Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Bitcoin ETFs Are All the Buzz — Analysis, 25 Oct

Bitcoin ETFs Are All the Buzz — Analysis, 25 Oct

Proshares Bitcoin Strategy ETF was officially launched on Tuesday, October 19th, and it started trading on the New York Stock Exchange (NYSE). The ticker of the first Bitcoin-linked ETF in the U.S. on NYSE is BITO:

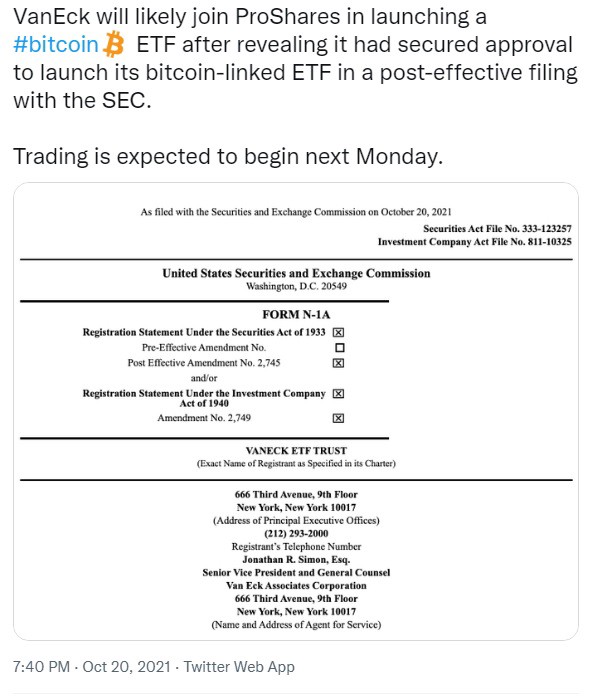

This long-awaited event has marked the beginning of the Bitcoin ETFs era. VanEck, a global investment manager, has also applied for a Bitcoin-linked ETF with the U.S. Security and Exchange Commission. The ETF is to be launched on Monday this week:

Valkyrie Bitcoin Strategy ETF started trading on Nasdaq on Friday, October 22nd:

Because of the launches of the Bitcoin-linked ETFs, the bullish market sentiment has intensified, and BTC recorded a new all-time high at the level of approximately $67,000:

Nevertheless, some financial experts believe the Bitcoin price increase results from inflation concerns rather than the Bitcoin-linked ETFs. According to the investment strategist from JPMorgan, the perception of Bitcoin as a better inflation hedge than gold is the key driver of the cryptocurrency price:

Famous Bitcoin bull and Twitter CEO Jack Dorsey seconds this point of view as well.

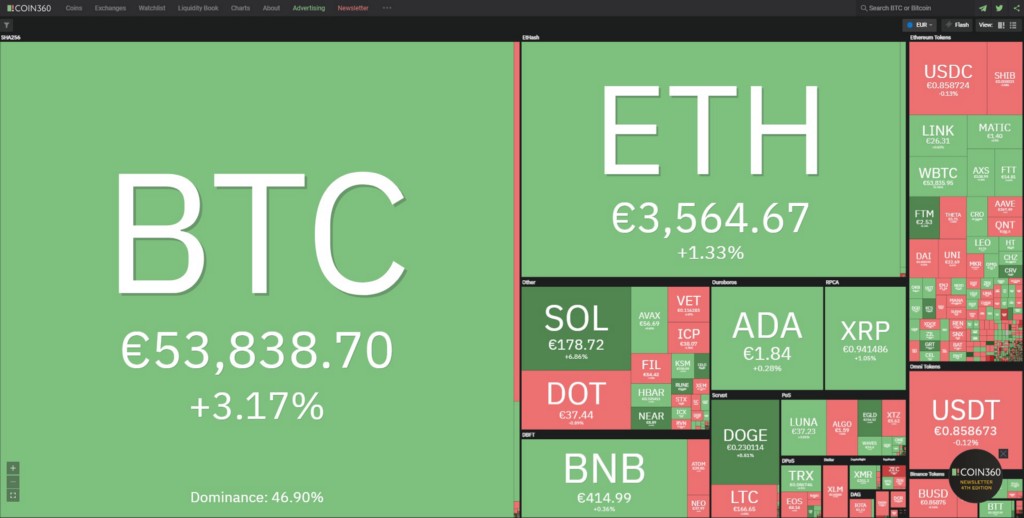

Last week was quite dynamic for the cryptocurrency market. In the first half of the week, the price of Bitcoin increased and set a new all-time high. However, closer to the beginning of the weekend, a pullback took place. Now, the Monday market starts with a small price rebound. According to Coin360.com, one Bitcoin costs €53,838.70 (+3.17%), one Ethereum — €3,564.67 (+1.33%), one DOGE — €0.2301 (+8.61%), and one UNI — €22.69 (-0.19%):

Now, let us analyze the price charts of the leading cryptocurrencies against the euro in the most noteworthy time frames.

