Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

How Decentralized Is Your Stablecoin?

Authored by Omid Malekan via Medium.com,

My thinking on stablecoins has evolved greatly since I started writing about them four years ago.

There are things I’ve gotten right (their emergence as a killer app for blockchain), things I’ve gotten wrong (the viability of Dai), things I was early on (adoption for vanilla payments) and things I remain conflicted on, like the viability of the undercollateralized AKA algorithmic variety.

Algorithmic stablecoins have always seemed like a fantasy to me, a design pushed by techies who don’t understand value. My conservatism was supported by events like the failure of Basis to launch (despite a massive ICO) and the collapse of similar projects that did launch.

My skepticism starts with their reliance on circular logic alone. Every currency requires a certain amount of faith to succeed, but few are born of faith alone. To escape the gravitational pull of oblivion, new types of money usually anchor themselves to an independent source of value at the outset. The U.S. dollar was originally tied to a Spanish currency that was then the global standard, and Bitcoin initially derived value from being the means by which a decentralized payment network was secured.

The first generation of algorithmic stablecoins tried to escape any independent tethering by using a two token model. One token was the stablecoin and the other the reserve asset against which it was minted and burned. The design was supposedly inspired by how central banks manage fiat currencies, as was argued in the Basis whitepaper:

“Basis implements price stability using the same economic principles relied upon by central banks around the world.”

That comparison was invalid for two reasons. Unlike an algorithmic stablecoin, people don’t adopt a fiat currency just because a central bank manages it. They adopt it because they have to, thanks to legal tender laws and other constraints. This initial (yet permanent) source of demand eliminates the tail risk of total collapse.

More importantly, the reserve assets that central banks use to manage their currencies are independent stores of value that happen to be useful for managing money. Unlike the reserve token of an algo stablecoin, assets like gold, foreign currencies and government debt have independent utility.

The first few generations of algorithmic stablecoins failed because they did little to generate demand and used a reserve asset of no utility beyond managing a stablecoin. Their design was particularly risky because unlike other crypto assets, stablecoins can’t appreciate in value. They can only fall, so their users are quick to abandon ship at the first sign of trouble.

Then came the Terra blockchain and its dollar stablecoin, UST. Although bunched into the Algo bucket, UST’s design was different. The team behind it actually cared about demand and stated so in their white paper:

While many see the benefits of a price-stable cryptocurrency that combines the best of both fiat and Bitcoin, not many have a clear plan for the adoption of such a currency. Since the value of a currency as a medium of exchange is mainly driven by its network effects, a successful new digital currency needs to maximize adoption in order to become useful.

What’s more, they backed their stablecoin with a different kind of reserve asset, one that had independent utility. Unlike the “seigniorage shares” tokens of projects like Basis, Luna is the native token of a proof of stake blockchain, and such tokens have succeeded in being valuable elsewhere, in contexts that have nothing to do with a stablecoin. Being independently valuable makes Luna a superior reserve asset. It also makes UST closer in design to crypto-collateralized stablecoins like Dai than purely algorithmic ones like Basis.

But unlike Dai, UST is not over-collateralized. That makes it more capital efficient — $100 worth of Luna can get you 100 UST — but also more vulnerable to a sudden plunge in the price of Luna. There are several solutions to this problem.

The first is to make sure that UST is always in demand. The greater the demand for any currency, the less important the reserve assets that back it. Enter the Anchor protocol and its generous (and heavily subsidized) yield to savers who deposit UST. This clever demand lever has been effective at increasing demand for UST but has its own risks. It leads to reflexive leverage — you can borrow at a lower rate then redeposit back into Anchor — and that introduces sysemtic risk. What if Anchor gets hacked in the way other DeFi protocols have? It’s also not sustainable.

Another solution to the collateral issue is to diversify away from Luna as the only reserve asset. Enter the Luna Foundation Guard and its purchases of bitcoins. Not only has swapping out some of the reserve for a different (and more established) coin increased the perceived stability of UST, it has also imported the support of Bitcoin maximalists who’ve been dreaming of a Bitcoin standard for years.

Both of these solutions reveal sophistication on the part of Do Kwon and the rest of the Terra team. They’ve helped UST escape the dangerous adolescent years of any non-overcollateralized stablecoin and set it up for further adoption. But they have also introduced new risks.

