Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Facebook Soars After Reporting Solid User Growth Despite Revenue Miss And Weak Guidance

Heading into today’s earnings from social media giant Facebook Meta (technically, the second quarter since the company changed its name), markets are on edge after the recent dismal results from Netflix and yesterday’ Google fiasco, which prompted some to ask if the advertising business is hitting a speed bump, one which would have clearly negative consequences for Meta, which has achieved the impossible and is equally hated by both the right and the left. That said, at the end of the day, it’s going to come down to one thing: the company’s MAU/DAU growth, or lack thereof. Everything else is mostly noise.

To be sure, after last quarter’s epic devastation which saw the stock crater 20% in its biggest post-earnings drop on record, it appears that many investors were already preparing for the worst with Meta shares were down as much as 6.6% on Wednesday, with the Facebook parent dropping to its lowest level since April 2020 ahead of results. The day’s weakness came after a stray Bloomberg headline erroneously reported a much lower guidance for Facebook than expected. Meta shares are down nearly 50% thus far this year, making them the fourth-worst performing component of the Nasdaq 100 Index.

And while investors will be listening closely to how the company details its business environment, many would also love to know what Zuckerberg thinks of the Elon Musk-Twitter deal, especially since there is no love lost between Zuckerberg and Musk, or Jack Dorsey.

So with that in mind, here is what Facebook just reported for Q1, and why the stock is soaring after hours:

Revenues and earnings:

- EPS $2.72, beating estimate $2.56

- Revenue $27.91 billion, beating estimate $28.24 billion (Bloomberg Consensus)

- Advertising rev. $27.00 billion, missing estimate $27.48 billion

- Family of Apps revenue $27.21 billion, missing estimate $27.52 billion

- Reality Labs revenue $695 million, beating estimate $677.1 million

- Other revenue $215 million, beating estimate $189.3 million

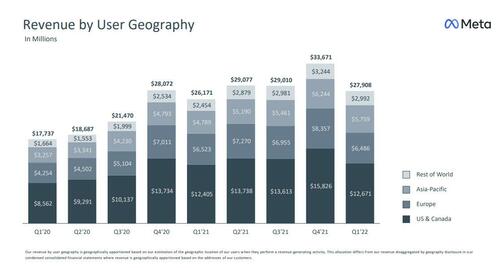

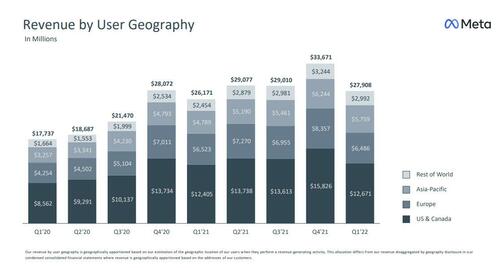

A red flag here: yes, revenue grew 7% YY, but that was the slowest pace of growth since the company went public in 2012. Meanwhile, US revenue barely grew in Q1 at $12.671BN, up from $12.405 BN.

Why the revenue weakness? Well, the ad sales environment – as Google indicated yesterday – is getting more difficult: there’s the war in Ukraine, the Apple privacy changes that make it more difficult to target ads effectively, the supply-chain issues affecting advertisers, and inflation.

Operating income

- Family of Apps operating income $11.48 billion

- Reality Labs operating loss $2.96 billion

- Operating margin 31%, estimate 29.8%

Users data:

- Daily Active Users 1.96BN, beating Est. of 1.94BN, up 4% Y/Y

- Monthly Active Users 2.94BN, missing Est. 2.95BN, up 3% Y/Y

One reason why the stock may be soaring after hours is after shrinking last quarter, US DAUs once again grew, from 195MM to 196MM.

