Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Stocks & Bonds Bloodbath As Fed Drops Hawkish Hammer

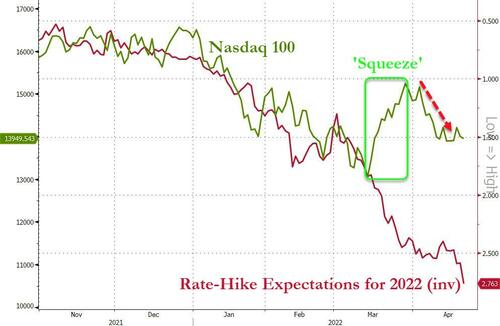

The short-term interest-rate (STIR) market is now pricing in 10 more rate-hikes this year, after St.Louis Fed’s Jim Bullard, SF Fed’s Mary Daly and even Fed Chair Jay Powell dropped the hawkish hammer of evil on silver-lining-seeking equity market investors (seeing multiple 50bps hikes ahead)…

Source: Bloomberg

The market is now fully pricing in a 50bps hike in both the May and the June FOMC meeting (and pricing in a 75% chance of a 50bps hike in July too and a 50% chance of a 50bps hike in September!).

Powell told the audience at an IMF debate that “the US labor market is too hot… unsustainably hot.”

Powell to speak pic.twitter.com/PKB5fvdjsz

— zerohedge (@zerohedge) April 21, 2022

Will The Fed begin sending out a daily questionnaire after every market dump it creates:

“Are you going to finally stop buying food and gas, and hoping to ever buy a house? If no, tomorrow we crash stonks some more!”

“Don’t fight The Fed”, they said…

The equity market is ‘starting’ to realize this reality as The Fed Put morphs into a Short Call where any improvement in stocks – and easing of financial conditions – is met with a heavier hand from the interveners in order to maintain the market’s faith that they are serious about controlling inflation expectations…

Source: Bloomberg

After the ubiquitous opening panic-bid, US equity markets puked and never looked back with Small Caps and Nasdaq leading the plunge. The Nasdaq fell from being up 2% just after the open to down over 2% by the close…

Or put another way – everything was awesome until…

This move sent all the US majors below key technical levels – S&P failed at 200DMA and broke below 50DMA, Dow broke back below its 200DMA and is testing its 100DMA, Nasdaq failed at its 50DMA and is making new lows, and Small Caps failed to hold above its 50DMA…

FANG+ stocks have erased all of the late-March meltup back to their lowest since Nov 2020…

Source: Bloomberg

There was something very odd today – Energy stocks were monkeyhammered lower (despite oil pries holding up fine)…

Source: Bloomberg

We love the smell of fund liquidation in morning?

Source: Bloomberg

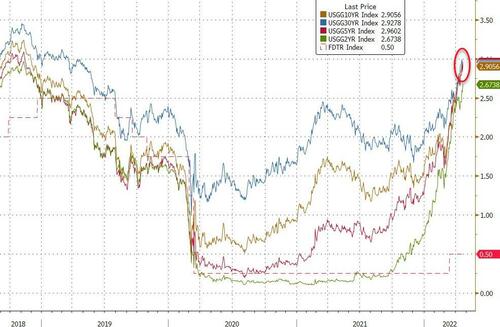

Thanks to Bullard’s comments that “the bond market now is not looking like a safe place to be,” bond yields exploded higher again, led by the short-end (2Y +9bps, 30Y +5bps). A late-day rally – as stocks were really puking, put some lipstick on an otherwise pig-like day. On the week, the long-end is best for now (around unch) while the short-end has been clubbed like a baby seal…

Source: Bloomberg

Lifting yields to multi-year highs…

Source: Bloomberg

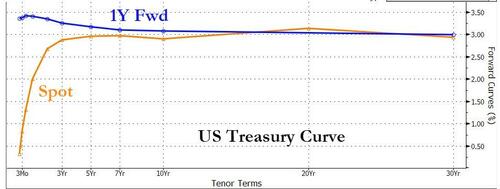

…and dramatically flattening the yield curve, sending 3s10s back near inversion…

Source: Bloomberg

For a sense of what is happening to the Treasury curve – look how flat the spot curve is from 3Y out.. and the yield curve is fully inverted from 6 month out in 1Y…

Source: Bloomberg

10Y US Breakevens surged above 3% to a new record high…

Source: Bloomberg

And amid all this, HY bonds are bloodbathing…

Source: Bloomberg

The dollar bounced back higher today after testing last Thursday’s (pre-Easter) close…

Source: Bloomberg

Bitcoin surged up to $43k today before fading back below $42k…

Source: Bloomberg

Will Ethereum catch up to its forward inflation proxy?

Source: Bloomberg

Oil prices rallied today, refusing to drop in the face of Biden SPR release plan…

Gold was steady today around $1950…

Finally, how much longer can equity ‘risk’ remain under control while bond ‘risk’ is soaring?

Source: Bloomberg

Or put another way – when will the equity market stop fighting The Fed?

Oh and by the way, Fuck TINA, the alternative is now bonds.

Source: Bloomberg

Stocks haven’t been this ‘expensive’ relative to bonds since April 2011… the last time that happened, bond yields plunged 200bps and stocks puked within 3 months.

Tyler Durden

Thu, 04/21/2022 – 16:01

Continue reading at ZeroHedge.com, Click Here.