Part of the appeal of algorithmic stablecoins is their promise of greater decentralization. Fiat-backed coins like USDC are censorable at the reserve level, and Dai is partially backed by off-chain assets. UST is advertised as a decentralized alternative because users can always swap it in a censorship-resistant way. Indeed, the other clever part of Terra’s design was the way in which Luna could be swapped for UST (and vice versa) at the protocol layer, eliminating smart contract risk and making conversion trustless. The introduction of non-native assets goes back on this promise.

The Bitcoin reserve is managed by the foundation, not the protocol. The Terra team has been suspiciously quiet about how these coins are controlled, but it looks like there is a multisig address managed by the board of the foundation. There is a governance proposal to hand control over to the validators, but that would introduce bridge risk.

Blockchain bridges are inherently risky, as proven by a series of major hacks in the past six months. The Terra ecosystem relies heavily on bridges. About a quarter of the collateral held by Anchor is bridged ETH, and at least half a billion dollars worth of the Luna that is meant to back UST has been bridged to other chains.

The Luna community’s tendency to discount these risks is disappointing. If you actually believe in decentralization, then you should be concerned about the fact that UST backing grows either more trusted or more risky with every additional BTC purchase. Other popular stablecoins have their own trust assumptions, but UST claims to be different.

It’s still early, and Do Kwon and the rest of the Terra team — assuming there is one, it’s hard to tell given the cult of personality — have done an admirable job of executing so far. I disagree with those who still believe UST is vulnerable to a sudden death spiral, as it is now backed by both a major coin in terms of market cap and powerful off-chain interests who will step in to defend it. The critics who think a death spiral is likely tend to focus on the rapidly depleting yield subsidy in Anchor. What they don’t understand is that Terraform Labs has an unlimited budget.

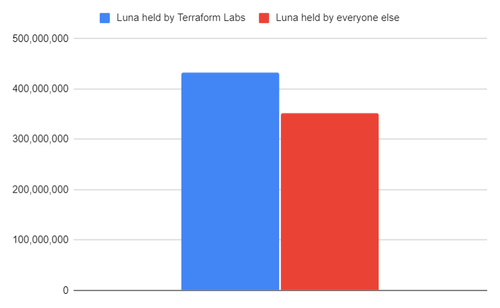

Or at least, a $35 billion dollar one. That’s the market cap of the non-circulating Luna tokens sitting in the lab’s blockchain address. To put that number in context, it’s bigger than the circulating supply. That’s how they can keep funding the Luna Foundation Guard, subsidizing Anchor, taking over Curve pools and taking other kinds of “whatever it takes” actions to protect their stablecoin.

The crypto domain is full of ironies, and this may be the biggest: the (supposedly) most decentralized stablecoin exists on the demonstrably most centralized L1. Terraform Labs is a corporation with Do Kwon as its CEO. That means a single individual effectively controls a majority of the premined tokens. I can’t think of a single other Layer-1 blockchain where one person enjoys a financial majority. Since Terra is a delegated Proof of Stake blockchain, then Do has de facto control over governance as well. To make matters worse, Do is also the director of the Luna Foundation Guard, which explains tweets like this:

or this

His use of “I” and “We” here is not rhetorical flourish, it’s reality. So when you read stories of how Terraform Labs “gifted” Luna to the Foundation, it’s just self dealing between one Do-controlled entity and another.

Is this not the definition of centralized power? I’ll go out on a limb and say Do Kwon has as much power over the Terra ecosystem as Mark Zuckerberg has over Meta. Both control a majority of the voting asset and run the legal entity making executive decisions. Both move fast and break (or fix) things. Remember the community governance proposal and subsequent vote on whether UST should have a Bitcoin reserve and how that reserve should be managed? Neither do I.

This is not how decentralization is supposed to work. Do might be the smartest guy in crypto, and he clearly means well, but a benevolent dictator is still a dictator. At best he represents a ton of key man risk, and at worst he can impose his will on the community. No wonder that Justin Sun is now following in Do’s footsteps in issuing an Algo stablecoin.

All that power diminishes the risk of a death spiral, but it also means all claims of decentralization for UST ring hollow. Adding insult to injury is the fact that Terraform Labs seems to also control a substantial portion of Anchor’s ANC governance token. Maybe there’s a roadmap for decentralization that I’m not aware of, but that’s besides the point.

The ultimate takeaway here is that building decentralized money that is not free-floating (a la Bitcoin) is hard, perhaps impossibly so. Every stablecoin has its tradeoffs. Some are censorable, some are capital intensive, and others are decentralization theater.

Tyler Durden

Sun, 04/24/2022 – 15:30

Continue reading at ZeroHedge.com, Click Here.