers and commission-rakers to say ‘the bottom is in’. However, realization that surging bond yields were more a technical factor (heavy IG calendar) than fundamental, stocks puked all the gains back into the European close. The standard bid appeared, but the machines just could not hold it…

Nasdaq ended today down 1.5% from pre-payrolls levels as the majors basically feel back to Friday’s lows. Small Caps are the best performers, managing to get back to even…

From Friday’s close, stocks were basically unchanged (after Nasdaq rose 2% at its peak) before a late-day panic-bid lifted them…

Some “traders” are still nailing these turns…

Nancy Pelosi’s trading is just uncanny. She literally nailed the exact NASDAQ bottom on May 24th buying those $AAPL and $MSFT calls. I mean… She’s 82yo, yet trades options better than a Citadel algo running on a dedicated $300m mainframe computer.

Bingo or Bridge, this is not. pic.twitter.com/CP9WdutUbb

— Wasteland Capital (@ecommerceshares) June 6, 2022

As a reminder, AAPL just ‘death-cross’ed…

Source: Bloomberg

TWTR shares tumbled early on after Musk’s 13D filing, but buyers stepped in and limited the losses…

Stocks and bonds both fell (in price), with stocks having plenty of room for catch down for now…

Source: Bloomberg

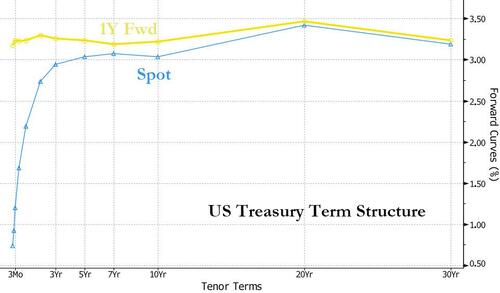

Treasuries puked today on the back of a major IG issuance calendar. All the major selling pressure hit from the US cash equity open to European close leaving yields up 10bps across the curve…

Source: Bloomberg

All spot maturities 5Y and greater are back above 3.00%… and we note that the market is implying a totally flat term structure around 3.25% in one year…

Source: Bloomberg

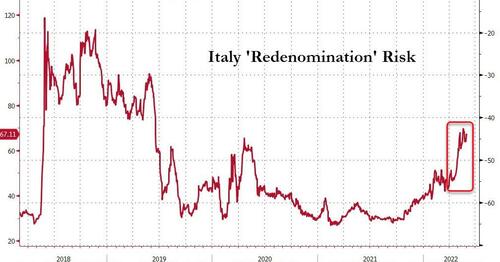

It is also worth noting that European yield spreads are blowing out – back to COVID lockdown crisis levels (yields are higher too but this is the spread to Bunds)…

Source: Bloomberg

Time for the ECB to start buying again STAT! Italian ‘redenomination’ risk is soaring again…

Source: Bloomberg

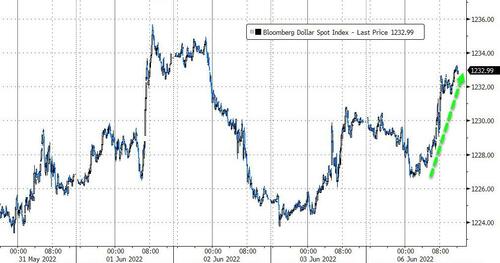

The dollar rebounded from earlier losses today…

Source: Bloomberg

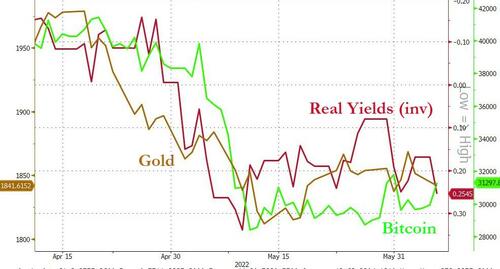

Bitcoin surged over the weekend, back above $31500, erasing last week’s puke…

Source: Bloomberg

And we note that Bitcoin’s recent outperformance relative to Ethereum has shifted that ratio back to significant support (for Ethereum)…

Source: Bloomberg

Gold slid lower on the dollar strength, back below $1850…

US NatGas surged over 9% today, back above $9 and at its highest close since Aug 2008…

US NatGas futures are now pricier than Day-Ahead European NatGas (“shared sacrifice”, right? “for democracy”?)

Source: Bloomberg

Finally, while it is noisy, we note that real yields are holding positive and it appears bitcoin and bullion are roughly tied to it…

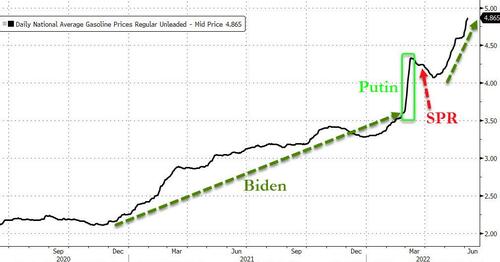

And of course, unless you are living under a rock, US pump prices just hit a new record high…

Source: Bloomberg

Get back to work Mr.Biden!

Tyler Durden

Mon, 06/06/2022 – 16:00

Continue reading at ZeroHedge.com, Click Here.