Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

In His Last Comment As Fed Vice Chair, Clarida Echoes Brainard, Says Rate Hikes Coming

In his last speech as Fed Vice Chairman Richard Clarida, who departs the Fed on Friday, two weeks before his term was scheduled to end after revelations of controversial personal trading activity, wrote that the central bank’s plans to raise interest rates in 2022 is justified within its new policy framework.

In the paper released by the Fed, Clarida wrote that a measure of inflation that smooths out base effects from a sharp decline then rise in prices during the pandemic is running at 3% in the months from February 2020 through October 2021 — a level “well above what I would consider to be a moderate overshoot of our 2% longer-run goal for inflation.”

He also said he thinks the economy will achieve full employment if the jobless rate, currently 3.9%, drops to 3.5 percent by the end of 2022.

“Commencing policy normalization in 2022 would, under these conditions, be entirely consistent with our new flexible average inflation targeting framework” he wrote adding that he continues to believe the underlying rate of inflation was hovering close to 2%, and that once price adjustments related to demand shifts and supply bottlenecks ease, the current inflation bout will prove “largely transitory under appropriate monetary policy.” Right.

Unfortunately, Clarida failed to disclose which stocks he is short to celebrate the coming rate shock, or whether he is simply buying puts.

But one thing that is clear is that today’s hawkish parade by Fed speakers has once again spooked stocks, which hit session lows following not just the paper by Clarida but also hawkish speeches by such prominent former doves as Lael Brainard and Charles Evans.

During her confirmation hearing, Fed Governor Lael Brainard said the U.S. central bank could raise interest rates as early as March to ensure that generation-high price pressures are brought under control.

“The committee has projected several hikes over the course of the year,” Brainard said Thursday in response to a question during her confirmation hearing before the Senate Banking Committee. “We will be in a position to do that, I think, as soon as asset purchases are terminated. And we will simply have to see what the data requires over the course of the year,” she added. The Fed is set to conclude its bond-buying campaign in mid-March.

As Bloomberg notes, Brainard’s intent to fight higher prices marks an important shift by one of the central bank’s influential doves, who in July argued that the risk from inflation was that it would revert to its years-long pattern. Of course, as we noted earlier, the risk – no, reality – now is that the Fed is hiking into a slowdown if not recession, and we expect this too will become obvious only in retrospect about a year from today.

Rounding out today’s hawkish procession was Chicago Fed’s (former dove) Charles Evans who said three hikes is a good opening bid for 2022, but it could be four if inflation does not improve quickly enough. And while he is reluctant to declare maximum employment, but inflation is too high.

He also said that the balance sheet is very large, fed will likely start shrinking it sooner rather than later following rate hikes; he also echoed Brainard and said that officials likely to think seriously about a March hike.

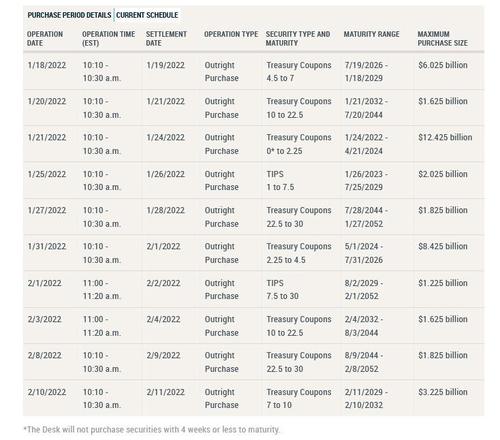

And speaking of the Fed’s shrinking balance sheet, at 3pm ET, the Fed disclosed its latest monthly POMO schedule which showed that the Fed will purchase only $40BN in Treasuries in the period Jan 14-Feb 11, down from $60 billion last month, and a number which will shrink by another $20bn next month before the taper is over in mid-March at which point the rate hikes will begin.

Tyler Durden

Thu, 01/13/2022 – 15:23

Continue reading at ZeroHedge.com, Click Here.