Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Alphabet Plummets 7% After Missing On Earnings, YouTube Revenues, Despite New $70BN Stock Buyback

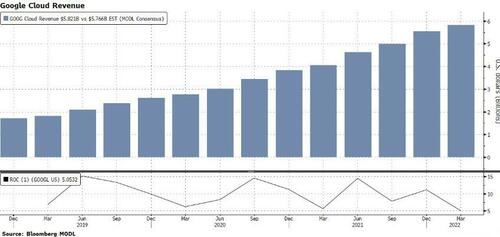

Heading into today’s post-market earnings juggernaut, which includes GOOGL, MSFT, V, GM, TXN and others, the two companies investors were most focused on were Microsoft and Google, pardon Alphabet, the second and third largest US companies by market cap, and which had been monkeyhammered heading into today’s close amid fears of another catastrophic report. As in prior quarters, investors will be laser focused on progress in Alphabet’s Google Cloud segment. The internet company’s cloud-computing unit is the No. 3 player in the U.S., behind Amazon Web Services and Microsoft’s Azure. Investors will also want to know how YouTube is performing.

But the far bigger question is whether Alphabet would continue the trend of earnings misses set last week with Netflix and ahead of the coming earnings from Amazon, Microsoft and Facebook.

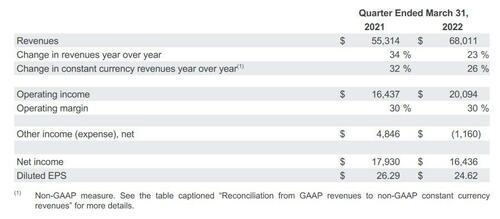

The answer, at least judging by the stock’s kneejerk reaction which is sharply lower, was a solid no. Here are the results:

- EPS $24.62 vs. $26.29 y/y, missing estimates of $25.71

- Revenue $68.01 billion, +23% y/y, beating the estimate of $67.98 billion

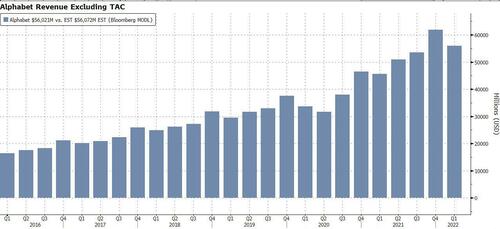

- Revenue ex-TAC $56.02 billion, +23% y/y, missing the estimate of $56.077 billion

- Google advertising revenue $54.66 billion, +22% Y/Y, beating estimates of $54.13 billion

- Google other revenue $6.81 billion, +4.9% Y/Y, missing estimates of $7.28 billion

- Google Services revenue $61.47 billion, +20% Y/Y, missing estimates of $62.58 billion

- Google Cloud revenue $5.82 billion, +44% Y/Y, beating estimates of $5.77 billion

- Other Bets revenue $440 million, beating estimates of $203.9 million

- Operating income $20.09 billion, +22% y/y, beating estimates of $19.7 billion

- Google Services operating income $22.92 billion, +17% y/y, beating estimates of $22.15 billion

- Google Cloud operating loss $931 million, -4.4% y/y, missing the estimate loss $893.2 million

- Other Bets operating loss $1.16 billion, +0.9% y/y

- Operating margin 30% vs. 30% y/y, estimate 28.8%

- Capital expenditure $9.79 billion, estimate $7.28 billion

- Number of employees 163,906, +17% y/y, estimate 161,312

The company also announced plans to buy back up to an additional $70.0BN Class A & Class C Shares.

Summarized:

Visually, revenue dipped vs Q4 but that is of course seasonal with most ad spending taking place in the previous quarter.

The good news is that despite the EPS miss, cloud revenue continued to rise, and was up 43% Y/Y to a record $5.82 billion, above the $5.77 billion analysts were expecting. Despite the revenue beat, Google cloud continues to mount losses: the unit lost $931 million during the quarter, only a slight improvement from last year

That was the good news: the bad news is that YouTube ad revenue was $6.9 billion, up 14% versus last year but missed the $7.4 billion Wall Street was expecting. According to Bloomberg, YouTube’s big drop compared to expectations may have come from the limits on iPhone ad-targeting as well as new competition from TikTok.

Commenting on the quarter, CEO Sundar Picahi said that “Q1 saw strong growth in Search and Cloud, in particular, which are both helping people and businesses as the digital transformation continues. We’ll keep investing in great products and services, and creating opportunities for partners and local communities around the world.”

CFO Ruth Porat said that “we are pleased with Q1 revenue growth of 23% year over year. We continue to make considered investments in Capex, R&D and talent to support long-term value creation for all stakeholders.”

Alas, don’t expect her to give any official guidance, which is why analysts will be keen to hear color on what she expects the current quarters to bring.

In a mirror image of last quarter, when the stock shot up 7%, today GOOGLE is tumbling 7% with traders disappointed by the miss in EPS and YouTube, and not even the $70BN buyback can help offset the bitter taste that this may be as good as it gets this cycle for the tech giant (as a reminder, last quarter Google annlunce a 20-for-1 stock split – that marked the top).

Tyler Durden

Tue, 04/26/2022 – 16:28

Continue reading at ZeroHedge.com, Click Here.