Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Amazon Crashes After Reporting Catastrophic Guidance, Worst Revenue Growth In Decade

With the bulk of the FAAMG stocks – which is now GAMMA following Facebook’s rebranding to Meta – having reported Q1 results (some great, like Facebook and MSFT, some terrible, like Facebook), investors were keenly looking to Amazon and Apple earnings after the close today, to round out the picture for the market generals and set the tone until next week’s FOMC meeting, and also to find whether today’s massive nasdaq short squeeze surge of 3% was justified.

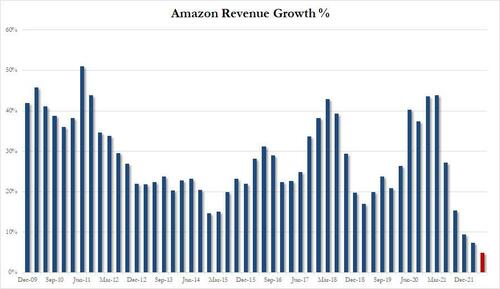

Focuing on Amazon, Investors want to see if growth from Amazon’s profitable cloud-computing and advertising businesses outshine slower growth from its e-commerce business, which is lapping the blockbuster gains it had during the pandemic. Investors are already expecting sales growth of about 7% in the first quarter to be Amazon’s slowest in 20 years. They mainly want to see if Amazon is managing higher labor and fuel costs in a manner that protects profits. The company hiked yearly Prime membership subscriptions by $20 and announced a new fuel and inflation surcharge on sellers to help shore up revenue.

Amazon impressed investors in January with a Prime price hike and a big earnings boost tied to its investment in electric vehicle maker Rivian Automotive. Unless it has some more surprises, investors will have to focus more on Amazon’s fundamentals.

And unfortunately, it is not looking good because moments ago Amazon report both historical data and projections which badly missed expectations.

-

Amazon 1Q Oper Income $3.7B, missing est. $5.42B

-

Amazon Sees 2Q Net Sales $116.0B to $121.0B, missing Est. $125.01B

Here are the Q1 details:

-

Net Sales $116.44B,+7.3% Y/Y, barely beating Est. $116.43B

-

Loss per share $7.56, beating the estimate EPS $8.40

-

Physical Stores Net Sales $4.59B, +17% Y/Y, beating Est. $4.3B

-

Online Stores Net Sales $51.13B, -3.3% Y/Y, missing Est. $51.5B

-

North America Net Sales $69.24B, +7.6% Y/Y, beating Est. $67.8B

-

International net sales $28.76 billion, -6.2% y/y, missing Est $29.78 billion

-

AWS Net Sales $18.44B, +37% Y/Y, beating Est. $18.25B

-

Subscription Services Net Sales $8.41B, +11% Y/Y, missing Est. $8.55B

-

Operating income $3.67 billion, -59% y/y, missing the estimate $5.42 billion

-

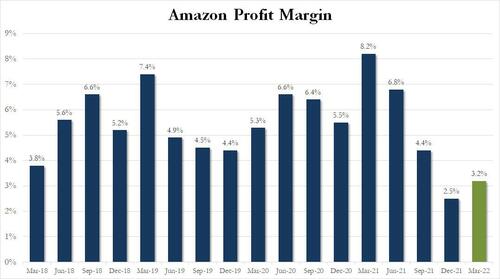

Oper Margin 3.2% vs 8.2% Y/Y, missing Est. 4.7%

-

Fulfillment expense $20.27 billion, +23% y/y, estimate $19.3 billion

-

Seller unit mix 55% vs. 55% y/y, estimate 56.1%

Addressing some of the topline weakness, Bloomberg Intelligence senior analyst Poonam Goyal said “The margin being weak in the online business — you could say that’s surprising but it’s really not. For the online business the supply chain problem isn’t going away any time soon.”

While operating margins rebounded modestly, from 2.5% in Q4, to 3.2%, it was well below the 4.7% expected.