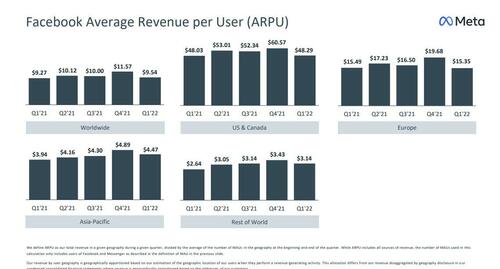

ARPUs were up in the US and worldwide, but dipped modestly in Europe.

User metrics:

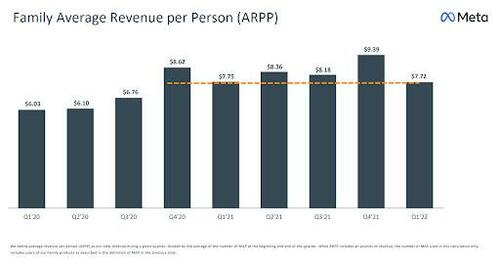

- Average Family service users per day 2.87 billion, estimate 2.87 billion

- Average Family service users per month 3.64 billion, estimate 3.63 billion

Some more data:

- Capital expenditures – Capital expenditures, including principal payments on finance leases, were $5.55 billion for the first quarter of 2022.

- Share repurchases – $9.39 billion Class A common stock shares repurchased. As of March 31, 2022, FB had $29.41 billion available and authorized for repurchases.

- Cash and cash equivalents and marketable securities – $43.89 billion as of March 31, 2022.

- Headcount – Headcount was 77,805 as of March 31, 2022, an increase of 28% year-over-year.

Last but not least, the company guidance. Here there was also some weakness, with the top end of the range missing consensus estimate sif coming higher than the earlier “leak” today.

- Meta Platforms Sees 2Q Rev. $28B to $30B, Est. $30.74B

- The s outlook reflects “softness in the back half of the first quarter that coincided with the war in Ukraine”

Some more details from the release:

- We expect second quarter 2022 total revenue to be in the range of $28-30 billion. This outlook reflects a continuation of the trends impacting revenue growth in the first quarter, including softness in the back half of the first quarter that coincided with the war in Ukraine. Our guidance assumes foreign currency will be approximately a 3% headwind to year-over-year growth in the second quarter, based on current exchange rates.

- In addition, as noted on previous calls, we continue to monitor developments regarding the viability of transatlantic data transfers and their potential impact on our European operations, and we are pleased with the progress on a political agreement.

- We expect 2022 total expenses to be in the range of $87-92 billion, lowered from our prior outlook of $90-95 billion. We expect 2022 expense growth to be driven primarily by the Family of Apps segment, followed by Reality Labs.

- We expect 2022 capital expenditures, including principal payments on finance leases, to be in the range of $29-34 billion, unchanged from our prior estimate.

- Absent any changes to U.S. tax law, we expect our full-year 2022 tax rate to be above the first quarter rate and in the high teens.

While perhaps displeased by the weakness in revenues, investors will be pleased that Meta reduced its expense guidance. As Bloomberg notes, there was a lot of skepticism that Zuckerberg would be able to fund his grand visions for the metaverse on a dying social network. But it’s not dying, apparently, and it’s not as expensive.

Commenting on the quarter, Mark Zuckerberg said that “we made progress this quarter across a number of key company priorities and we remain confident in the long-term opportunities and growth that our product roadmap will unlock,” he said. “More people use our services today than ever before, and I’m proud of how our products are serving people around the world.”

And unlike last quarter, when FB cratered by the most on record after an earnings release, this time investors have exhaled a collective sigh of relief and sent FB stock surging more than 10%.

According to Bloomberg, if this share-price jump of 12% holds through Thursday’s close, it would be the biggest post-earnings advance for Meta since the company reported results for the fourth quarter of 2015. That said, coming into today’s report Meta shares ended Wednesday’s session at the lowest level since April 2020. The stock has shed more than 6% in the past two days and is down 48% this year through the close.

Facebook’ Q1 earnings slide is below (pdf link)

Tyler Durden

Wed, 04/27/2022 – 16:32

Continue reading at ZeroHedge.com, Click Here.