Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

‘Bad News Is Good News’ – Stocks Soar As Macro-Meltdown Accelerates

Plunging productivity – meh, buy it! Ugly ADP print – meh, buy it! Disappointing Factory Orders – meh, buy it! Hawkish FedSpeak – meh, buy it!

The market shrugged off hawkish comments from Lael Brainard (Fed Vice Chair), who dismissed the ‘September pause’ idea and Loretta Mester (Cleveland Fed), who suggested rates should get above neutral and warned that recession risk had risen. She also noted that Fed officials “all aligned” on the fact that inflation is way too high and that it’s the No. 1 problem in the economy.

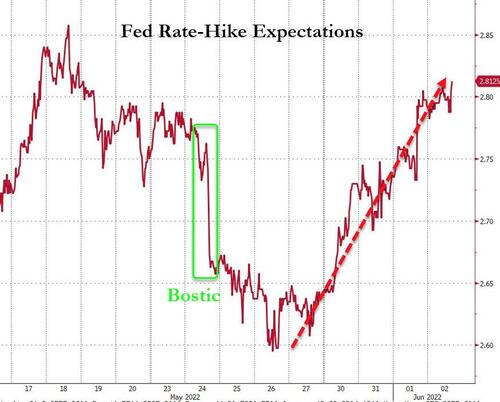

One market did react – short-term-interest-rates (STIRs) pushed hawkishly higher adding back a full 25bps rate-hike from the post-Bostic dovish lows…

Source: Bloomberg

But stocks, while at first stunned by Brainard’s bearishness, regained their feet and exploded higher.. because… well who the fuck knows – bad news is good news again. Nasdaq and Small Caps ended the day up around 2.5% with that late-day panic bid…

In the last few minutes everything ripped into the green for the week (reversing yesterday’s puke) with even The Dow catching up…

MSFT managed to get green after tumbling over 4% on a guidance cut…

Treasuries went nowhere despite the manic-panic in equities…

Source: Bloomberg

The long-end of the curve did underperform modestly today (2Y unch, 30Y +2bps) but on the week the long-end is notably outperforming the belly’s weakness…

Source: Bloomberg

The dollar puked back all of yesterday’s gains, tumbling back to unchanged on the week…

Source: Bloomberg

Bitcoin rallied back above $30,000 today after tumbling yesterday…

Source: Bloomberg

Oil prices rallied today despite all the hype about OPEC+ pumping more and Biden praising their actions. Not exactly what

As Goldman warned, net/net, the increase in OPEC+ production is too small to fix the oil’s market structural deficit.

Gold surged back up to $1875, last week’s highs…

Finally, presented with almost no comment at all, there’s this…

Source: Bloomberg

Yes, US Macro data is collapsing (absolutely and relative to expectations)… and stocks are celebrating!

Imagine how high stocks will soar if payrolls prints with a massive job-loss.

Tyler Durden

Thu, 06/02/2022 – 16:00

Continue reading at ZeroHedge.com, Click Here.