BTC/EUR

In the weekly chart (1W), after the Three White Soldiers candlestick formation, BTC/EUR has formed a Shooting Star — a small bearish candlestick with a long upper shadow and little lower shadow:

According to the technical analysis theory, the Shooting Star is a potential trend reversal candlestick pattern that occurs at the top of a solid price increase. However, for now, we don’t consider this bearish candlestick as a bearish signal. We think that it is just a signal indicating that the market has started to consolidate.

In the 4-hour chart (4H), last week, BTC/EUR has almost reached our price target or the 100 Fibonacci extension level (approximately €58,503) after exiting the Bullish Flag:

According to the chart, the price has retraced after an attempt to hit the 100 Fibonacci extension level; now, it is consolidating at the 61.8 Fibonacci extension level (around €50,613). We expect BTC/EUR to make another attempt to reach the 100 Fibonacci extension level or approximately €58,503 again.

ETH/EUR

In the weekly chart (1W), ETH/EUR has formed another bullish candlestick with a local low above the previous one and a local high above the previous one:

Most importantly, we would like to highlight that the last bullish candlestick has a closing price above the closing prices of the previous two local highs. It means that the bulls were not only able to reach new price levels but were also able to confirm them. In our view, this is a signal solidifying the bullish sentiment.

That’s why it is worth keeping an eye on the Cup and Handle technical pattern (C&H) in the weekly time frame (1W) we talked about in our previous analysis.

As can be seen from the chart, the price of Ethereum has already surpassed the upper line of the C&H. If ETH/EUR pulls back to this line and rebounds, a buy signal will occur. In this case, we may open a long position to catch the continuation of the uptrend.

DOGE/EUR

In the 4-hour chart (4H), DOGE/EUR has exited the Descending channel (downtrend):

As can be seen from the chart, a breakout took place, and the price went through the upper line of the channel (resistance line). We consider this as an initial signal pointing to the end of the bearish dominance.

However, for now, there is a bullish signal only in the 1-hour chart (1H) — DOGE/EUR has started to draw an Ascending channel (uptrend):

Nevertheless, we would like to underline that the 1-hour chart is not the most reliable one for mid-term and long-term price dynamics predictions. Usually, traders use the 1-hour time frame for scalping or intra-day trading. That’s why we have to be very cautious if we base our trading strategy on the 1-hour chart.

UNI/EUR

In the daily chart (1D), UNI/EUR has started to consolidate:

This consolidation occurs at the 30-day Moving Average (MA 30) and the 90-day Moving Average (MA 90). Right now, there is no clear signal in which direction the price will exit the consolidation range. That’s why, for now, we prefer to abstain from entering the market.

Moreover, in the 4-hour chart (4H) of UNI/EUR, the situation has not changed since our previous analysis. The price of Uniswap has exited the Descending channel (downtrend) but has still not surpassed the level of the last local high:

We plan to wait for a price increase to lift UNI/EUR above the previous local high or €23.30. Then, we will open a small long position.

Stay updated on everything Bitcoin-related with Bitvalex. Bitvalex is a licensed digital wallet and cryptocurrency exchange; learn more about us and blockchain technology and sign up to use our services.

The analysis is purely informational and does not constitute investment, financial, trading, or any other sort of advice and you should not treat any of Bitvalex’s content as such. Bitvalex does not recommend that any cryptocurrency should be bought, sold, or held by you. You are solely responsible to conduct your own due diligence and consult an advisor before making any investment decisions.

Originally published at https://bitvalex.com.

Check out our new platform 👉 https://thecapital.io/

https://twitter.com/thecapital_io

Bitcoin ETFs Are All the Buzz — Analysis, 25 Oct was originally published in The Capital on Medium, where people are continuing the conversation by highlighting and responding to this story.