Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Bitcoin & Big-Tech Bounce As Bullard Banter Batters Bonds, Bullion, & Black Gold

Follow The World and The IMF slashing global growth outlooks, threats of 75bps-hikes from St.Louis Fed President Jim Bullard spooked some markets today while others gave zero shits and were panic-bid.

“First of all, that one was successful, and did set up the U.S. economy for a stellar second half of the 1990s, one of the best periods in U.S. macroeconomic history,” Bullard said during an April 18 virtual event by the Council on Foreign Relations (CFR).

“And in that cycle, there was a 75 basis point increase at one point. So, I wouldn’t rule it out.”

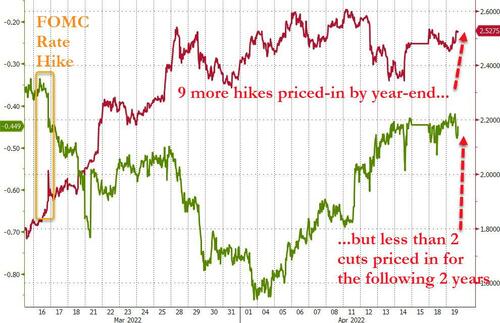

STIRs are already pricing in 9 more hikes this year (basically 50bps each in May, June, and July then 25bps in Sept, Nov, and Dec), but we do note that the number of subsequent rate-cuts is falling notably…

Source: Bloomberg

And all of that sent yields higher, most specifically, 10Y Real Yields are surging ever closer to being positive for the first time since March 2020…

Source: Bloomberg

But stocks shrugged off the uber-hawkish-ness and the uber-staglation-ness and surged from the cash-open with Small Caps and Nasdaq up 2%…

Erasing all of the losses from before Thursday’s plunge…

The S&P is back above the 50DMA, Dow above its 100DMA, and Russell 2000 at its 50DMA…

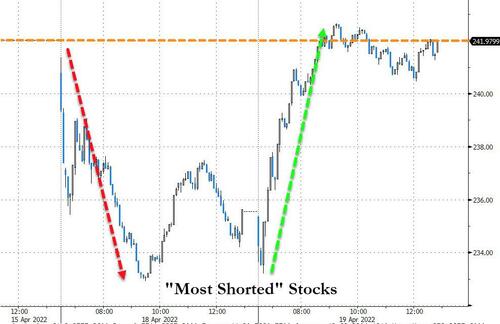

As Shorts were squeezed back to unch on the week…

Source: Bloomberg

As stocks rallied, bonds were clubbed like a baby seal (despite growth being slashed), especially at the shorter-end (2Y +15bps, 30Y +6bps)…

Source: Bloomberg

But as bonds puked the yield curve flattened dramatically (NOTE that 2s30s reversed almost perfectly at the levels of the last FOMC meeting…

Source: Bloomberg

The dollar continued to rise to its highest close since June 2020…

Source: Bloomberg

Bitcoin extended its gains, topping $41,000 today…

Source: Bloomberg

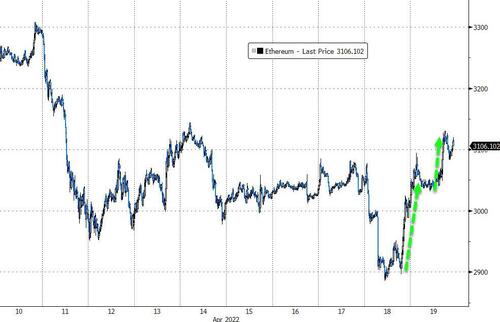

Ethereum topped $3100…

Source: Bloomberg

Oil prices were slammed lower today after The IMF slashed its growth outlook…

As Nomura’s Charlie McElligott noted, there have only been 29 days when the intraday low-to-high has been more than $8 – 2008: 7 times, 2011: 3, 2020: 2, 2021: 1… but so far in 2022: 16 times.

After tagging $2000, Gold futures have plunged lower, tumbling 2% today…

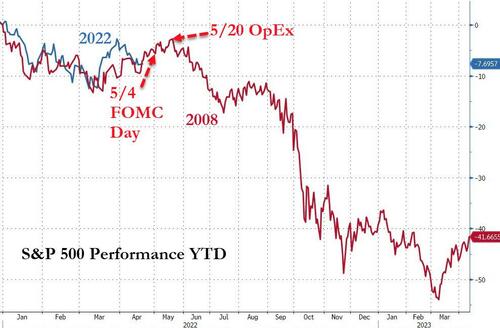

Finally, are we set for a bear-market bounce again here into the next FOMC meeting and to May’s OpEx, before the pain begins again?

Source: Bloomberg

Do dip-buying equity investors really expect record highs amid a series of 50bps rate-hikes?

Tyler Durden

Tue, 04/19/2022 – 16:00

Continue reading at ZeroHedge.com, Click Here.