Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

May-Day Mayhem: Stocks Dump’n’Pump, Bonds Blowout, & Commodities Chaotic

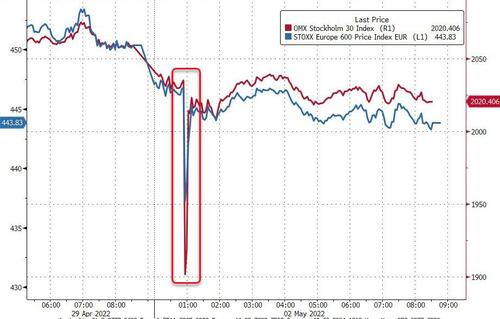

While the Brits danced around their May-Poles (Google it), removing more of what little liquidity there was in global markets, Europe’s stock market suddenly puked overnight following a flash-crash in Stockholm (which was reportedly sparked by some shitty math by a Citi index trader)…

Source: Bloomberg

US Futures also puked very briefly at that time but it wasn’t until the European close that the real carnage started to hit in US equities. But after the chaos calmed down ray of hope appeared (not in any headlines of course) which seemed to spark a buying panic in the last hour of the day…

The explosion higher was sponsored by a VIX crushing move…

The S&P found support around 4050…

Which for those who follow SpotGamma, should have been a great opportunity…

Our models show a distinct kink in the gamma curves near 4050, which implies support in that area.

If we were to test 4050 pre-FOMC, we’d anticipate a bounce purely due to “options positioning”. This comes not only from large put positions, but there is a material amount of call positioning, too. Further a visit to this area would likely correspond with another surge in IV, and we believe dealers are long tail risk. This means that they are getting a vega payout, alleviating them of some short delta obligations. In turn, they can offer more liquidity which supports markets (we’ll aim to post this concept today).

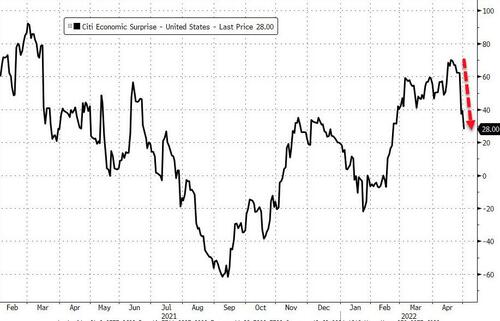

The big miss in ISM Manufacturing, on top of last week’s surprise negative GDP print has sent the US Macro Surprise Index plunging…

Source: Bloomberg

But bonds – for now – ain’t pricing for the imminent recession. TSY yields surged higher across the board today with the short-end outperforming. This will be the 6th straight week of Treasury losses if it holds through the chaos of The Fed.

Source: Bloomberg

10Y Yield tops 3.00% (3.0003% to be exact) for the first time since Dec 2018…

Source: Bloomberg

10Y Real yield goes positive for the first time since Mar 2020, spiking up to 0.16% intraday…

Source: Bloomberg

Bear in mind that the last time 10Y was here, Powell folded like a cheap suit and reversed his hawkish policy stance…

Source: Bloomberg

Earlier we noted that Japan has been dumping bonds with both hands and feet. We also note that the incentive for Japanese investors to pile-in at these levels is gone now, due to the surging cost of hedging the JPY…

Source: Bloomberg

Citadel’s Ken Griffin warned “we are in perhaps the highest uncertainty since the Great Financial Crisis,” adding that “we don’t know if inflation expectations have become unanchored.” He wasn’t finished as he warned the west is “facing existential problems” adding that the Biden administration is “deluging corporate American with regulation.”

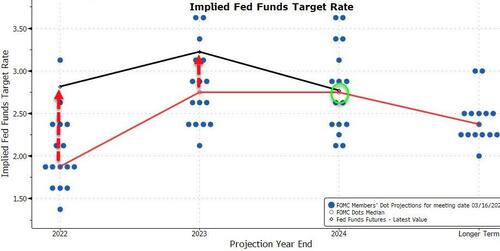

STIRs are fully-priced for a 50bps this week by The Fed and are pricing-in 25% odds of a 75bps hike in June (with July and Sept both priced for 50bps hikes each)… and 10 more (25bp) hikes overall by year-end

Source: Bloomberg

The market remains notably more hawkish than The Fed’s Median Dot Plot… for now…

Source: Bloomberg

Credit markets continued to crack with HY Spreads at their widest since the COVID crisis…

Source: Bloomberg

The dollar rebounded from Friday’s brief respite in its seemingly inexorable rise…

Source: Bloomberg

Bitcoin chopped around today, trading between $38k and $39k…

Source: Bloomberg

Gold was clubbed like a baby seal back below $1900 (now well below pre-Putin-invasion lows)…

US NatGas rallied 5% on the day…

Oil prices shot higher… after crashing overnight… to end unch…

Source: Bloomberg

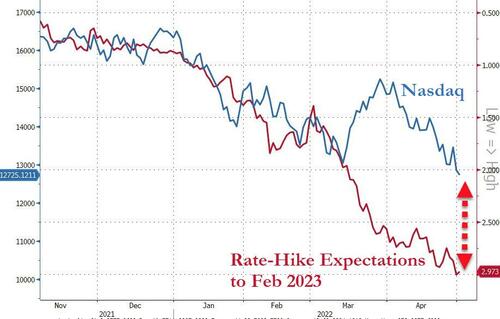

Finally, if the STIRs market is indeed leading The Fed down this tightening path, then stonks have more pain ahead before reality sets in…

Source: Bloomberg

The question is – are stocks front-running Powell’s flip-flop back to QE as the pain becomes intolerable and political pressure unshakable.

Tyler Durden

Mon, 05/02/2022 – 16:01

Continue reading at ZeroHedge.com, Click Here.