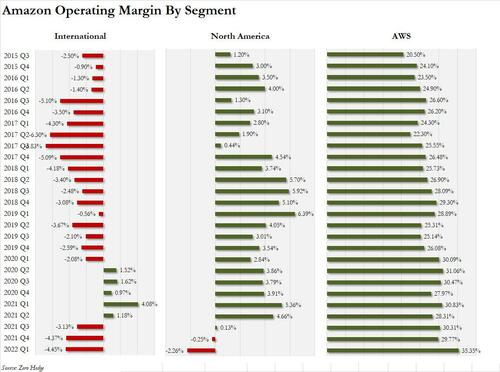

Things could have been significantly worse were it not for sales at its cloud-computing service increasing 37%, roughly in-line with what analysts expected. Amazon Web Services (AWS) continued to stand out as a profit machine even as competition from Microsoft, Google, and others with revenues rising to $18.44 billion (from $13.5 billion a year ago, against expectations of $18.34 billion. Additionally, the segment’s operating income increased to $6.52 billion from $4.16 billion.

However, it’s not all ponies and unicorn farts for AWS as revenue growth slowed from 39.5% in the fourth quarter.

What is remarkable here is that while AWS profit margin actually rose to the highest on record at 35.35% (from 29.8% in Q4), it barely offset the loss at both North American and International divisions, both of which generated more than $1 billion in operating losses in the quarter!.

And while historical data was mixed at best, just barely beating on sales if showing some weakness in online store and international sales, as well as missing on operating margin, what the market is focused on is the company’s dismal guidance, whose upper end of $121BN missed the Wall Street median estimates of $125BN, while also projecting an operating loss as bad as $1 billion (up to a $3 billion gain).

-

Sees net sales $116.0 billion to $121.0 billion, estimate $125.01 billion (Bloomberg Consensus)

-

Sees operating loss $1.0 billion to profit $3.0 billion, estimate profit $6.8 billion

One unpleasant highlight here: reported revenue growth of 7.3% in the first quarter, its slowest growth in about two decades. Worse, the company’s guidance to a median $118.5BN in the next quarter would be growth of just 4.8%, even lower!

Some more guidance details:

-

Amazon Guidance Assumes Prime Day Occurs in 3Q 2022

-

Amazon: Working Through Inflationary, Supply Chain Pressures

-

Amazon Delivery Speeds Approaching Pre-Pandemic Levels

-

Amazon ‘No Longer Chasing Physical or Staffing Capacity’

It wasn’t just revenues that were concerning: as Bloomberg notes, one red flag about Amazon’s financial condition: Worldwide shipping costs jumped 14% to $19.6 billion. Meanwhile, revenue from online store sales dropped 3% and revenue from third-party sellers services increased 9%.

Indeed, inflation is exposing the dangers of Amazon’s low-margin e-commerce model that has conditioned customers to expect low prices and quick delivery.

Another potential challenge on the expense side: retention of workers — whose compensation is largely tied to Amazon’s stock price — if investors sour on the stock. Keeping customers happy with a money-losing business is a dangerous proposition if it compromises employee compensation. Amazon will have to convince investors the money-losing quarters will only be temporary and it will be able to make its network more efficient to cut expenses.

Commenting on the quarter, Amazon CEO Andy Jassy said the company is focused on improving efficiencies in its warehouse and delivery network that it rapidly expanded during the pandemic, but it will take some time. To be sure, Wall Street definitely got blind-sided by the quarterly loss and projected loss in the current quarter. Inflation is taking a toll on Amazon.

Unfortunately, Amazon doesn’t have many tricks up its sleeve. It already raised Prime subscription prices and tacked an inflation and fuel surcharge on its online merchants. All of that is baked into Amazon’s earnings outlook and it’s still projecting a loss in the current quarter. CEO Andy Jassy is proving himself to be a Jeff Bezos disciple: He’d rather stick it to investors than to customers.

So it Amazon going to spoil the tech party again? Well, we have to wait for AAPL for the final verdict, but as of this moment, AMZN is down some 10%, trading around $2,600 after closing at $2,900 the regular session after surging some 4.6%.

Tyler Durden

Thu, 04/28/2022 – 16:19

Continue reading at ZeroHedge.com, Click Here.

_0.png?itok=6Z2QdkYj)