Feature your business, services, products, events & news. Submit Website.

Breaking Top Featured Content:

Poor Americans’ Credit Card Usage Spikes As Their Savings Run Out

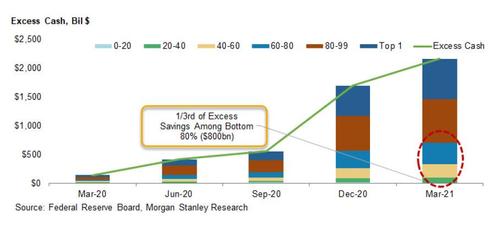

Last week we explained why the widely propagated myth that there is north of $2 trillion in “excess cash” savings spread evenly across the US population courtesy of Biden’s trillions, was nothing but a fake pipe dream: as we showed then when looking at cash holdings (checkable deposits and currency) from 1Q20-1Q21 across the income distribution, 65% of excess cash (cash accumulated above the 4Q19 level) is held among the top 20%, while just 35% was spread across the entire bottom 80% (the top 80% holds ~$1.4tn in excess savings and bottom 80% holds ~$800bn).

And in light of the recent feverish pace of consumer spending among the bottom 80%, we also said that much if not all of these cash savings had been spent.

Overnight, Bank of America indirectly confirmed this.

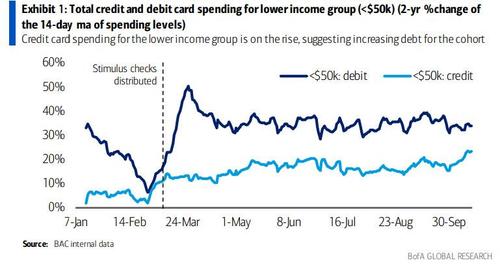

When looking at its latest debt and credit cars spending data, BofA chief economist Michelle Meyer observed that spending on credit cards among the lower income cohort has spiked with a 23% growth rate over a 2-year period, up from the summer average of 15%

And, obviously, with consumers ramping up their charging it means that their bank accounts (where those mythical excess savings would be found) this surge in credit card spending has come at the expense of debit card spending growth which has slowed notably over the last several weeks.

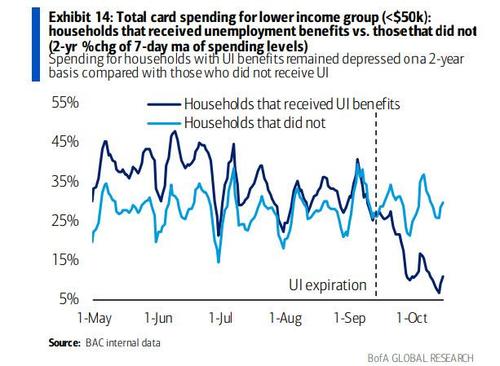

According to Bank of America, this growing reliance on credit cards reflects “the loss of income support from the expiration of unemployment benefits (UI) which has disproportionally impacted the lower income population.” Indeed, UI recipients in the lower income cohort reduced spending meaningfully, with the 2-year growth rate falling to 11% from 31% prior to the expiration in early Sept

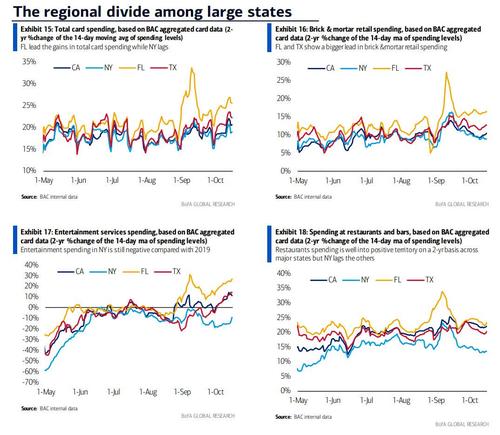

And while it may not be directly linked to consumers savings running out, BofA also highlights another curious observation, one we touched upon last week: as the chart below shows, there has been a growing divide between spending trends across the country. Among the strongest is Florida where total card spending is up around 25% over a 2-year period. This contrasts with CA and NY, for example, with growth of 20% and 18%, respectively, over a 2-year period for total card spending.

BofA sees a particularly significant gap between NY and FL when it comes to spending on entertainment services or restaurants/bars. For example, in NY spending on restaurants and bars is up 14% over a 2-year period and down 8% for entertainment. But in FL, the jump is 24% and 25% 2-year growth, respectively, for restaurants/bars and entertainment services.

The gap started with the Labor Day holiday which aligned with the peak in COVID cases nationally. This is the direct result of Florida having some of the fewest restrictions due to covid among all states, which not only has led the state to see a dramatic plunge in covid cases as natural immunity has surged…

Hospitalizations in Florida are down 81% in the past month and a half with no new policy interventions, no vaccine passports and no mask mandates, proving once again that the only way to bring the numbers down is to do new policy interventions, vaccine passports and mask mandates pic.twitter.com/1Yj5mJDB6v

— IM (@ianmSC) October 14, 2021

… but also to a healthy boost for the local economy, while at the same time paranoid New York snowflakes refuse to step out over mortal terror that the Chinese virus just can’t wait to penetrate their 3 mask layers and to kill them all.

Tyler Durden

Fri, 10/22/2021 – 14:40

Continue reading at ZeroHedge.com, Click Here.